Every true blue Singaporean will know that saving for big-ticket items can be very leceh—it’s hard to keep track and you have to start saving wayyyyy in advance. You will need to first acknowledge the urgency, have the discipline to set aside money, AND constantly keep your itchy fingers away from the cookie jar.

What if I tell you that you can now simply tell Hugosave your plans and watch your savings accumulate without lifting a finger?

Making piggy banks super smart

Most savings accounts (and traditional piggy banks) are “passive”, i.e. it’s 100% on you to fill it up, and it’s 200% on you if it isn’t full by the time you need it to be. Even with internet banking, things haven’t gotten a whole lot smarter either. If you are one of those with a long-term savings bank account apart from your “general use” account, you still have to order the transfer of funds between accounts.

We’re not trying to hao lian (show off) here, but seriously ah, Hugosave’s Money Pots is perhaps the smartest tool to save for your goals. Let me show you how.

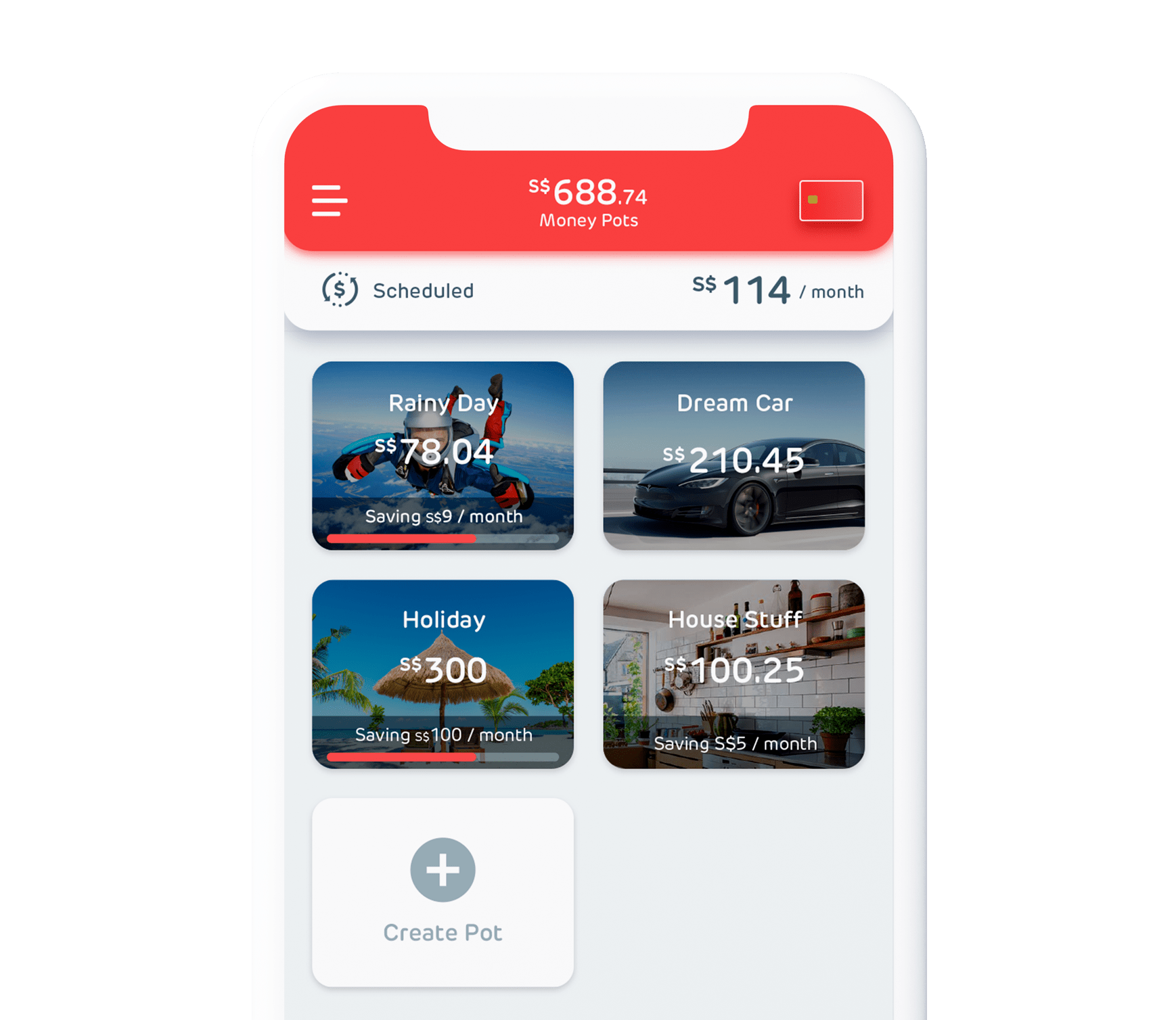

Compartmentalise savings goals with Money Pots

