Since the pandemic started early 2020, gold prices went from US$1,527/oz on 2 Jan 2020 to US$1,805/oz on 30 Dec 2021, with a four-decade high of US$2,048 on 5 Aug 2021. This confirmed what we had known all along—people flock to gold during uncertain times as economies do poorly. Rising inflation and economic instability from the unabating coronavirus mutations signal the right conditions to buy into safe-havens like gold as a safeguard. What’s more, many central banks have been increasing their gold holdings. If you are also thinking of buying gold, check out this neat guide to gold.

The need to be able to buy physical gold digitally is evident. The economic downturn had negatively affected many gold-based instruments, since they are correlated assets i.e. their value is tied to larger fluctuations in the traditional markets. This made physical gold, which is non-correlated, more attractive than gold derivatives. However, because of restrictions in movement and virus transmission risks, buying gold directly from a bank or a bullion shop may not be viable for some.

The Pros of Buying Gold Digitally

- Competitive/flexible trading fees: Average trading fees range from 1-3% per transaction. Hugo’s gold trading fee is at 0.5% per transaction (waived till 30 June 2022).

- Low/flexible storage cost: thanks to technologies in accounting, most online bullion dealers and precious metals platforms are able to provide flexible storage solutions. Hugo does not charge storage fees.

- Trade gold in smaller amounts: there are platforms that offer flexible amounts of gold purchasable. You can buy gold through Hugo Gold Vault at any amount, with the option of going by weight or value.

- Convenience: You can buy/sell anytime and anywhere you want as long as you have an internet connection. You do not have to store the gold yourself or go to a physical vault to pick it up.

