In this article, we explain 14 chim (sophisticated) terms used commonly in gold investing so that you will not only sound smart but are actually smart when you meet your friends on gatherings.

(P.S. If you want to go further and actually stump your friends, read our complete guide to gold investing)

Hedge

Let’s start with an easy one. Hedge, in normal speech, refers to an enclosure, a boundary, or a barrier. Its meaning in finance is not too far off; a hedge refers to an investment made to offset losses incurred by other instruments by taking an opposite position. By having a hedge, you can add some stability to your basket of riskier assets and balance out losses incurred by other assets.

Gold has been used as a hedge for a long time because it can help investors protect themselves against excessive risk and inflation. For example, as currencies lose value for a number of reasons (e.g. political instability, public policies, inflation), gold price has been observed to rise against it. So, an owner of gold is protected (or hedged) against a falling dollar.

Inflation

:max_bytes(150000):strip_icc()/inflation_color2-216537dd3aeb4365b991b67790765e4f.png)

Need more and more money to buy the same cup of coffee. | Image source: Investopedia

Inflation describes the rate at which the value of a currency falls while, consequently, the prices for goods and services rise. As general prices rise, the purchasing power of consumers decreases.

An increase in the supply of money is usually the driving force of inflation, though this increase could have varying reasons. Governments may print more money to fund policies, giving away money to citizens such as grants and subsidies, or legally reducing the value of the legal tender currency (currency devaluation). Governments can do this because gold is no longer a currency standard (also explained more below) and no longer does a fixed amount of gold dictate a currency’s value.

Commodities

Image source: Flickr

Defined as “a substance or product that can be traded, bought, or sold” in the dictionary, the meaning of commodities is not that different in the investing world. Commodities include things like crude oil, agriculture and livestock and precious metals.

The prices of commodities tend to move in opposition to stocks (which is largely affected by market performance). No matter the economic situation, commodities are needed and consumed for daily living. This is why some investors rely on commodities investments during periods of market volatility. Gold is among the top commodities traded around the world.

Gold Bullion

Image source: Pixabay

Gold bullion refers to investment-grade gold (officially recognized as being at least 99.5% and 99.9% pure gold) commonly in the form of bars, ingots, or coins. Sometimes a gold bullion is called a physical gold bullion to emphasise that it is a real, tangible asset, instead of its paper counterpart.

Troy ounce

A metric used in weighing precious metals such as gold. Not to be confused with the usual ounce (28.35g), a Troy ounce is defined as weighing 31.1g. It uses the Troy weight system as opposed to the way we weigh other goods.

Here’s an interesting fact: the Troy system of weight is named after the city of Troyes in France, and was widely used in Europe during the Middle Ages. However, the system fell into disuse as more popular systems emerged and now the troy ounce is the only remaining metric used from the Troy system.

Asset correlation

Asset correlation is a measure of how the relationship of investments influences one another. For instance, when both assets move up as the other moves up, they are considered to be positively correlated. When one asset tends to move up while the other goes down, the two assets are considered to be negatively correlated.

Assets like physical gold that don’t show any relationship to each other are non-correlated and will not be influenced by the movements of other assets, making it a safer investment as it is not prone to external changes.

Volatility

Volatility is the rate at which the price of an asset increases or decreases over a particular period. It is measured by calculating the standard deviation of the annualised returns over a given period of time. Simply put, volatility measures the risk of a security and indicates the pricing behaviour of the investment and helps estimate the fluctuations that may happen in a short period of time.

Market volatility is inevitable. It’s the nature of the markets to move up and down over the short-term. This includes gold too—gold is a volatile investment IF you are buying and selling gold very actively (we’re talking about within the day or week). However, over the longer term (>3 year), gold prices trend upwards in a remarkably stable fashion as compared to other asset classes. This is why we think keeping savings in gold is safer and is a good counter to inflation.

Liquidity

Liquidity refers to how quickly and easy an asset or investment can be converted into ready cash without affecting its market price. The most liquid asset of all is obviously cash itself. However, gold is considered a liquid asset too as there is constant demand for gold and the system for gold trading is highly developed and accepted worldwide. Investors can sell (and buy) gold relatively quickly at a recognised universal price.

Counterparty

Counterparties are entities that form part of a transaction. Each transaction involves counterparties that make the exchange possible. In other words, buyers and sellers of an asset may have to involve middlemen to facilitate the process (e.g. broker).

There is an added aspect of risk by counterparties because there is always the possibility of a counterparty being unable to fulfil the obligations on their end of the transaction. However, there are firms that can help to mitigate the risk. Buying PHYSICAL gold has no counterparty risk since

1) you have a legal claim to the gold you bought i.e. it’s yours to own and no one can deny it,

2) your ownership of the gold relies on no one else.