As Sun Tzu once said, “If his forces are united, separate them.” The lump sum of all your savings goals can look scary! Don’t worry, divide them by setting up a Money Pot for each of your goals. Name them “Aussie trip”, “New sofa”, “Ah Girl’s tuition fees”, “Wedding day” or whatever. Instead of confronting the idea of saving $60k in 5 years, it’s better to segment the sum into multiple Money Pots and conquer one by one over 5 years. This is literally having multiple smart piggy banks and automatically filling them up all at the same time and in your phone.

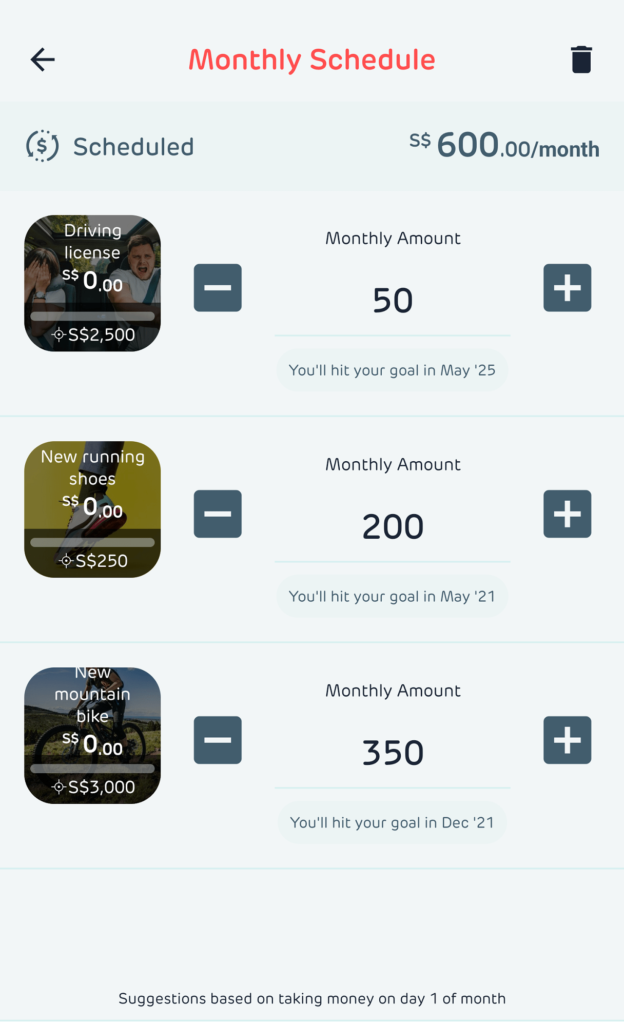

Decide how intensely you want to save for each goal

A common savings strategy is to set aside a portion of your monthly salary, deposit it in a separate bank account, and only withdraw when you want to fund something. While that’s all well and good, it is nevertheless “reactive”. Hugo’s Money Pots let you save for as many goals as you want and choose how fast you want to chiong. There’s no limit to how many Money Pots you can set up so you can save for different goals and check in on their progress at any time. Steady bo!

