Meredith Woo of MoneySmart.com recently published a sponsored review of the Hugo Gold Vault on 1 October 2021. Below is an excerpt of her write-up; you can read the original article here. You may also check out her review of the Hugo app here.

How to buy gold in Singapore?

While I’m not going to buy a chunky gold chain (not my style, TBH), that’s one of the ways we can invest in gold — by purchasing the physical form. There are other physical formats such as gold bars (if you can afford them), gold bullion coins (also pricey) and other iterations that include gold certificates, buying through a gold savings account, buying into gold-related ETFs or multi-asset funds, investing in gold-related industries, or even trading gold-related derivatives.

Frankly, I’d rather not invest in the physical, flashy metal. I mean, in my already-small home, they take up precious space, and somehow, things just magically get lost in my home — the risk of losing a single kilo bar valued at $57k is something my heart can’t take!

The best way for me would be something like that of a regular savings programme, where I can automatically deposit a small sum each month to stay invested in gold without putting in much effort. It’ll be easy for me to buy and sell gold, without lugging the physical thing to a goldsmith, wondering if I got the right prices, or buying gold and wondering how “pure” it is.

A much, much easier way to invest in gold

Thus, earlier in July when I discovered the savings app Hugo and its Gold Vault, this was literally, right on the money.

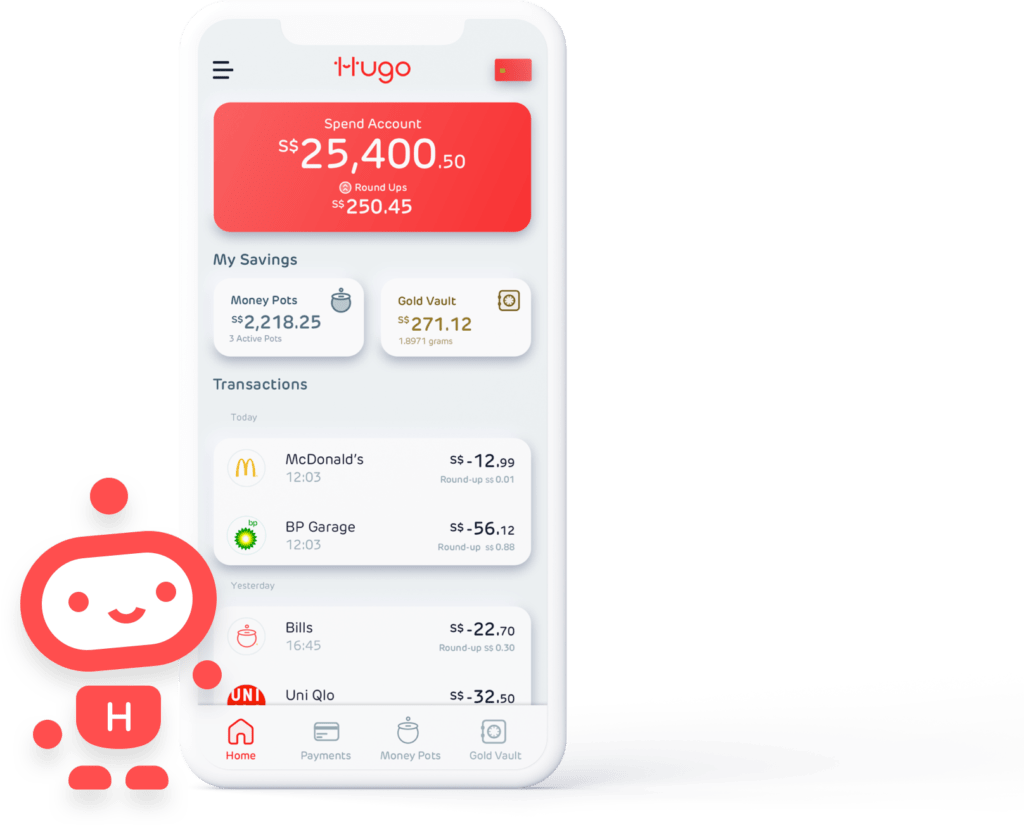

First off, the Hugo app is really simple to use. As a digital account that helps users to spend smarter through the Hugo debit card, save more actively via Roundups and Money Pots, and invest with Gold Vault, Hugo aims to be the Wealthcare® Buddy who takes care of our financial wellbeing.

So anyway, with Hugo’s Gold Vault, I can include gold in my normal savings plan (yes even my long-term investment goals) and see my savings turn into wealth over time. Here are the 5 ways how Hugo makes investing in gold much, much easier and safe for me.

