Compared to their millennial seniors, Gen Zs are often lauded as a financially savvier bunch. They are said to be more informed on finance and more active at saving and investing.

But really meh?

With a whole life left ahead of them, and ambitious lifestyles along the way, Gen Zs will need to make sure every dollar they save now makes a difference.

1. Their savings levels not ready for high financial risks

While 4 out of 5 Singaporean Gen Zs already started saving before turning 22—more than twice as compared to “senpai” millennials, many could still do better handling their money. Despite starting saving early, their savings are generally not ready to take on the world as they are new to the workforce.

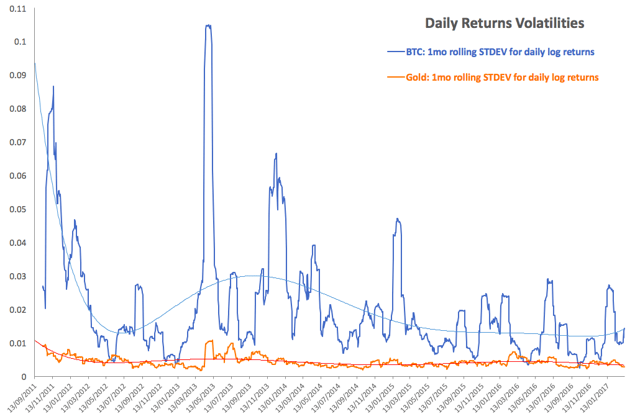

Many Gen Zs may not be in positions for risky investments (read cryptocurrencies and other NFTs) where they can lose their savings in the blink of an eye. Ok, maybe not so dramatic, but you get the point. Some assets e.g. blue chip stocks and property could be too expensive to afford now.

We’re not saying they should not invest at all, but that they should focus on investing in safer assets to build up their finances before venturing into the financial wild west. Safer assets include precious metals like gold, other commodities, ETFs etc. Hugosave’s Roundups and Gold Vault functions allow them to save their digital “spare change” and invest them in physical gold. They can also do ad hoc investments at their comfort level.

Source: Seeking Alpha | The peaks and valleys of gold are very much gentler as compared to Bitcoin.

2. Time is of the essence, and it’s on their side

Compounding is said to be the 8th wonder of the world. It’s also a reward for those who start early and stay diligent.

Gen Zs, right now in their 20s, still have a whole life ahead of them. This is why they should start putting a portion of their savings in stable instruments now to get the most out of the time they have. The compounded earnings can help to shoulder the heavy financial burdens they will soon face, such as wedding, housing, child-rearing and, eventually, retirement.

So why compounding?

Well, let’s use gold price’s annual average returns of about 10% as an example, and calculate its appreciation over 10 years. If you invest $100 in gold annually for 10 years at an average average return of 10% p.a., your $1000 becomes $1530. That’s 53% returns!

Source: Goldprice.org | Gold price increased by about 20% from 10 years ago.

3. Inflation over time cannot be ignored

High inflation as a result of black swan events like Covid-19 pandemic and the Ukraine-Russia war have shown us how devastating it can be on the value of our money. Inflation eats away at our purchasing power i.e. when too much money is chasing too few goods, the value of our money drops. Coupled with wage stagnation, things get dicey when saving for the future.

Gold has proven to be a reliable hedge against inflation, since the gold price generally has a positive relationship with inflation rate. Keeping some of your savings in gold can ensure its value is resistant to erosion.

Source: Funds Europe | The value of gold tends to commensurate with consumer price indices.

4. Liquidity is very important in the early savings stages

As said earlier, Gen Z’s finances right now are quite delicate, since it hasn’t been long since they started drawing a relatively modest salary. It’s going to be quite a while before they accumulate a good amount of emergency savings WHILE portioning a sum for investments.

The ability to return your investments in cash in a short period of time is a good thing to have. Fortunately, because gold is widely accepted across the globe, the gold market is readily accessible. Buying and selling gold can be done very quickly as compared to many other assets.

Once Gen Zs have stabilised their finances in diversified portfolios, they can rejig their financial strategies according to their individual needs and preferences.

Meet your goals with a multi-pronged approach

Saving money as a Singaporean Gen Z is no walk in the park, but it’s not super difficult either. One advice to realising life/financial goals is to adopt a uniquely tailored approach to each goal. Their goals may be to grow retirement pot, protect from financial risks, hedge against inflation, saving up emergency funds or even fund a frivolous year-end family trip. Having an optimised strategy to reach each goal provides the flexibility, freedom and feasibility needed.

On top of other asset classes, gold is great for long-term goals where Gen Z will want to use to hedge against future financial shocks, and preserve the value of their savings so that they can meet their financial milestones with a peace of mind.

Don’t snooze already

The key is for the Gen Zs to decide what their goals are, adopt a strategy and get on it NOW. We get it: things can happen and goals may change, but starting on the Wealthcare® journey early means there’ll be more options and breathing room when plans do change.

With Hugosave, Gen Zs can invest in physical gold at their comfort level, starting from S$0.01. We think everyone has at least one cent to their name lah, right? Plus, Hugosave’s Gold Vault feature affords maximum liquidity; users can buy and sell gold anytime and access needed funds quickly.

With their busy lifestyles climbing the corporate ladder while living out the best time of their lives, Roundups ensures they can automatically invest as they spend, taking some financial load off their shoulders.