Set timeframes to keep track of your savings goals

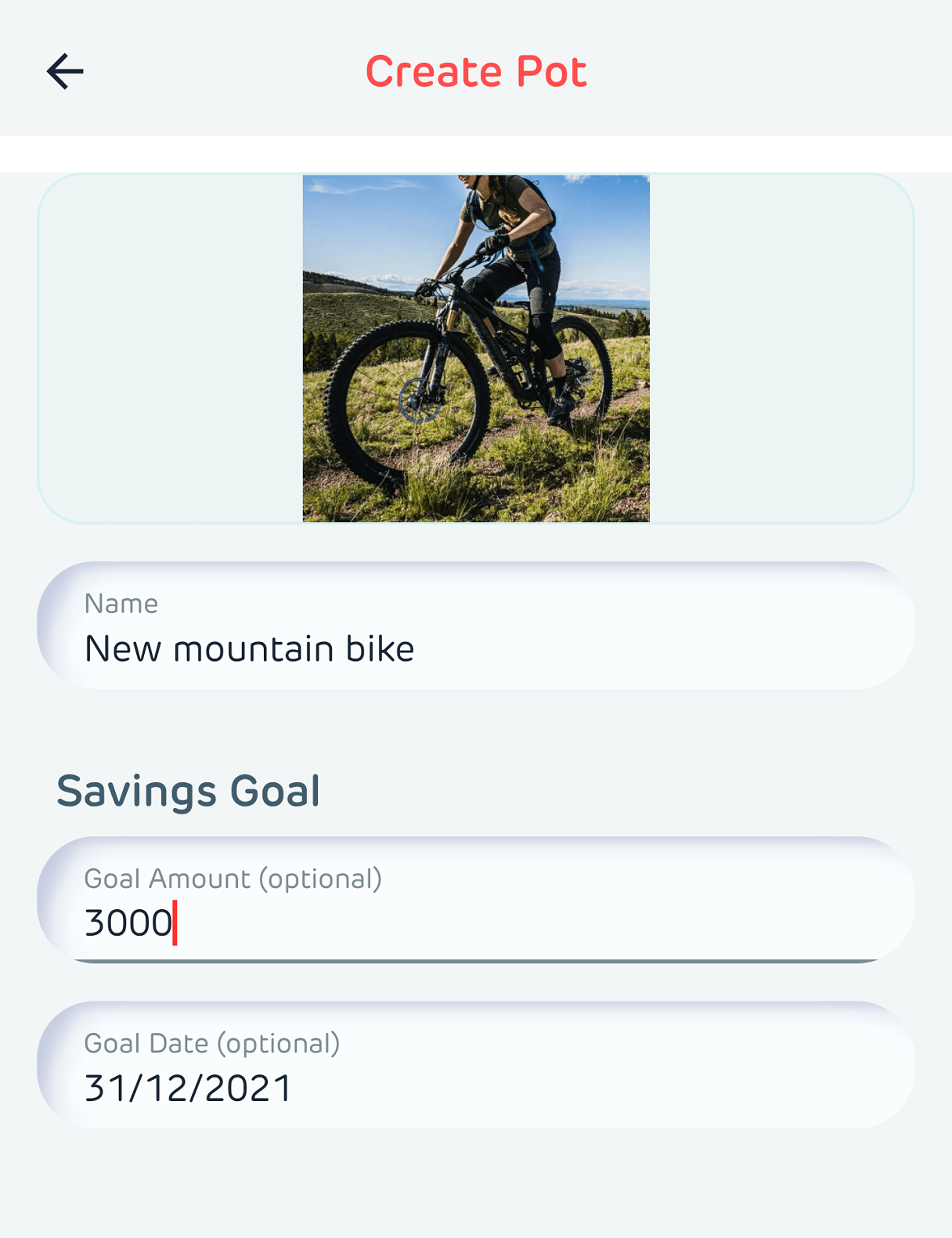

Not all goals are equally urgent. Saving for your wedding at the Ritz Carlton in a year from now will be more urgent and intense than your dream Bentley. With Money Pots, you can tell Hugosave when your goals are due and better manage your priorities. What’s more, Hugosave will nudge you periodically and remind you to deposit money into your Money Pots! Show me one piggy bank that can do that.

You can name your Money Pot, set your display picture, input your goal amount and tell Hugosave when you want to reach your goal by!

