At the risk of sounding like a broken recorder, gold plays an important role in global finance. Once used as a backing to the US dollar (which then backed major global currencies), the gold standard provided stability to monetary systems. Today, although no longer a currency backer, gold’s unique characteristics and intrinsic qualities make it a safe-haven asset for investors. Its shiny exterior is as appealing as its ability to be a reliable store of one’s wealth.

Another way gold puts a smile on your face.

So, What Makes Gold An Important Investment?

We’ve covered before why today’s investors need gold more than ever. But let’s briefly go through why:

- Gold is scarce. The greater the money supply, the greater the value of gold.

- It is a relatively stable asset over the long-term.

- It is a non-correlated asset and is not dragged down by other assets.

Find out more: The Simple Sum podcast featuring Hugo CEO David Fergusson on why gold is so relevant today.

What Else Is There Besides Physical Gold?

There are various gold-based investment products besides the physical gold you can touch, smell and taste (though we don’t recommend doing that) out there, with each having its own pros and cons.

Some examples of other gold products include gold-related Exchange-Traded Funds (ETFs) and gold-related stocks. You can find out more about them in our handy guide here.

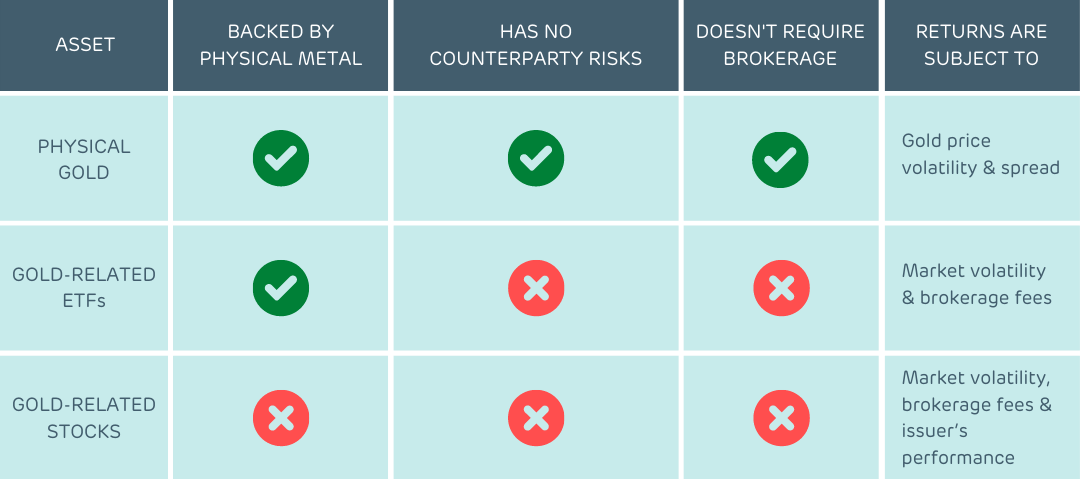

Counterparty Risks of Gold

All investors should always be mindful of this, if not being ample clear. According to Investopedia, “Counterparty risk is the likelihood or probability that one of those involved in a transaction might default on its contractual obligation. Counterparty risk can exist in credit, investment, and trading transactions.” In other words, as long as there is a medium or middle-man between you and your asset (i.e. brokerage, investment manager, even a bank), you are exposed to varying levels of counterparty risks.

Physical gold

Non-correlated asset: This refers to gold price’s tendency to move independently of every other asset in your portfolio because it is not tied to any other asset classes but is driven largely by supply and demand and investor behaviour. In times of bear markets, increased market volatility and inflation, investors tend to buy into safe havens like gold, increasing its demand and value.

Doesn’t have counterparty risk: When you own the gold directly, you are not at risk of a middle-man not being able to fulfill his contractual obligations to you. This does not mean your gold is not subject to other risks (e.g. loss, theft), but that some risks you cannot control do not apply to you.

Highly liquid: It is cash in disguise. You can go to a dealer or bank any time to convert your physical gold to cash easily. No one will say no to it.

Gold-related ETFs

Both new and veteran investors can buy into gold ETFs since they are relatively easy to manage and invest in. When you invest in gold ETFs, you don’t own the gold physically because you are actually buying securities that track the price of gold. As such, there can be many parties involved in each transaction, ranging from issuers of the ETFs, custodians (i.e. institutions that source and store underlying physical gold assets), and fund managers. When any of these parties fail to fulfil their obligations, you may not get back your capital and potential returns. Unlike investing in physical gold, there is no gold you can claim too.

Gold-related Stocks

The returns of your gold-related stocks ultimately depend on the performance of the issuing company. If the company is at risk of default, they may not make payment for your investment.

Read this article for a comprehensive guide to gold products.

At this point, I know how overwhelming it can be to digest all these gold-related terms at once.

Let me do the analysis for you

Don’t worry; I’ve got you covered. Refer to this table for what you need to know about each gold investment type:

Note: This table is NOT about potential returns or suitability as an investment.

Go for the Real Deal with Hugo

Different gold products may work for different goals. But if you are looking for a way to save money in a stable vehicle with good returns over the long-term, physical gold stands out. You get to own the actual gold, and hedge against broader market risks your portfolio is exposed to.

HOWEVER, protecting your gold from theft or loss can be a hassle and expensive. Hugo’s Gold Vault is a sweet way to invest in physical gold in a convenient, affordable and safe way. With low fees (0.5% per transaction), you can buy/sell and storing your physical gold, insured by Lloyd’s of London, in an LBMA-accredited vault in Singapore. That’s right – it’s safe, and it belongs to you legally.

Trade gold at your fingertips and grow your savings through gold!