It might seem like many people around you are investing. People in their 20s and 30s are growing their earnings to travel, move out of their parents’ home or get married and start their own families. Those in their 40s and beyond want to grow their savings for their children and ageing parents and prepare for their retirement. All invest in hopes of beating the eventual inflation in Singapore—with more to give to themselves and the people they love.

Investing is daunting when faced with charts and jargon you don’t understand. You may have also heard that you need a huge sum of money to invest, which is not something enticing to those with low-risk appetites. By the way, you don’t need a huge sum.

While there are risks involved in any investment, remember that you have control. You can decide how much you want to invest. No sum is too small. For instance, you can invest in gold with only SGD $0.01 with Hugosave!

Through this guide, we aim to simplify complicated investment terms and give you an overview of gold investment in Singapore.

Why Gold?

These are the top reasons that make gold an attractive asset amongst investors:

It’s a safe-haven asset

This historic yellow metal is a safe-haven asset – that is, a type of investment that is expected to retain or increase in value, even amidst times of market turbulence – that has retained its value over centuries. Investors regard gold as a hedge against inflation, which means that it can offer returns that are higher than your initial investment over time.

It’s a risk diversifier in one’s portfolio

When investors add gold to their range of investments, the overall risk is decreased, especially during economic downturns such as the 1997 Asian Financial Crisis, the 2007-2009 Global Financial Crisis, or the COVID-19 recession.

It has high liquidity

Gold is recognised and in demand worldwide. There is a readily available market to trade gold, making it easy for gold investors to sell for cash anytime.

What Affects Gold Prices?

Gold is a commodity, so its price depends on the demand and supply of the market.

The demand for gold comes from the jewellery and technology industries, and investments by central banks and investors in physical gold (gold coins, bars, etc.) and gold-related assets (exchange-traded funds or ETFs).

During an economic downturn, the value of the United States Dollar (USD) is likely to depreciate. This is inversely related to the price of gold. As such, the demand for gold as a store of value will increase.

While gold is a popular asset amongst investors during a weak economy, there tends to be less demand when the economy recovers and stabilises. When the stock markets improve, investors will prioritise other investments that can generate income on a regular basis. However, gold is still a viable investment to grow one’s wealth as a stable and accessible asset.

How to Read Gold Price Charts?

The standalone price of gold doesn’t tell us when to buy, hold or sell the metal. We need to understand the gold price charts to make informed and timely decisions.

The key is to understand the change in the price of gold over time. Whether it is a line or box graph, the x-axis and y-axis will remain the same.

Here is a two-step process to help you read any gold price chart:

- Look at the y-axis or vertical axis. It indicates the price of gold.

- Look at the x-axis or horizontal axis. It indicates the time measured.