1. Buy gold from just S$0.01

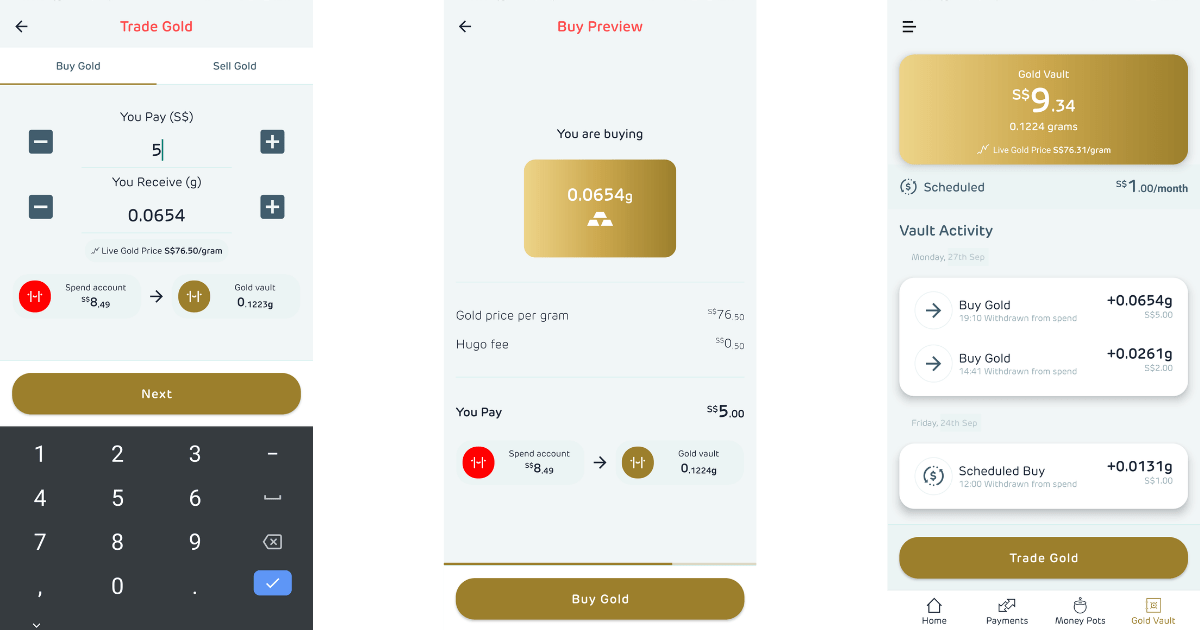

On the Hugo app, I can buy gold in any amount (tap on the number itself to change the exact value) — yes, even from just S$0.01. Imagine if I sauntered into a goldsmith asking to buy this amount of gold (it’s a microscopic amount), I’d get chased out of the shop immediately.

This is why many of us who need an investment vehicle like gold are priced out of it; there are some people who cannot afford some of the existing denominations out there. And that’s most unfortunate.

But yes, it’s possible on the Hugo app, because you’re buying into part of an actual physical asset and owning it digitally. This super low barrier to entry is really comforting for those who are beginning to dip their toes into gold (or investing as a whole) and understanding the commodity better before diving right in with a larger investment.

This means that anyone can invest in gold! Hugo makes it easy with its $0.01 starting point — the lowest currency denomination in Singapore — so that anyone of us, no matter our budget or our views on gold, has basically no barrier to entry.

It also works well with Hugo’s Roundups function, which we’ll talk about in more detail later, but you’re bound to end up with some loose change, hence a few cents here and there instead of a round figure, so this is perfect.

2. Investing in physical gold becomes highly liquid

Also, on the Hugo app, you can buy and sell gold at any time, 24 hours a day, 7 days a week. That’s because trades are done digitally, via the app, and only takes mere seconds.

Buying and selling the gold was delightfully convenient and frictionless. The steps to buy/sell gold:

- Open the Gold Vault in the app

- Input the amount of gold I wish to buy/sell

- Tap on Trade Gold and confirm purchase/sale

That was it. The money I get from selling will then be credited into my Spend Account within 2 working days. So much better than trying to sell your gold bracelet, which may take a much longer time as you’ll need to find a buyer — and not from Carousell, please!

3. Highly competitive rates from the get-go

Another challenge I’ve faced that’s caused much inertia for my first foray into gold is really the fees and charges out there. Which platform should I use, and would it offer me competitive rates that won’t eat into my profits?

Well, Hugo offers highly competitive rates at just 0.5% per trade, compared to about 2% to 5% as offered by other competitors and platforms. To illustrate, if I buy $500 worth of gold through Hugo, I only have to pay $2.50 in fees.

With this type of rate, I think it’s reasonable for me to go ahead, instead of intensely racking our brains and trying to compare the best rates (but there may be other terms and conditions, hidden fees, and who knows what buried behind all that newbie-unfriendly jargon).

