Covid-19 has severely weakened economies and caused increased market volatilities across the globe. Yet, through it all, one major asset withstood the challenges and even outperformed its pre-pandemic results. Global investment demand for gold hit a record-breaking 40% increase from the year before, according to research done by the World Gold Council. Gold as a major asset is expected to continue performing well, with prices climbing in 2021 as investors choose safe-haven assets amid the lingering uncertainty of the pandemic.

What is a store of value?

Essentially, any asset, currency, or commodity that can be saved, retrieved and traded in the future without deteriorating in value, i.e. either worth the same or more, is a store of value.

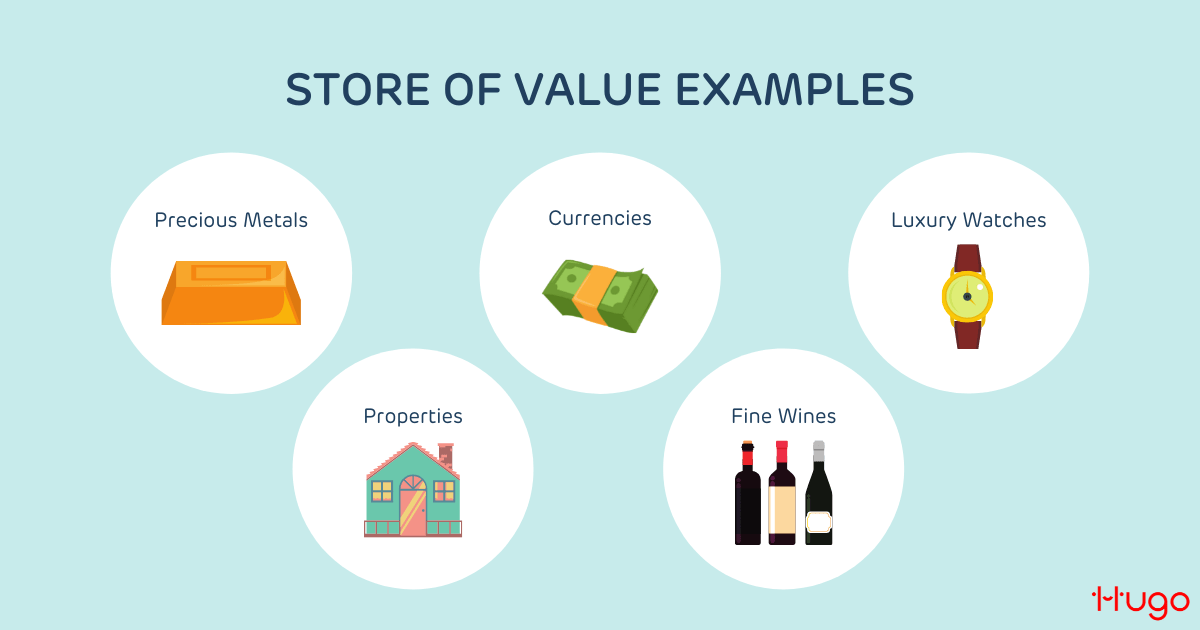

Examples of stores of value

Precious Metals

Throughout history, economies have used precious metals like gold and silver as currencies to store value, transport wealth around, and exchange them for other assets or currencies. Until 1971, the gold standard was a store of value for the US Dollar.

Currency

A healthy and stable economy can back a currency and make it a credible store of value. A good example is the Singapore Dollar. Since currencies are a medium of trade, people can store their wealth by accumulating them (savings), or unleash their purchasing power by spending it.

Property

Properties are some of the hottest assets to own nowadays. Once used only as places of residence or to set up shop at, today, it’s a way to store value and generate income. As populations grow and land becomes more scarce, the value of properties goes up along with demand.

Luxury watches

Although not as common, luxury watches like those of Rolex, Patek Philippe and Audemars Piguet have been used as a store of value. With their rarity, build quality, specific uses and premium branding, these watches enjoy strong and lasting demand that allows them to store value over time.

Fine Wines

Like luxury watches, fine wines from respectable wineries can store/increase their value over the time it takes to reach optimal flavour and value. There are wine collectors and connoisseurs who are willing to pay top dollar for rare wines.

