For something to be cool, it has to have two characteristics. One, it produces positive effects in your life that few can, be it physically, emotionally or psychologically. Two, it represents a concept of living that people want and regard highly. That makes gold one of such cool things!

For thousands of years, it has been one of the most popular and useful materials on Earth, from its role in finance to engineering to design. Sure, investment vehicles like stocks and property are more talked about today, but one of the reasons is because they are very volatile. If you are a parent, you would probably be more anxious over your mischievous kid than your responsible and independent firstborn. Same idea lah.

Cool facts about gold in finance

Before we get into how gold is cool in the 21st century, let’s remind ourselves of the roles that gold has been playing even before we were even born. We promise to not tell grandfather stories!

Gold was once the primary currency of the world

Before fiat currency (basically, your paper notes and coins) was invented, physical gold was used as currency in many civilisations. Up until 1914, countries would peg the value of their currency to their gold prices. Today, Singapore’s currency is backed by the Singapore gahmen. If our gahmen is good, we’ll have a strong SGD. However, we can’t always assume it will stay good, right?

Gold cannot be printed, unlike fiat money

Today’s money can be printed as needed since currencies are now backed by governments. The greater the supply of money, the lower its value (inflation) and things become relatively more expensive. While that $1 coin you set aside in 1998 is still legally $1 in 2021, it may no longer buy you a kopi or teh in many places. In contrast, governments cannot print gold, therefore it retains its value relatively well and even increases against inflation. We’ve done some simple calculations to prove the point: if you had invested that $1 in gold in 1998, you would yield about $4 today. If it had sat in a biscuit tin, that coin would be worth about the same as $0.73 in 1998. Jialat.

Watch a short video on the impact of gold and fiat money on economies:

Singapore economy is boosted by gold

Generally, when a country exports more than it imports, its currency’s value increases. Not only is gold Singapore’s 4th most valuable export, but we are also ranked consistently among the top 10 in the world for the value of gold exported. As such, when gold prices increase, the value of our total exports increases as well, strengthening our currency. So, why would any Singaporean investor not want to buy at least some gold?

Why gold is still cool in 2021

Up until recent years, if you spoke to anyone about buying gold pieces, you might have heard them describe gold as orh-biang or 老土 (lao tu, old-fashioned). We suspect it has something to do with the old ah bengs who would strut around with their massive gold chains, Rolex watches and gold rings that put Captain Planet to shame.

Well, things have changed. In the 21st century, vintage has become the new modern and people are turning their attention back on gold and some old traditions have become cooler than ever!

1. We STILL love tying the knot with gold

Gold is a huge thing for weddings in Singapore. A Chinese wedding custom, known as 过大礼 (guo da li), involves the groom giving the bride’s family a set of gifts. One of the gifts is called the 四点金 (si dian jin, “4 Touches of Gold), which includes 4 pieces of gold jewellery to signify that the husband will take care of and provide for the wife.

Image credit: Singapore Brides

For the akad nikah or the solemnisation ceremony in Malay weddings, there’s quite a list of jewellery to prepare: the wedding ring, the batal air sembahyang ring and jewellery in the gift trays. The wedding ring is the grandest of them all and is usually in yellow gold.

Indian brides wear the most elaborate jewellery at the wedding, from the crowning maang tikka worn across parted hair to the payal anklet. Traditionally, the jewellery pieces would be in yellow gold.

2. You must mean a lot when someone gives you gold

There are only a few very, very special occasions when Singaporeans give someone gold. When we do, it’s because the receiver is worth that much.

- Engaged couples: Gold wedding gifts are among the most expensive items involved in the wedding, and there is no reason to scrimp on something meant for your life partner.

- Wedding rings: 21st-century couples still appreciate the timeless meaning of gold and much prefer their symbol of eternal love be represented by gold rings.

- Newborns: Some Chinese family members consider it auspicious to give gold minted coins and medallions to the parents of newborns.

The giving of gold is more than just about its bling. When you give someone one of the most expensive and rare metals on Earth, it means he/she deserves the value of gold. So, instead of the cliched mug, socks or Capitaland vouchers, how about some gold?

