This is the second article of a series of 4 where we list another 12 (out of 48) super practical, flexible, and adaptable money-saving tips we can all apply to improve our Wealthcare®. (Check out the 1st article here.)

1. Delete stored credit card numbers

Avoid impulse shopping online by deleting your stored credit card numbers in your online shopping accounts with merchants. It’s easier to keep tabs on your spending when the transactions are recorded in one place. As our CEO David mentioned before, some purchases may be recurring (e.g. subscriptions) that you may forget to stop over time; deleting unused card numbers can help cancel items you never realised you didn’t need!

2. Declutter and sell

Marie Kondo would be proud of you.

Go through everything in your house and sell (or donate and discard) anything that no longer sparks joy. You’ll declutter and possibly make a decent return on your unwanted items. Get on Facebook Marketplace or Carousell, or contact a local flea market organiser!

3. Apply the 24-hour rule

For bigger shopping decisions, apply the 24-hour rule and check back to see if you still want it later. At the store, use the 10-second rule to stop and have a good think before putting it in the trolley.

4. Set hot water heater at a lower temperature

There are a few easy ways to save on utility costs, such as:

- Set your hot water heater at a lower temperature where possible to save on hot water heating costs.

- Turn off lights when leaving a room.

- Turn off devices at the powerpoint.

However, it’s also important to regularly check if your provider is offering the best deal, or if you should be switching providers for greater long term savings.

5. Seal your home

Seal your windows and door frames with caulk. This means your home is better protected against hot air entering and cool air escaping, and so your fan unit doesn’t have to work as hard or your air conditioning can be set at a lower setting – thereby saving you on energy costs.

6. Take public transport

Me when I open the Grab app and see a surge.

Take the bus or MRT where possible instead of taking the taxi/Grab or driving your own car. Taking public transport is a GREAT way to generate Roundups! Additionally, try to walk or cycle as much as you can. Staying healthy can help steer you away from preventable diseases that rack up expensive healthcare costs!

7. Consolidate your debt

If you have multiple debts, consider consolidating them into a single loan. You could save on interest while making your repayments easier to manage. This is one of the best finance power moves you can make!

8. Go for used

Someone else may be doing a Marie Kondo-style decluttering!

Buy used where appropriate. Good quality clothing, used phones with warranty, and sporting equipment in excellent condition, for example, can be purchased at a fraction of the cost of brand new items. Again, Facebook Marketplace, Carousell, and the flea markets are where you want to be.

9. Invest in a slow cooker

Slow cookers make delicious, one-pot meals easy and cheap. Check out the countless slow-cooker recipes online. Slow cooking allows you to get other stuff done while your dinner is stewing/baking/roasting/sous vide-ing, making your day more efficient. Read our #HugoHeroes’ grocery tips here to enjoy even more savings!

10. Collect coupons

Check out online coupon sites and take advantage of discounts on everyday and household items by shopping with coupons.

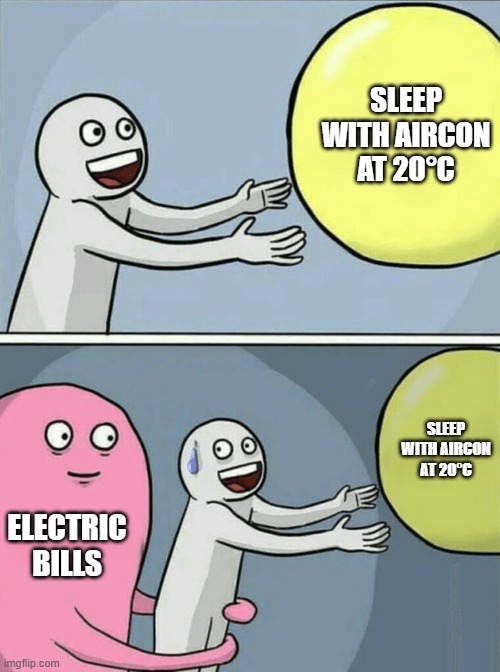

11. Use air conditioning wisely

You don’t want to be cuddling expensive utility bills to sleep.

Keep the air conditioning filter clean and run it at the minimum cooling setting you need to feel comfortable. This principle works for your fan too!

12. Organise neighbourhood swaps

Organise neighbourhood swaps and sharing with friends! Swap and share everything from toys and clothing to appliances you use only occasionally.

Taking care of our finances is not hard. These small steps are easy to take and can be habituated. When saving becomes second nature, it becomes effortless. Stay tuned for more easy things you can do to grow your finances!