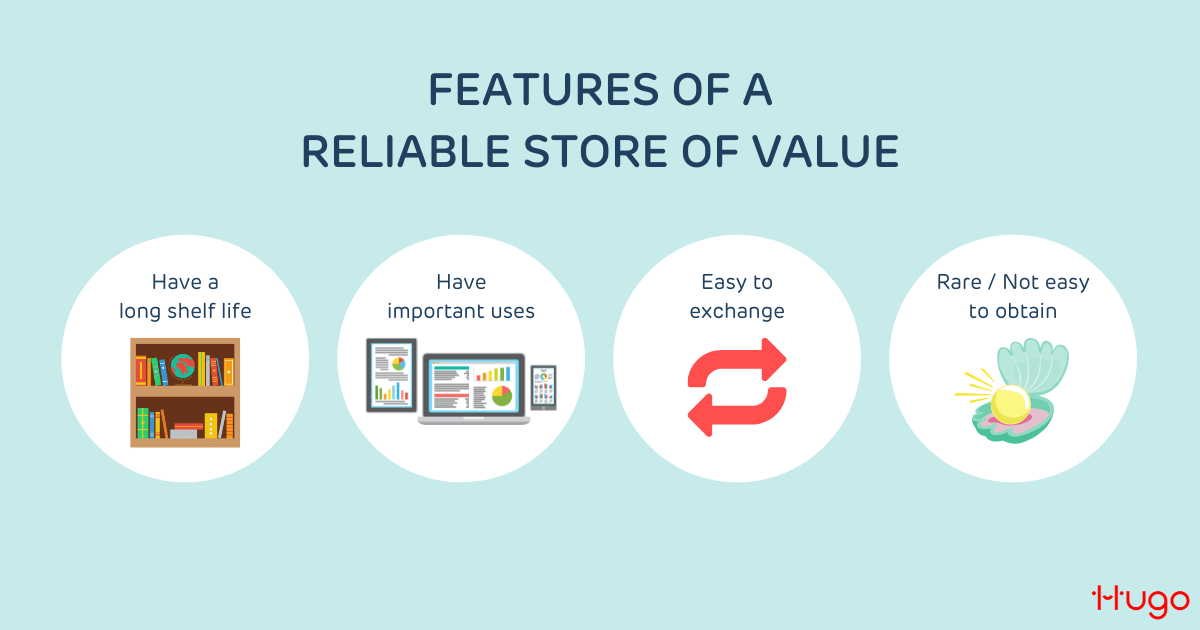

Features you’ll want in a reliable store of value

There are features to look out for before you decide to allocate a portion of your wealth to a particular medium. Features you’ll want in a reliable store of value are:

- Long shelf life – you won’t want to lose value to rot, rust, or decay.

- Utility – mass adoption and use facilitate demand, and thus value.

- Ease of exchange – you will want to trade it for goods you want easily.

- Rarity – When there is a low supply for a good in high demand, the amount people are willing to pay for it increases.

Another aspect to consider is whether the asset is subjected to regulations. If an asset is under immensely strict or ever-changing regulations, the risk increases while returns decrease. However, reasonably reliable regulations can also increase an item’s value since it lends credibility.

Gold has proven to be a good store of value because it is a rare metal with a very long shelf life, has various important uses, and is traded everywhere (liquid). This makes it a safe haven, an important feature to consider when searching for a reliable store of value. All these characteristics are what you should look out for while selecting a store of value.

Why is a good store of value important during a pandemic/economic crisis?

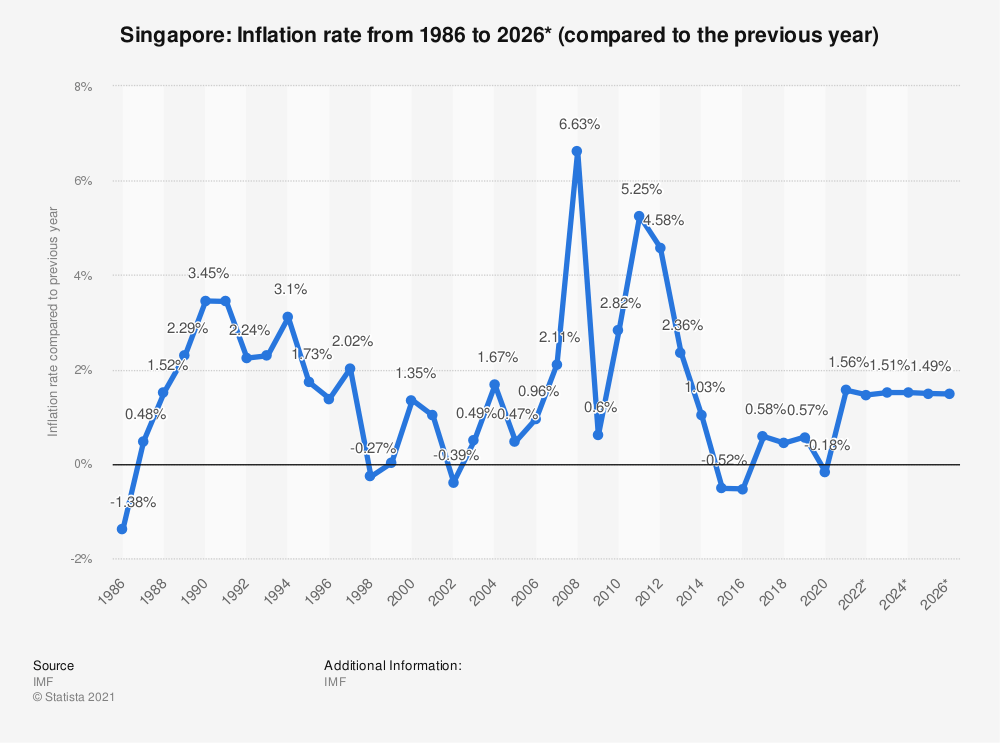

In an economic crisis brought about by the pandemic, equities tend to perform poorly, causing much uncertainty among investors. With increasing inflation (see table 1), there would be a decrease in spending power because of higher prices in goods and a lower interest rate that would lead to lesser returns in bank savings.

