2021 saw the continued excitement surrounding cryptocurrencies and the boom of NFTs. The stock markets did pretty well in 2021 too, with S&P 500, Dow Jones and Nasdaq achieving double digit gains.

However, these assets are volatile; while they can make you rich relatively quickly, they can make you become poorer just as quickly. After years of bottom-flat interest rates, 2022 is set to see interest rates leapfrog. Investment banks, from Goldman Sachs to the Deutsche Bank to the Bank of America, have published revised forecasts for interest rate hikes. This will effectively raise lending rates for consumers and affect cost of living in all sectors. The Russian invasion of Ukraine, threatening to become a prolonged and wider conflict, has been causing stock markets to do poorly.

How Gold Alleviates Your Risks

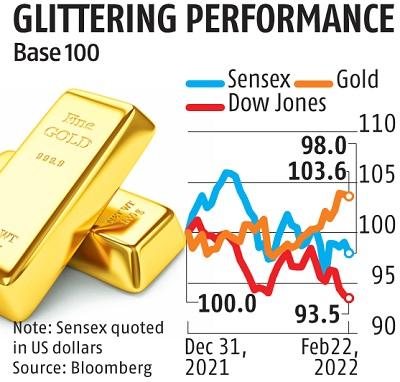

Against the backdrop of risky crypto investments, interest rate hikes, financial scams and a raging war, gold is shining bright. Gold is relatively resilient against risks, even during trying times and especially so in times of instability. Gold has stayed strong, even as other investments fell.

Source: Business Standard

Hedge against inflation

Empirical data suggests the relationship between gold and inflation usually improves during times of rising inflation, as fears of value loss bring more investments into good stores of wealth like gold. Additionally, since 2012, the import and supply of investment-grade gold in Singapore have been exempted from GST. Rising inflation leads to both economic and political instability as fears and anxieties arise and this is where gold’s demand as a safe haven will go up.

Bringing stability

Just a month into an uncertain year post-Covid and riddled with rising interest rates, market volatility and fears of a coming recession, gold prices have remained buoyant. Despite supply chain issues, inflation and lingering pandemic risks, investment flows into gold have been very resilient and steadily rising. Gold can only increase in value. This is good news whether you are holding onto it in a vault or as a stock.

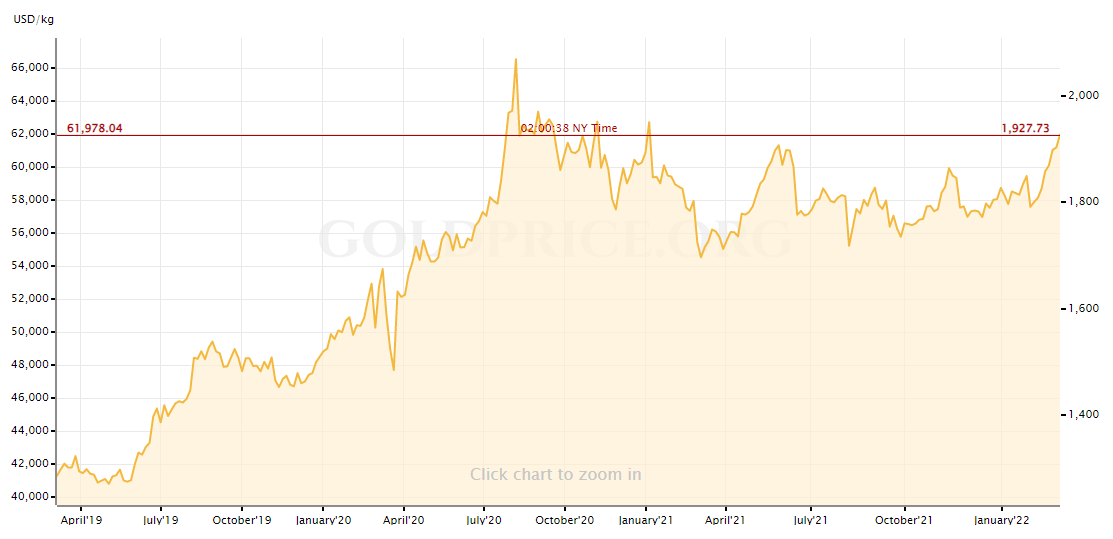

The war between Russia and Ukraine, and the readying posture of their allies for a war on a larger scale stoke new economic fears among investors. This is evident of the stock market tumbles. However, gold price is closing in on its all-time high at the time of writing.

Source: Goldprice.org

How Safe is it to Invest in Gold?

People have always used gold to diversify their portfolios and protect their wealth during political and economic instability, and when other investments decline in value. Because gold prices tend to be less volatile than stocks over the long term, gold is viewed as a safe investment. In most cases, because of its physicality and accessibility to investors, the chosen commodity is gold.

As a non-correlated asset to the stock market, it’s wise to put a portion of your investible money in gold to balance out risks you undertake in other derivatives. If you are into cryptocurrencies and NFTs, you should recognise the highly volatile nature of the asset class, and keep gold a part of your overall portfolio.

Buying Gold through Hugo Gold Vault

Hugo’s Gold Vault lets you save money and invest in gold at the same time in a liquid, accessible and safe manner.

- Buy/sell physical gold easily via your app.

- Your gold is stored in an LBMA-accredited vault in Singapore.

- Your gold is insured by Lloyd’s of London.

- You have a legal claim over your gold.

- Monitor LIVE gold prices via the app and make informed decisions.

- Start buying/selling gold at SG$0.01.

- You can use Roundups to save in gold regularly and intuitively.

- Set monthly schedules to buy cost-average into gold.

- You can make opportunistic ad-hoc gold buys/sales too!

- Each transaction carries a very competitive 0.5% trading fee only. (Waived until 30 June 2022.)

Hugo gives you a leg up investing in gold because it’s easy and convenient to trade via the app. With Hugo, everyone can buy and sell gold at their own discretion, and the Gold Vault is part of the holistic savings app.

Conclusion

As investors both new or seasoned, protecting and maintaining wealth and managing investment risks is a priority. When you add gold into your investment portfolio, you are giving yourself more stability and a better balance against other riskier buys.

This article is meant for information only and not meant to be relied upon as financial advice. Before making any investment decision, you should seek advice from a qualified financial advisor regarding its suitability. All investments come with risks and you may lose money on your investment. Invest only if you understand and can monitor your investment.