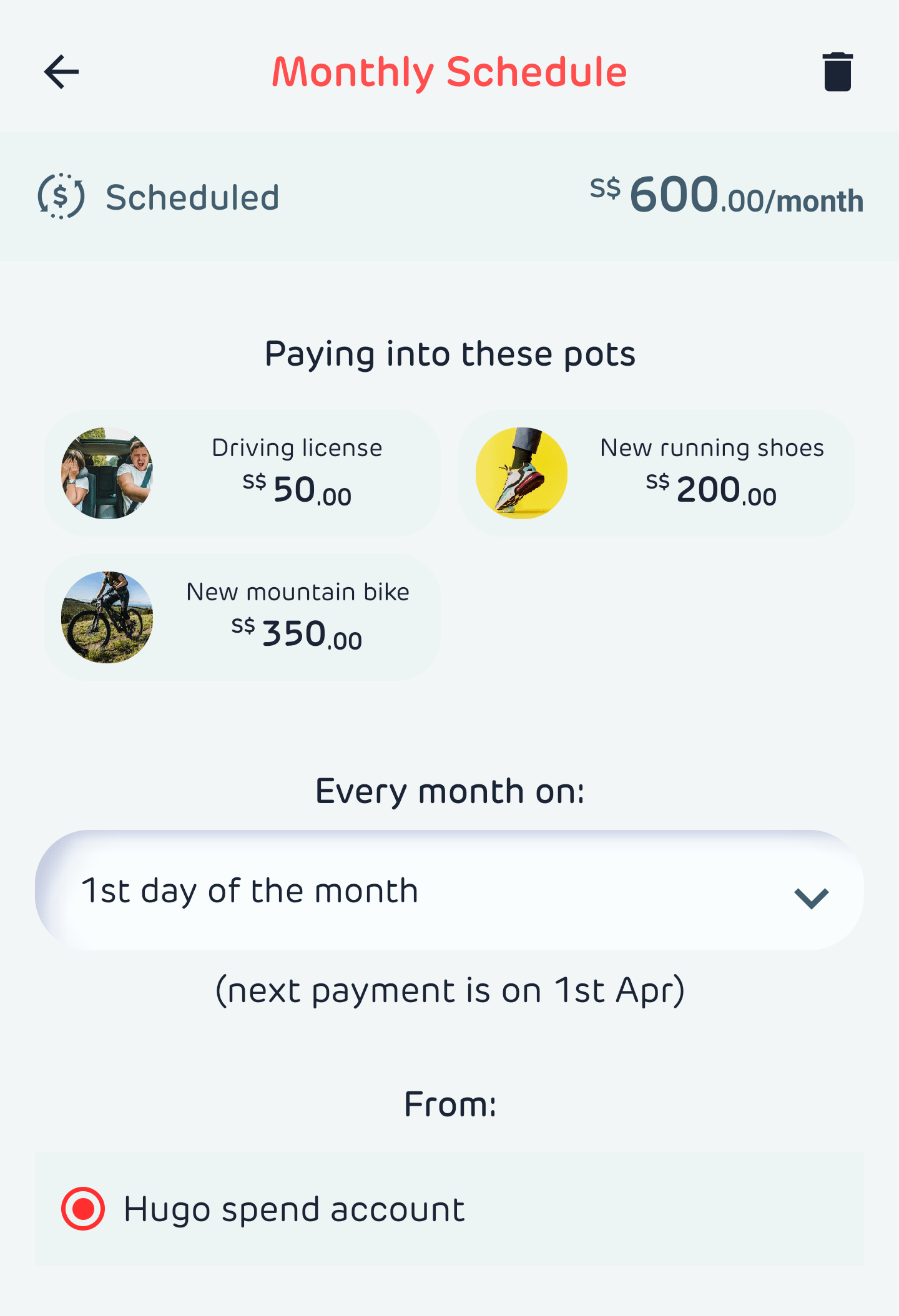

Hugosave calculates your total scheduled savings amount per month and lets you decide when you want to deposit your money. No more manual transfers!

Saving for group goals is easier and clearer

Some of your savings goals may not be yours alone, e.g. for your wedding, a home renovation with your spouse, or a birthday trip with your friends. With Money Pots, you can split the amount among your friends and get them to set up their own Money Pots for it! This is like you and your friends coming together to break piggy banks to buy ice cream, only that you can do it digitally now.

Money Pots Make Saving Super Easy!

Whether you’re saving money for a goal that’s a few months or a few years away, setting up Money Pots is an amazing tool to plan your savings strategy effectively, chart your progress, reach your goals and transform your fortunes!

Win up to S$80 in Goldback® when you complete all in-app Quests! Read more about our new Rewards Centre here. Don’t say bo jio!