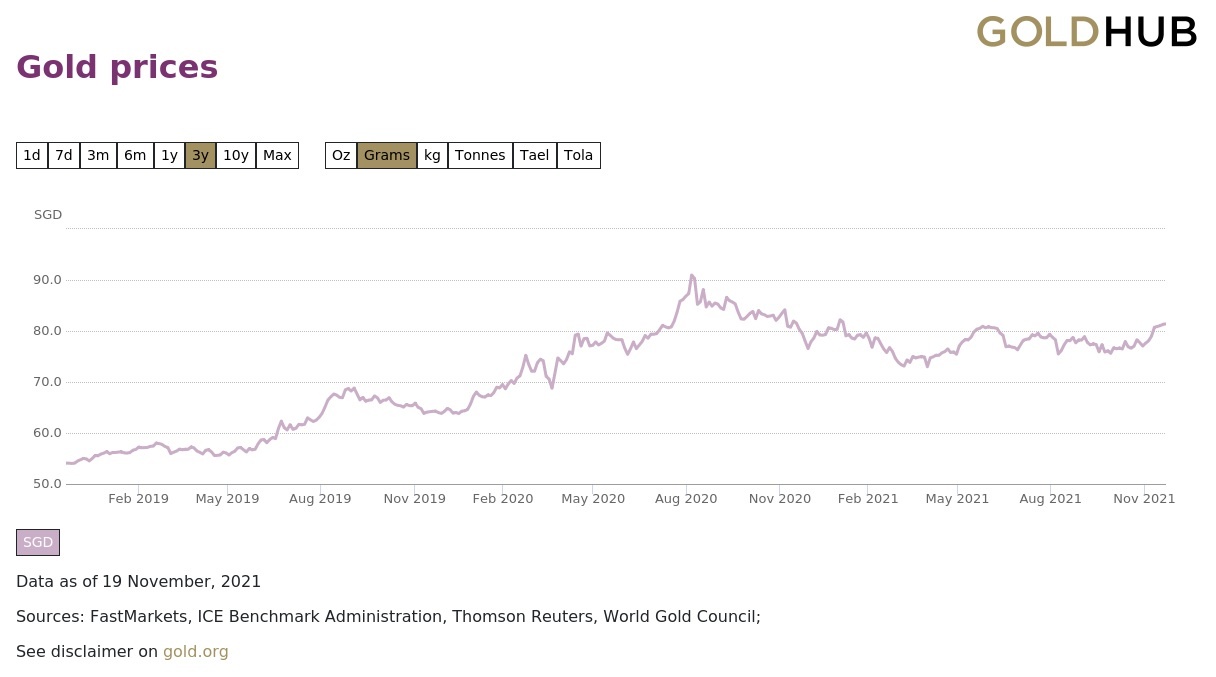

Let’s start with this line graph below.

This graph shows the price of gold in the Singapore Dollar (SGD) over three years. The price of gold hovered between $70 and $80 per gram in September 2021.

The World Gold Council charts allow you to toggle the following measurements:

- Time such as daily, weekly, monthly and yearly

- Weight of gold such as kilograms (kg) and tonnes (1,000kg)

- Currencies such as USD and Great Britain Pound (GBP)

Other examples of gold price charts include spot gold prices and historical gold prices.

A spot gold price chart shows the price at which gold is bought and sold in real-time. It is updated every minute, allowing short-term investors to make timely decisions to buy, sell or hold their gold. The spot gold price is subject to change in currency conversion, which means that the price for the same amount of gold can vary for investors using different currencies.

In contrast, a historical gold price chart shows the price at which gold was bought and sold over the years. It allows investors to understand previous trends and make informed long-term investments.