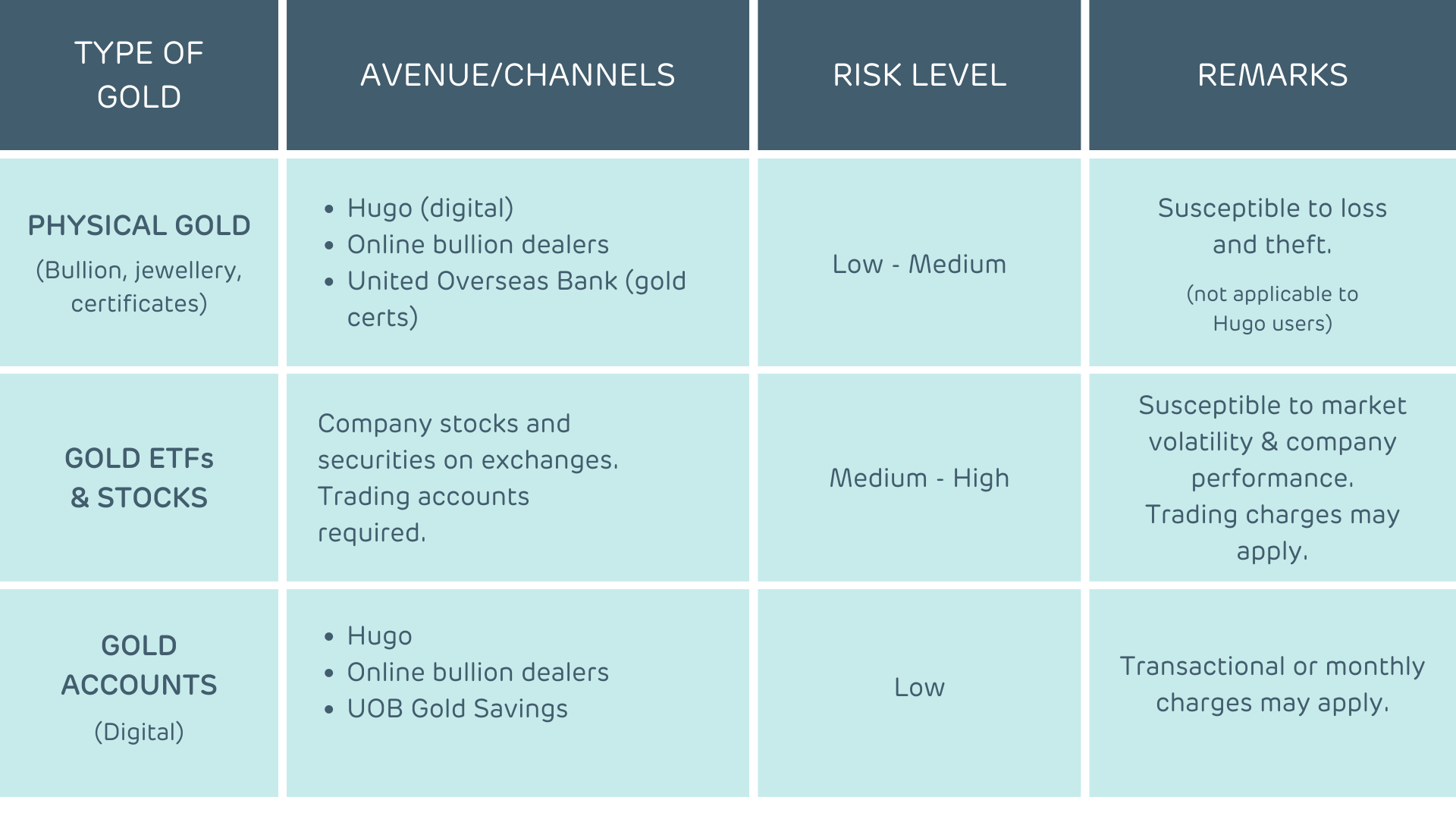

Ways to Buy Gold Digitally

Gone are the days when you have to physically hold the gold in order to own it. Gold investment today is available and accessible online. There are many ways you can buy and save with gold electronically without having to have a vault on standby.

Here are a few ways you can buy gold online:

Buying Gold through Hugo Gold Vault

Without having to open a trading account or try to keep track of it on different platforms, Hugo has a neat suite of features that helps you manage your money better:

- Hugo Gold Vault lets you buy/sell physical gold easily via your app.

- Your gold is stored in an LBMA-accredited vault in Singapore and insured by Lloyd’s of London, mitigating your risks effectively.

- You have a legal claim over your gold.

- Monitor LIVE gold prices via the app so you can make informed decisions.

- Start buying/selling gold with $0.01, and use Roundups to save in gold regularly and intuitively.

- Set monthly schedules to buy more gold over time and cultivate a savings habit.

- You can make ad-hoc gold buys/sale too!

- Each transaction carries a very competitive 0.5% trading fee only. (Waived until 30 June 2022.)

Hugo gives you a leg up investing in gold because it’s easy and convenient to trade via the app, everyone can buy and sell gold at their own discretion, and the Gold Vault is part of the holistic savings app.

All in all, this is why we believe Hugo is a great way to invest in gold digitally.

Buying Gold through Other Digital Platforms

Bullion sites

Gold can be bought through many avenues in various forms. As an online investment service, gold can be bought directly on websites like BullionStar and BullionVault. Do note that these direct sellers charge fees for trading and for storage. You may also buy bullion from banks directly where they are also stored. Some banks like UOB also offer gold in the form of gold certificates. UOB charges a flat S$5 per certificate as well as a service charge of S$72 per kilobar per annum, subject to GST.

Stocks

Rather than investing in physical gold, you can also buy stocks in companies that mine and refine gold. Top gold mining companies include Barrick Gold (GOLD) and Newmont Mining Corporation (NMC). While this gives you exposure to gold as an investment without having to handle storage, you will be exposed to risks associated with corporate performance, governmental policies on environment, natural disasters etc. These risks can impact the mining companies’ stock performance. To buy these stocks, you will need to have a trading account where you can buy and sell on international exchanges.

Securities

You may also prefer to invest in a basket of gold-related securities through gold mutual funds or ETFs. ETFs may track the price of gold, include the stocks of multiple gold mines and refineries and provide exposure to gold futures and options. This way, you can get exposure to the gold market in a cost-efficient way, without actually having to own the precious metal. For example, SPDR Gold Shares ETF leads the charge on the Singapore Exchange.

Conclusion

Buying gold digitally through reputable platforms is an increasingly popular way to invest gold, since investors no longer need to personally go to a bullion shop/bank, transport and then store the gold. Hugo allows you to buy physical gold (which has no counterparty risks unlike ETFs and derivatives) conveniently at a very competitive rate and stores the gold on your behalf. It’s as easy as it gets.

Before making an investment, always be mindful of the platform’s reputation and track record, that it has a physical and real address, clear policies on its trading services, transparent pricing and, finally, a transparent transaction process.