About the author: Eileen Tay works in the banking and finance industry and is an early #HugoHero. Understanding the value of money and the future value it can generate, she finds all kinds of ways to maximise spending, savings and investments to realise her dreams and retire comfortably.

Chinese New Year is right around the corner! Your net gains on ang bao money will depend on your marital status and the size of your entire “clan”. But whatever amount we receive, I think ang bao money should be considered as a bonus and not cause me to change my spending levels. It’s tempting to buy the things I’ve been eyeing but never actually got around to doing it, but I RESIST!

My ang bao money falls in the category of Extra Money, along with other additional income like bonuses and side hustle earnings. Extra Monies are for me to save towards retirement so that I can either

- Retire earlier since I can fund it at the same rate for longer, or

- Retire as planned but increase the quality of my retirement since I have more to spend.

Investing it in safe-haven assets

I invest a portion of my ang bao money in safe-haven assets like physical gold since I can be sure to gain in the long-term. I do invest some of my recurring income in gold as well, and investing the extras gives my gold holdings the periodic boosts.

Since the beginning of 2017 to the date of writing this article (period of 5 years), gold price has grown by a whopping 47%, from S$1681/oz to $2482/oz. I am certain gold price will continue to rise, so it’s worth putting the extra money I don’t need now in gold.

Topping up my CPF

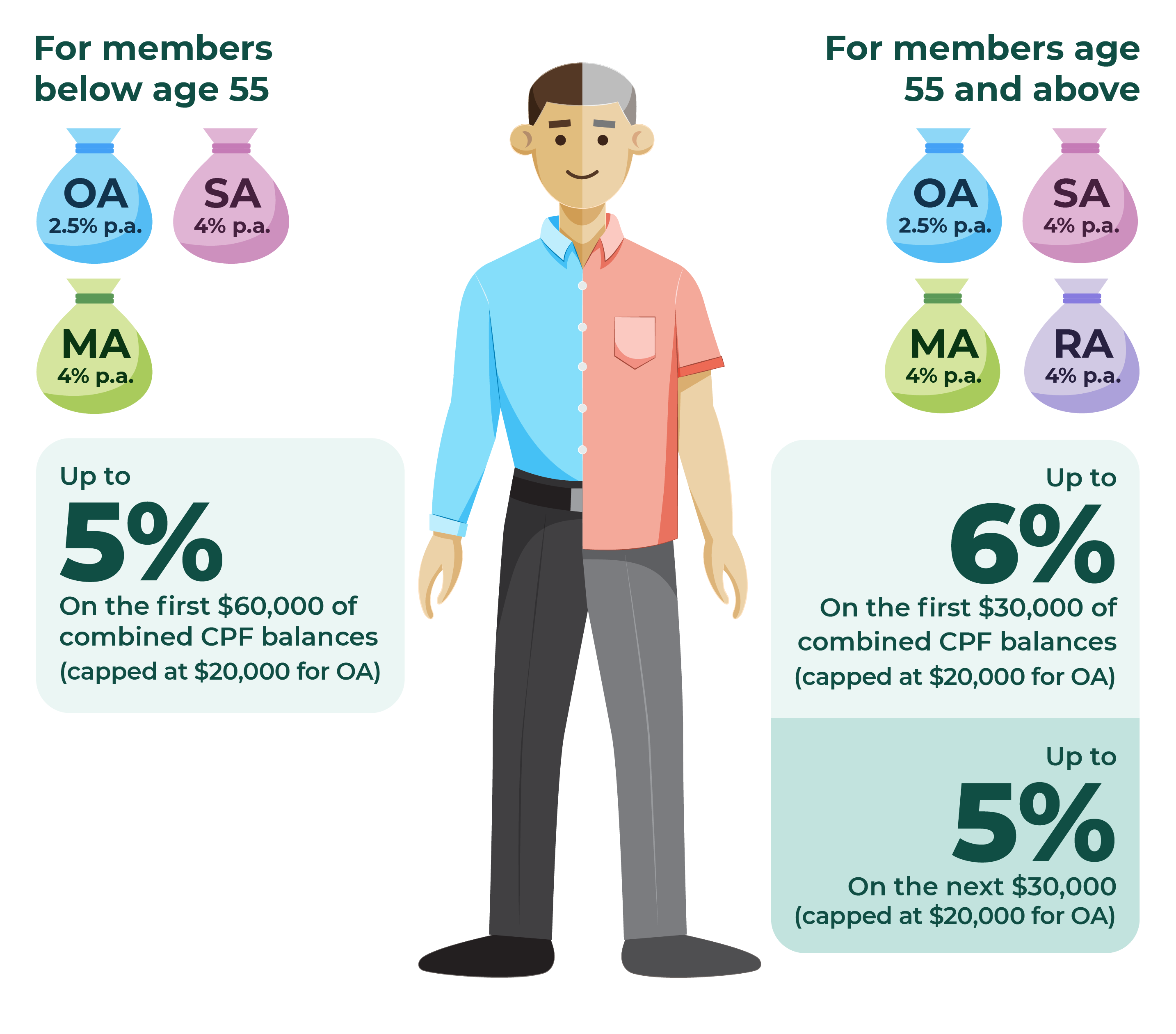

This is along the same grain as the above. On saving for retirement and future medical expenses, the CPF is actually a pretty useful tool. The Special Account and Medisave Account generates a guaranteed 4% interest p.a. Topping up my SA and MA with my ang bao money along with a portion of my salary is helping me reach a comfortable retirement sum faster.

Source: CPF

Top up my emergency fund

The general rule of thumb is to have 3-6 months’ worth of your salary set aside for emergencies. The fund should be enough to tide me over a jobless season, pay for unforeseen medical expenses etc. I am re-topping up my emergency fund, after using some of it previously, and it’s wise for me to use my 2022 ang bao money to reach there faster.

Repay debts

Many people have some form of debt like student debt, credit card debt, housing loans etc. While not all debt is detrimental (debts can be used to boost your earnings), we can all agree that the longer you hold your debt, the more expensive it gets. I incur little debt since I;m more debt-averse, but when I do incur some, I like to pay them off as fast as I can. Using ang bao money to pay down some debt earlier helps me avoid paying more interest.

Increase productivity

Other than investing in gold, I also invest in things that make me more productive so I can save effort and time, and put those into other areas. For example, I am going to use some of my ang bao money to fund a new computer since my 5-year-old laptop is getting really laggy and inefficient.

It’s about generating more value

These are just my ways of maximising my ang bao money. You will probably have your own way to do the same. Regardless of strategy, the idea is to make every dollar generate more dollars or reduce costs that grow over time i.e. debt.

While some use this extra cash to buy more stuff, I see it as a way to a longer-term goal faster so I can make room for other life’s fulfillments. Part of Wealthcare®, a.k.a financial wellbeing, is about our state of mind with regard to finances, and knowing our priorities are comfortably within reach is a good place to be.

Meanwhile, let’s all enjoy CNY with our loved ones in joy, luck and prosperity!

Happy Chinese New Year!