Table 1: Singapore inflation rates from 1986 – 2026 | Source: Statista

As seen in the graph above, the inflation rate in Singapore increased sharply after 2020 and is expected to continue at a heightened rate till 2026. In times of economic crises, commodities like gold and silver are safe-haven investments that have a negative correlation to market performance.

A comparison of stores of value

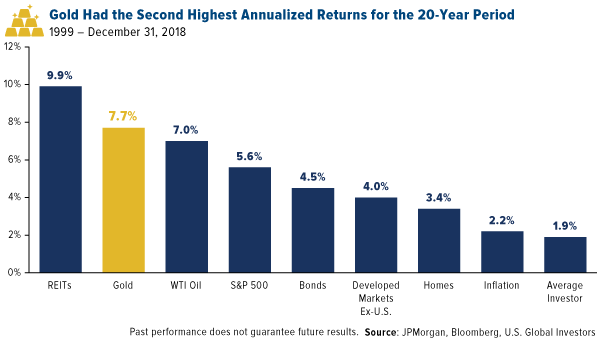

Table 2: Comparison between annualised return over a 20-year period | Source: SeekingAlpha

As seen in the above table, gold investment is beneficial even during crises as it had the second-highest annualised returns over 20 years, withstanding economic crises that occurred in between.

Locally, gold is a very accessible investment as compared to other popular forms of investments like property. Given the latest government cooling measures and HDB policies in place, investment risks in property have increased while returns have reduced, or stagnated at best. Additionally, investment in gold can start at a lower price instead of the huge capital needed to buy a house; this makes gold a much more affordable choice for most people. Liquidity would also be an important consideration: you want to be able to liquidate your investment with ease whenever you need it and property may not fare the best in that category.

And before you go into wines, consider the high costs in the form of storage and transportation that eat into your earnings and make drinking it instead a much more enjoyable experience.

Gold – a reliable commodity, especially amidst crisis

As one of the world’s earliest forms of currency as well, gold has long been considered reliable because as a physical commodity, it cannot be printed like money and its value is not impacted by interest rate decisions made by governments. And because gold has managed to maintain its value over a long time, it has become a form of insurance against adverse economic events.

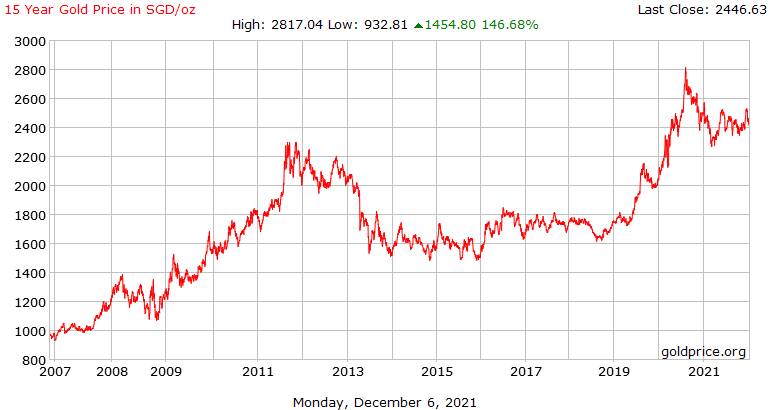

Table 3: Gold price history over a 15-year period | Source: GoldPrice

As seen in the chart above, there is a sharp hike in the price of gold whenever an economic crisis takes place. From the 2008 Financial Crisis to 2011’s Black Monday crisis and even till today, as we grapple with the economic crisis left behind by the pandemic, the price of gold remains high and trending upwards. It is evident that throughout history and in the present, gold has proved itself to be a reliable commodity. Investors continuously go back to gold as a safe option whenever other economic conditions prove to be unstable.

Buying Gold – Your Options

In general, those looking to invest in gold have multiple choices. You can purchase the physical asset, or shares of a mutual or exchange-traded fund (ETF) that replicates the price of gold, or trade futures and options in the commodities market. A good option if you’re just starting out is to use Hugo’s Gold Vault—it allows you to include gold in your normal savings plan towards long-term investment at any amount; you can even monitor live gold prices. Trading in gold has never been simpler. Check out our guide on Gold investing.

While investing in gold is a good way to protect wealth during a crisis, everyone should be educated on the risks of investments before making a decision.