4. Your gold investment can be automated

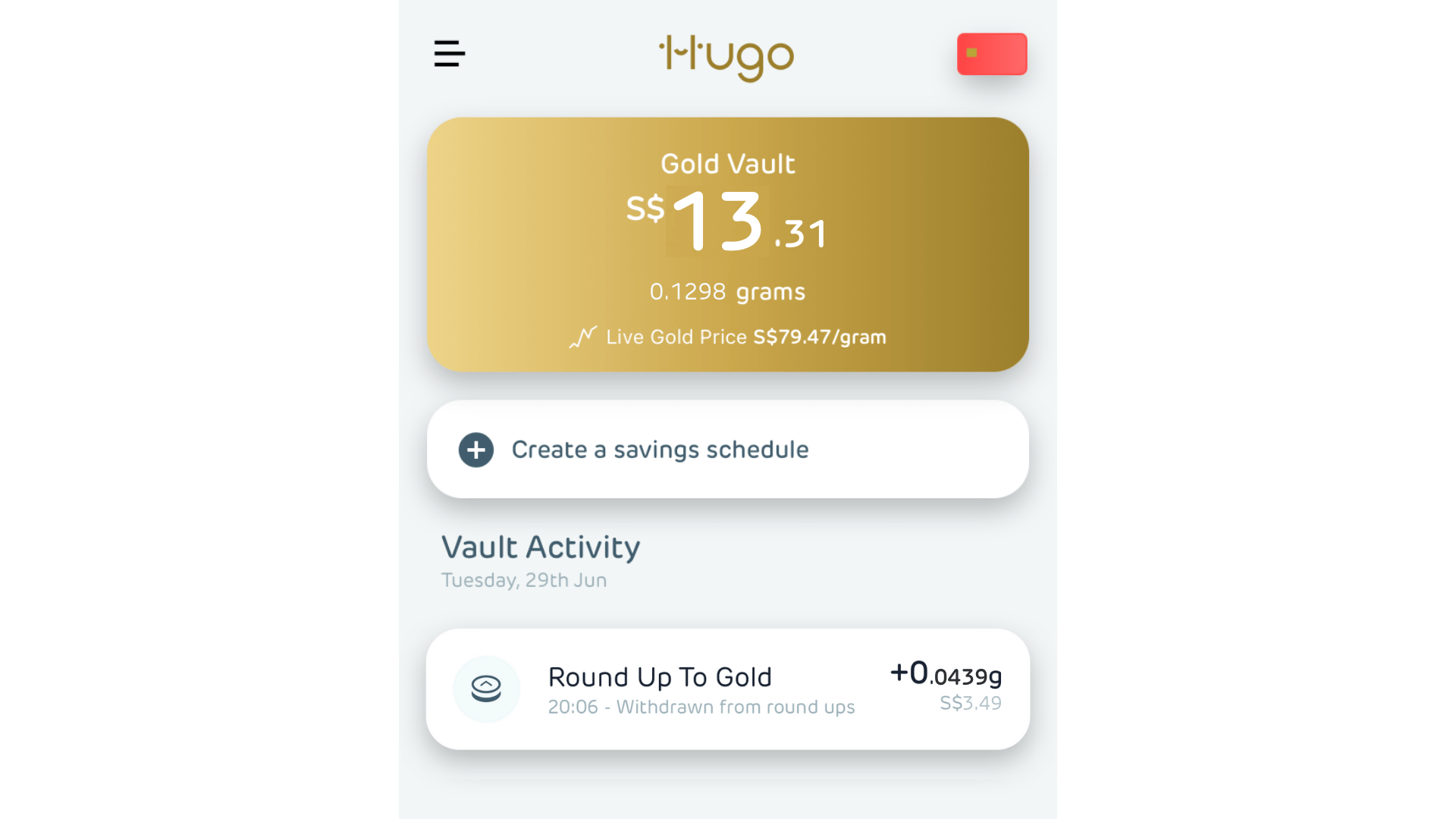

Earlier on, I mentioned Hugo’s Roundups function. You see, Hugo’s Roundups function works exactly like putting spare change into a piggy bank. When activated, it rounds up your purchases to the nearest dollar, and the balance “coins” are accumulated on a weekly basis.

That’s a super convenient way for me to save and invest…I don’t even need to do anything after the initial set up. Also, in this way, the value of my savings is preserved (in gold) and grows over time — with hardly any effort on my part!

It’s a bit like a regular savings plan, but shinier…! (Because gold, mah)

Oh, and did you know that Hugo users can also set up a monthly gold buy schedule? Here’s how to do it:

- Input the monthly amount of money to debit from the Spend Account to buy gold

- Select the preferred day of every month to do so and Hugo will do the gold buy accordingly and automatically.

5. Your gold investment is safe

Also, when you buy gold via Hugo’s Gold Vault, you’re actually buying physical gold insured by Lloyd’s of London, and the gold itself is stored in an accredited London Bullion Market Association vault. Yup, it’s not some ETF or index that merely tracks the gold price. PLUS, the gold you buy through Hugo legally belongs to you — this means you’ll have direct ownership of your gold without counterparty risk.

In addition, via the Hugo app, you’ll be able to see the live gold price, and the app ledger records all trade details such as the gold amount, exchange rate and so on. This level of transparency is reassuring to me, especially for those new to trading gold like I was, so that I could invest with confidence.

This article is an excerpt of a sponsored review of the Hugo Gold Vault published on MoneySmart’s blog on 1 October 2021. You can read the original article here.