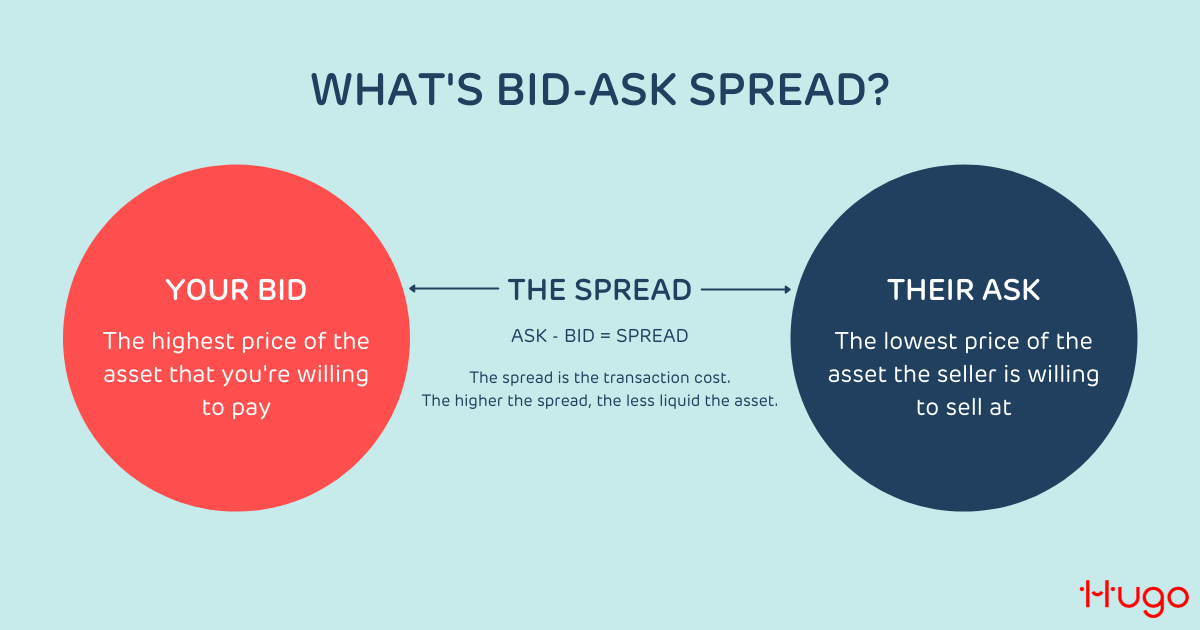

What is a Bid-Ask Spread?

The bid-ask spread of gold refers to the price difference between the highest price at which a buyer is willing to pay for a gold asset (i.e., bid price) and the lowest price a seller is willing to sell it (i.e., ask price). The ask price is higher than the bid price. For instance, if the ask price is $160 and the bid price is $155, the bid-ask spread of gold is $5.

The bid-ask spread of gold can indicate:

- Liquidity of the asset (i.e., the lower the spread, the more liquid gold is)

- Volatility of the market (i.e., the lower the spread, the less volatile the market)

- Transaction cost (i.e. the lower the spread, the lower the transaction cost)

How to Invest in Gold?

These are some ways you can invest in gold in Singapore.

Gold Bars, Bullion Coins, and Jewellery

Physical gold assets include gold bars, bullion coins, and jewellery. You may purchase them from authorised banks, dealers and retailers by the Monetary Authority of Singapore (MAS).

Pros: Physical gold is tangible. You can wear gold jewellery as fashion accessories.

Cons: They are susceptible to theft and loss. You will have to pay additional costs to store and secure them.

Gold Certificates

Gold certificates are proof of gold ownership that you can sell anytime. They are a viable option for those who prefer direct ownership of gold. You may purchase them from MAS-approved banks.

Pros: Gold certificates require less storage space compared to other physical gold assets. You may convert them to cash or physical upon demand.

Cons: You will need to pay additional charges for each transaction.

Gold-Related Exchange Traded Funds (ETFs)

Gold-related ETFs are portfolios of gold-related stocks that can be bought and sold on the stock market. You won’t have direct ownership over gold in this type of investment.

Pros: Gold ETFs are highly liquid and easily accessible to investors of the stock market.

Cons: You will need to pay additional expense ratio fees for someone else to manage the funds on your behalf.

Gold-Related Stocks

Gold-related stocks are sold by gold mining and production companies with no direct ownership over gold. You may earn dividends (i.e., profits made by companies issuing these stocks), break-even or incur losses.

Pros: Gold-related stocks are highly liquid and accessible on the stock market.

Cons: They are subject to market volatility and company performance (e.g. debt, company management).

Gold Accounts

Gold accounts by authorised banks and fintech platforms like Hugosave allow you to use your savings to buy and sell gold. Gold savings may be converted to physical gold and/or cash.

Pros: You won’t have to manage the physical asset.

Cons: Depending on the platform, you may need to purchase a minimum quantity in each transaction. You may also need to pay additional fees for transactions. Note that Hugosave has no minimum quantity requirement.

