Deepavali is here! The festival of lights symbolises Light/Good triumphing over Darkness/Evil.

In Hinduism, 8 is considered a number associated with wealth and abundance. Also known as Ashtha, Aṣṭa, or Ashta in Sanskrit, it is the number of wealth and abundance. This Deepavali, we debunk 8 financial myths so you can achieve WealthcareⓇ.

1. Investing is only for the rich, and I’m not rich 🙁

Last time, policemen wore shorts and during that time, you had to amass a sizable fortune to invest. But today, anyone can start investing with just a small amount of savings, whether it’s in stocks, REITs, FOREX or commodities etc. So, the most important thing is to start investing as early as you can, with an amount you are comfortable with. With Hugosave’s Gold Vault, you can now invest in physical gold from as low as S$0.01!

2. I can plan for retirement in my later years

Remember the days when we procrastinate and then get into a “last-minute panic” just before exams or submission? Don’t do that for your retirement. A comfortable retirement IS an expensive affair. Your income will reduce by a lot and costs associated with old age like healthcare can balloon, so planning your retirement needs to start now.

Use Hugosave’s Money Pots to plan and save for your long-term goals, and start investing securely towards your future with our Gold Vault.

3. Gold is the worst performer in 2022

Not even close. Whilst gold prices dipped 8.5%, it outperformed other asset classes across the board which saw double-digit declines. Dow Jones Industrial Average (DJIA) is down 20%, S&P500 down 16.4% and Nasdaq Composite Index down 34.1%. Singapore Savings Bonds is one of the few giving a positive return at just above 2%. However, it’s just a consolation given our inflation rate is above 5%. (Figures are derived at time of writing)

“How about cryptocurrencies?” Well, if Bitcoin is any good as an indicator, it’s down about 59%. So, yeah…

Source: gold.org

4. Keeping my money in savings account is da best

This is a myth, though with a sliver of truth. First, we will have to define what “best” here means. It is a good place to store cash for immediate liquidity that we can use for daily expenses and other very short-term expenditures (medical, bills and other recurring obligations).

However, with interest rates between 1-3%, keeping all or too much of your disposable income means you won’t be growing it in investments, or worse, letting its value be eroded by rising inflation.