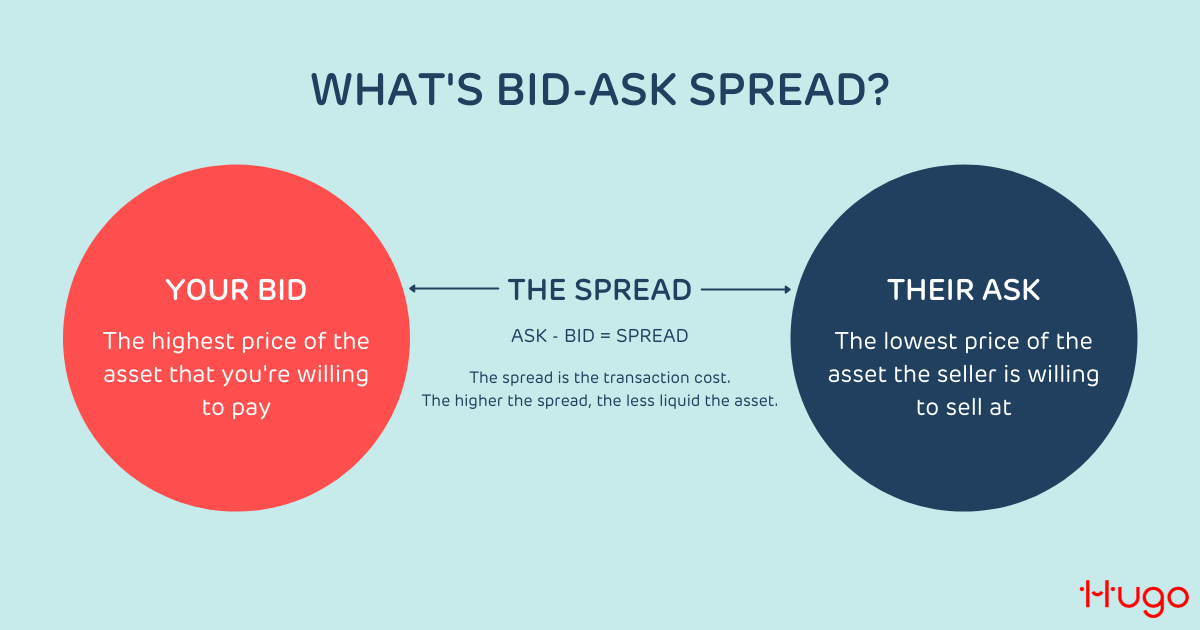

Bid-Ask Spread

A bid-ask spread is the amount that an ask price exceeds the bid price for an asset in the market. The bid refers to the highest amount a buyer is willing to pay, the ask is the lowest amount the seller is willing to sell at, and the spread is the difference.

The spread can indicate the cost of facilitating the sale (e.g. production cost, middlemen fees) and the liquidity of the asset i.e the greater the spread the harder it is to sell.

Dollar-cost averaging

Dollar-cost averaging (DCA) is an investment strategy in which an investor divides up the total amount they intend to invest across a period of time for a target asset. The purchases occur regardless of the asset’s price and at regular intervals.

This strategy lessens the mental load on an investor since they don’t have to watch gold prices all day everyday trying to time the market. Because gold is highly reliable long-term, investors might find it more sensible to adopt a DCA strategy.

Hugo allows gold investors to DCA their gold holdings very easily and conveniently! Hugo Roundups helps users save as they spend and invest those savings into gold on a weekly basis. Users can also set monthly gold-buying schedules to ensure they increase their gold holdings in a diligent and steady manner.

The Gold Standard

The UN Monetary and Financial Conference at the Mount Washington Hotel in Bretton Woods, New Hampshire, in July 1944 | Image source: Federal Reserve History

Once a universal system used by nearly all countries, the Gold Standard involved fixing currencies in terms of gold. Countries were also able to link their currencies to other countries which did so.

The system has since collapsed, but it has created a lasting influence on international currency exchange and trade through its development of the International Monetary Fund (IMF) and the World Bank.

Allocated Gold

Allocated gold refers to physical gold that belongs to you legally but is stored in a 3rd-party vault on your behalf. The gold belongs to you, is not reflected in 3rd-party balance sheets, and is not affected by the financial performance of any other parties. Allocated gold is simply held under a custody (or ‘safekeeping’) arrangement.

When #HugoHeroes buy gold through Hugo, the gold is allocated to you i.e. you own the gold and have a legal claim to it.

London Bullion Market Association

The London Bullion Market Association (LBMA) represents the wholesale gold and silver market worldwide. Members of the LBMA provide banking, dealing, vaulting and transporting services that efficiently facilitate the trading of large-bar gold and silver between buyers and sellers.

The LBMA also ensures the quality of materials by accrediting member bullion refineries so that wholesale bars meet strict standards of fineness, weight, shape and markings. The LBMA also represents the gold and silver market’s interests to governments and regulators.

In addition, LBMA also accredits vaults that meet its standards for trustworthiness, safety and security with storing gold and silver bullions. Hugo stores all gold owned by #HugoHeroes in an LBMA-accredited vault.

The More You Know…

For those curious about the different gold derivatives that are available out there, take a read through this article that breaks them down into simple, easy to understand terms. Gold has held its value remarkably well over long periods of time and is likely to continue to do so. Now armed with more knowledge on gold investments, depending on your own preference and aptitude for risk, you may choose to invest responsibly in gold.