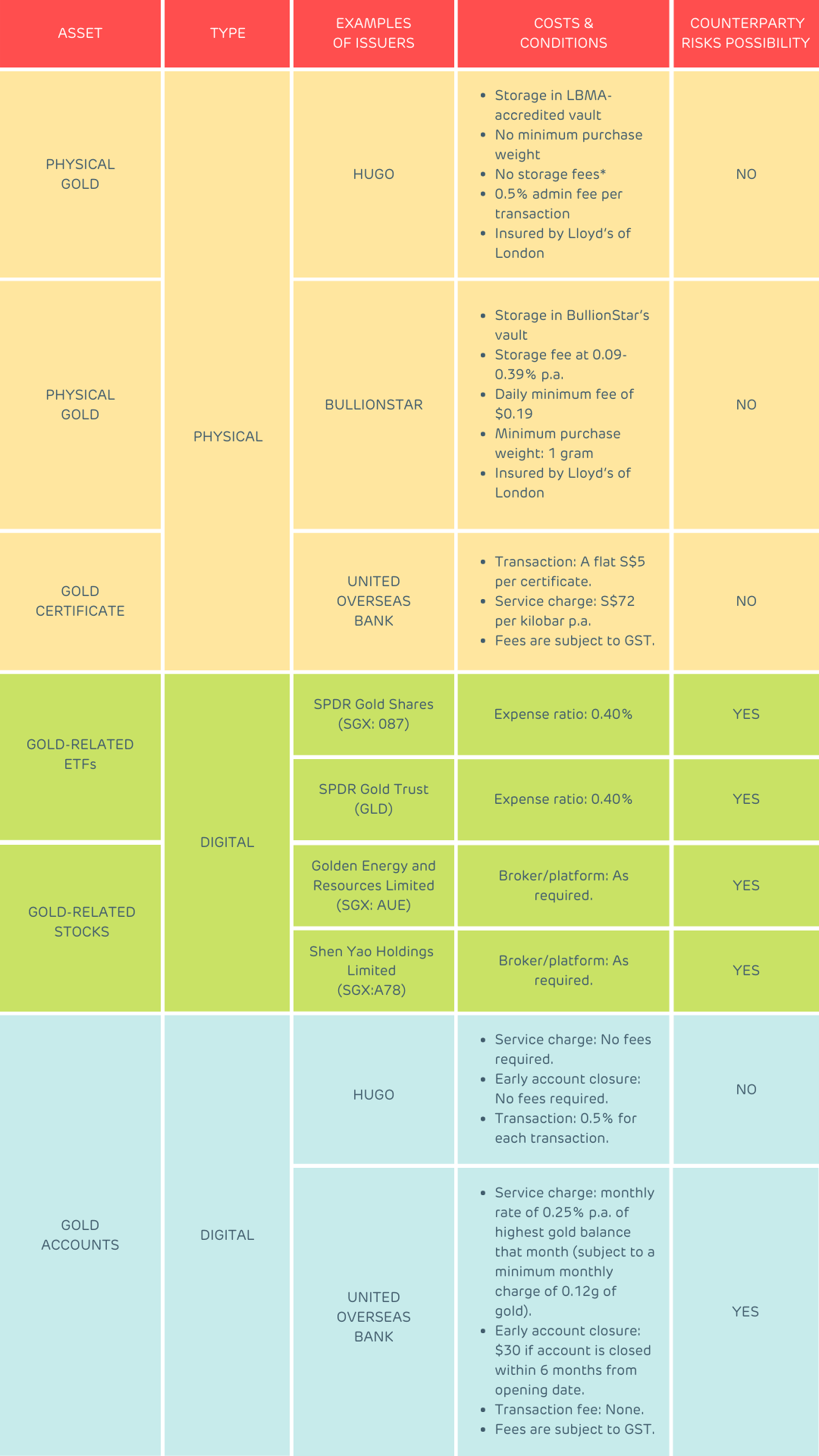

Note: This table is non-exhaustive.

Check out this article for a more in-depth comparison of the different gold instruments.

Hugosave Gold Vault: Safe and Easy

Investing in gold can help you grow your savings faster and fight against inflation. It is no longer an investment for the rich and huge risk-takers alone. Kickstart your first investment in gold with the lowest risk and costs today!

The Hugosave Gold Vault allows you to buy and sell gold easily—at any time and at any amount starting from $0.01. While the trading process is done digitally, the gold you buy belongs to you legally. Besides being safely secured in vaults by the London Bullion Market Association (LBMA), your gold is covered by the world’s leading insurance company Lloyd’s of London.

How Hugosave Gold Vault Works

When you spend with Hugosave, your Hugosave Roundups will round up your purchase to the nearest dollar and save your spare change. Every week, your spare change will be automatically swept to your Hugosave Gold Vault, which helps to invest in gold on your behalf. For example: when you spend $28.50, your spare change of $0.50 will not only be saved but invested into gold—preserving and growing the value of your savings over time.