3. It’s worth its weight in, well, gold

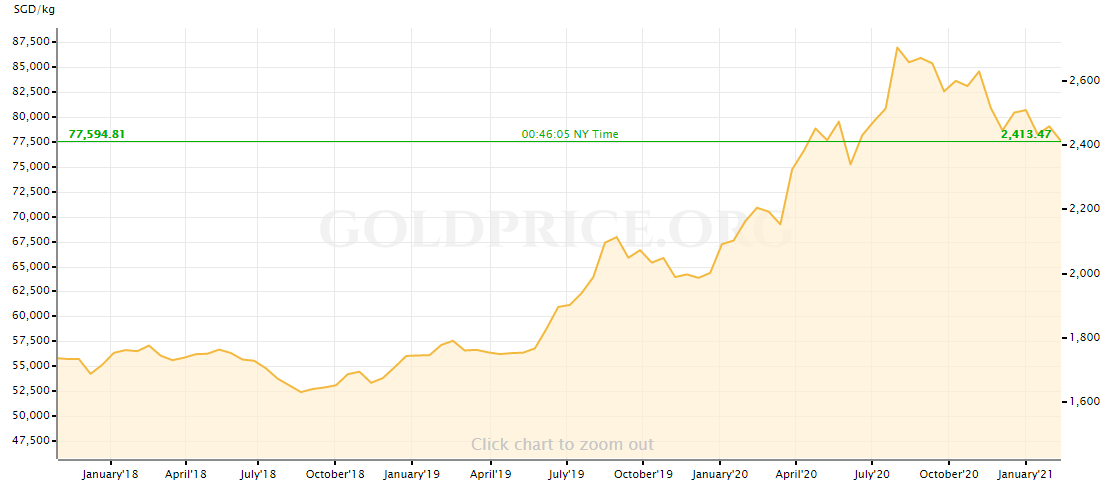

As mentioned earlier, gold is basically the OG form of money, and in today’s financial world, its status as a safe haven investment makes it more precious than ever. While the stock markets have been ravaged by COVID-19’s impact on society, gold prices surged through the second half of 2020, hitting $2,600 an ounce, completely destroying previous record prices. Gold remains a key asset that underpins central bank reserves; if it is good enough for governments and billionaires, it is good enough for the rest of us.

Source: https://goldprice.org/gold-price-history.html

Between its longevity, having been around for centuries, and having proven itself as a good hedge against bad economic scenarios, you can bet on gold holding its monetary value.

4. Putting our nest eggs in multiple baskets, and gold is one

Any responsible investor would know that it’s good practice to diversify our investment portfolios. Different investments are subject to varying levels of rewards and risks in different economic conditions. Generally, gold prices are inversely related to stock market performances, i.e. gold prices go up when stocks go down. By buying both gold and stocks, you can manage your losses in the stock market better. Therefore, gold is widely used by investors to both protect and grow wealth.

5. Technology is making gold buying easier and easier

While most see gold as a sound investment, it was not always available to everyone. In the not so distant past, to buy gold, you had to set aside a tidy sum of money to buy/trade gold from either gold jewelers, bullion dealers, banks, or gold brokers. Therefore, only atas people could comfortably afford it. However, with innovative trading apps available today, anyone can buy gold without having to set aside sums of money. Case in point: The minimum sum to buy gold through Hugo? 10 Singapore dollars.

Going for gold: which gold, though?

Alright, so you’re ready to invest in gold, but there are many gold-based products in the market. Gold funds, gold stocks, and even buying physical gold are all options!

- Gold bullions can be in a bar, coin, or of any other tradable and practical forms. The price of bullions typically includes the cost of the metal, the costs of refining and shipping it, and the dealer’s premium.

- Gold ETFs and Mutual Funds hold bullions on your behalf and do not involve you holding physical gold. They are seen as much more liquid than you going around with a gold bar trying to find a buyer.

- Gold Futures and Options utilise either physical gold or gold futures as their underlying instrument.

- Gold Jewellery needs no introduction. While they are often combined with other metals (thus not pure gold), gold pieces are often passed down generations as family heirlooms, adding sentimental value.

Go(ld) with Hugo

Through the Hugo app, anyone can own a digital Gold Vault, where you can buy, sell and hold gold conveniently. At the touch of the finger, you now can invest in gold easier and more affordable than other methods in the market, and just as safely. FYI, while trading gold through Hugo is a digital process, what you are buying is physical gold that is legally owned by you (which explains the in-app security measures we’ve employed) and stored securely in an LBMA-accredited vault in Singapore.

The Hugo Gold Vault also allows you to monitor live gold prices and buy or sell gold. By automatically sweeping money you’ve saved in your Hugo Roundups into your Gold Vault, we take the hardest part of the process (which is already super easy) out of your hands so you can go and enjoy life.

Trading in gold has never been simpler.

Hugo makes it easy to clinch that gold

In summary, gold has been mined as a precious metal for millennia and remains a timeless alternative currency to fiat money—all for good reasons. By diversifying your investment strategy and including gold in your portfolio, you can protect your nest egg and even grow it amidst market volatility, like we’re seeing right now.

Do you have an iron rice bowl? Good!

How about a golden nest egg to go along with it?

Find out more about how Hugo’s Gold Vault makes buying gold super easy so you can grow your wealth just as easily!