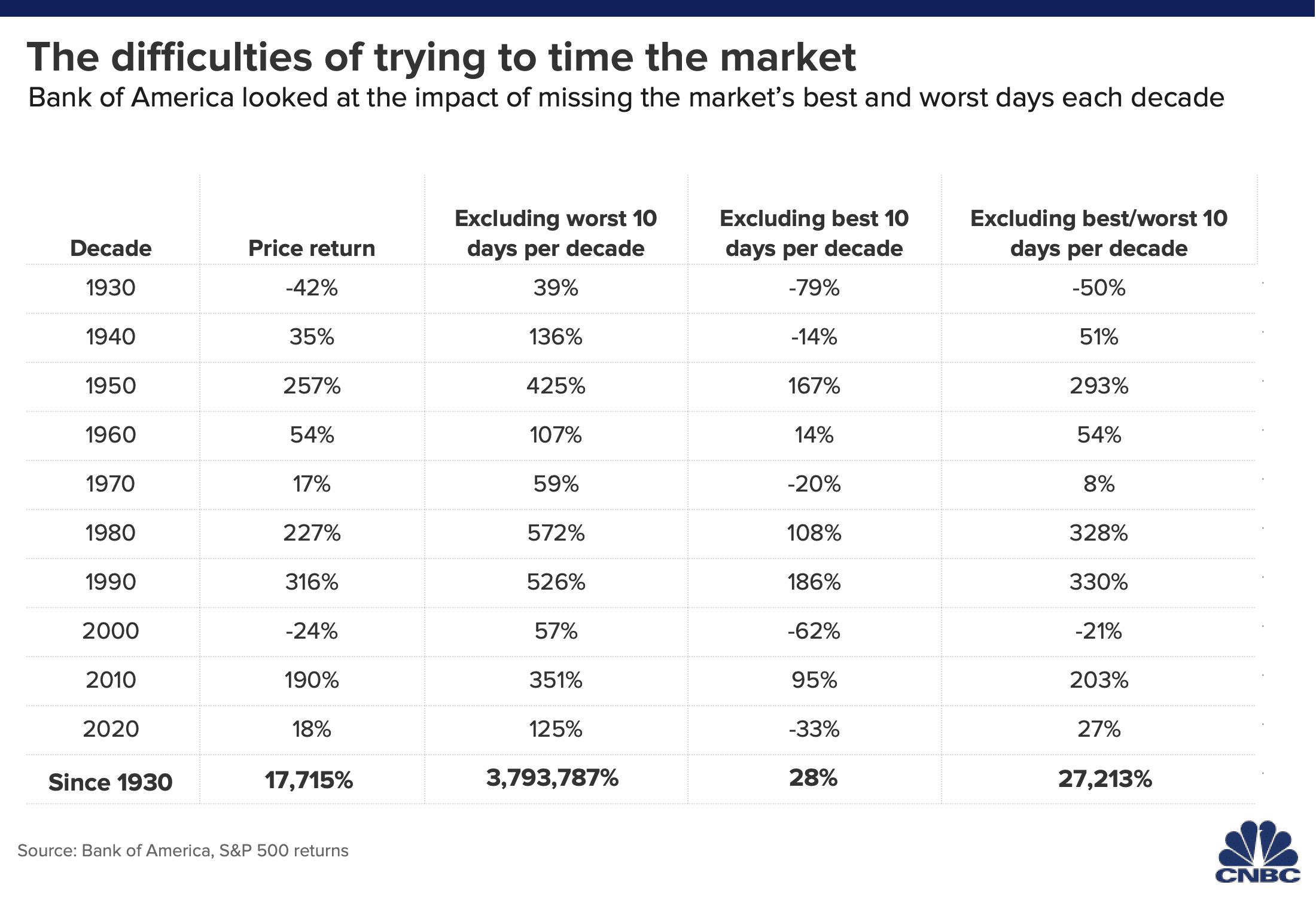

5. Timing the market will get me the greatest returns

It’s been time and time again proven by many experts that timing the market is not only a risky strategy but also not well worth the time and effort.

Source: CNBC

Bank of America studied data for the past 90+ years and found that, on average, if investors missed the S&P 500′s 10 best days every 10 years, their total return would be about 28%. However, if they had invested diligently through the ups and downs and capturing the averages, they would have an ROI of more than 17,000%.

Most of us are not investment gurus or prodigies. Our predictions on when the best times to buy and sell are are as good as anybody’s guess.

6. Credit cards are better. A debit card is just another ATM card.

There is no better or worse between both; both are great at doing what they are intended for. Debit cards are convenient cashless payment options that can help minimise the risk of overspending. They can be utilised creatively to complement your savings and budgeting strategies. You can open an account solely for a particular spending, deposit a set amount of money and spend within that amount while earning some modest rewards.

The Hugosave Platinum Visa Debit Card is designed to give you a convenient and safe cashless payment alternative, while investing your digital spare change in physical gold for long-term growth and protection.

7. You MUST have an aggressive investment portfolio to build up wealth.

The higher the returns, the higher your exposure to risk. Instead of building up wealth, you might find yourself licking your financial wounds when things go south. Your investment portfolio should be carefully and responsibly crafted to suit your financial circumstances and appetite for risk and returns. Where there is an undertaking of risk, it is wise to hedge against it. Gold is a trusted asset to hedge against investment risk; having some can smoothen the risks in your portfolio. To build wealth, aggression is not the key, but diligence and wisdom. Speaking with a trusted and qualified financial advisor is a good start.

8. Bitcoin is a reliable store of value.

Source: CoinMarketCap

Enough said. #cryptowinter