When it comes to having a great night out with friends and family, it’s easy to overspend and lose track of how much money you end up paying for drinks, food, transport, venue tickets, and other things. So how can you have an enjoyable night while saving money and not worrying too much about costs? Try these eight of the easiest hacks that will help you keep spending down and boost your savings.

1. Create your own budget for the night

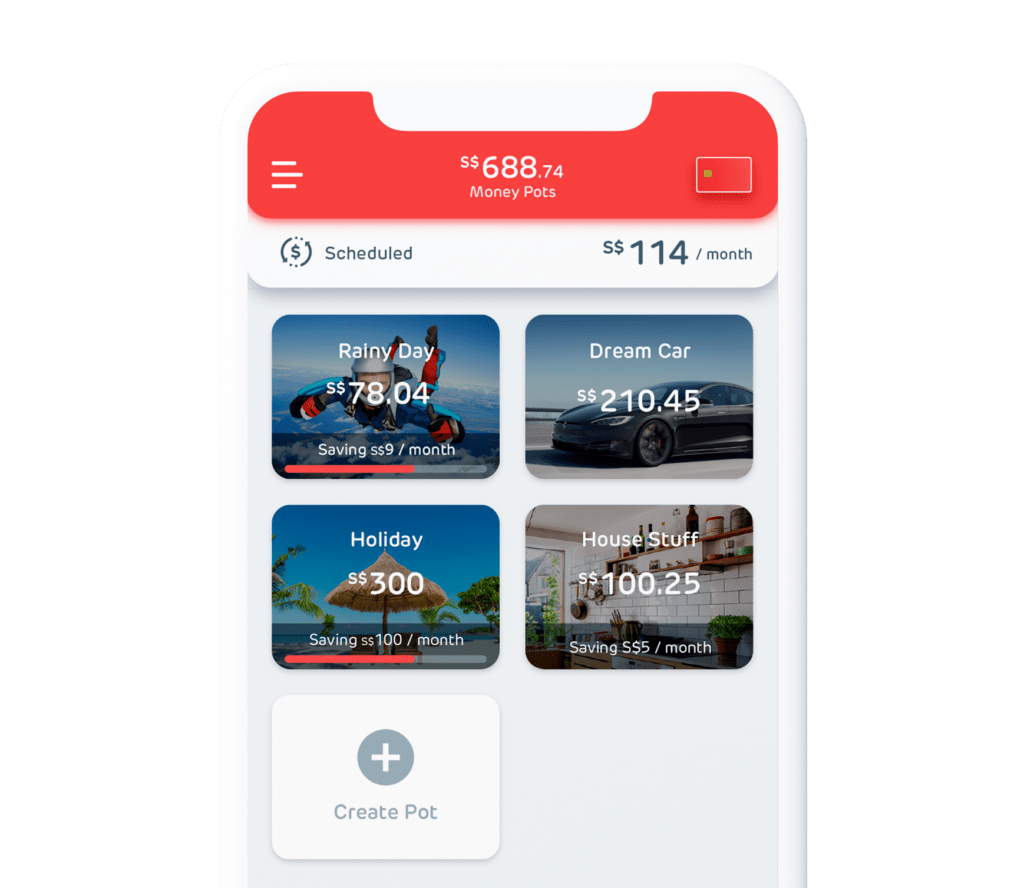

Create Money Pots to plan for your short- and medium-term finances. This way, you are sure to save up in time for your goals and keep to your spending!

Setting a limit is the easiest way to prevent overspending when you’re out. Before you head out, create a budget and consider how much you usually spend on a night out. Then reduce it by, say, 20% or 30%. To make sure you stick to it, Hugo’s Money Pots make it really easy to remind you of your budget. For example, if you usually spend around $100, you might set up an $80 Pot. Using your Hugo Card to pay for your night’s expenses will help you easily track how much you’ve spent so far. You can save more money for a car, holiday, or other personal goals.

2. Eat at home

Homecooked food still beats Michelin-starred food lah…

Singaporeans love to eat out and spend a lot on food, beverages, and food delivery services. The quickest way to overspend when you’re out for the night is on food and alcoholic drinks. However, if you’re heading out to a concert, movie, or other activities that aren’t food-related, there’s no reason why you can’t eat at home first. Eating at home is a quick and easy way to save money. If you get into the habit of eating at home whenever the focal point of your night out isn’t about trying out a new restaurant with friends, then you’ll end up saving a lot of money that night and for your future, whether it’s for retirement, a housing deposit, or a holiday overseas.

3. Look at the menu before you go out

If you know where you’ll be eating out, why not check out the menu first? How many times have we over-ordered on impulse because we’re hungry? Decide what you want to eat beforehand rather than when your stomach is empty and the wait staff are in a hurry to take your order. Check out the menu online before you head out and have something in mind before you arrive. You could end up saving a few dollars every time you eat out with this simple hack – and still enjoy a delicious meal with friends and family. Over the course of a year, you could save hundreds of dollars or more that you could put towards investing.

4. Split the bill

When out for the night, check with your friends to see if they’re happy to split the bill. This easy trick could dramatically reduce the bulk amount you end up paying for the night. For example, you could share an appetiser and main course with a friend rather than having everything yourself. This gives you a chance to try dishes you want to sample at half the cost. Use bill-splitting apps to make it super easy and save yourself the hassle of having to deal with cash and change. By sharing a few items and splitting the bill, you’ll leave more money in your pocket for your savings while still enjoying the experience of sharing plenty of different food and drinks with friends!

5. Ride share!

Similarly, sharing your transportation costs with friends helps you save money. Getting a Grab or a GoJek to and from all the places you’re going for the night can end up costing quite a bit on a night out. Add to this the convenience of using rideshare services rather than less convenient but cheaper options like the MRT. However, not shying away from simply asking a friend who lives nearby whether they want to share your ride, or if a friend can drop you home, you could end up halving your travel costs for the night. A few dollars saved each time you go out adds up to hundreds each year. That’s money you can direct to your savings and have it invested and growing for your future and your financial security.

6. Stay hydrated!

Me: Mom, I twisted my ankle!

Mom: Drink more water!

Hydration is especially important in a hot, humid country like Singapore. When you’re out partying with friends, it can be easy to forget to stay hydrated by drinking plenty of water. You might end up spending a lot of money quenching your thirst with alcohol, which is actually dehydrating for your body. So what’s a simple, easy hack for staying hydrated while still enjoying your alcohol in moderation? For every alcoholic drink you have, have a glass of tap water.

Tap water is free, and you’ll give your liver a break and be less likely to wake up with a headache the next day. What’s more, you’ll be more sober and likely make smarter money decisions. This is a win-win situation that will save you more money in the long run. With this money, you can easily build up an emergency fund, save for a holiday, or something else.

7. Save the late-night food for when you are back home

Supper is a popular affair with a lot of us. We all know how tempting it can be to cap off a fun night out with a delicious takeaway meal, given all the fantastic late-night supper spots out there in the city. This can add to an already expensive night and make it hard for you to keep to your budget. However, you can save yourself more time and money by delaying gratification and waiting until you get home to satisfy your craving for supper. This simple hack can see you saving a lot of money for everything from a new phone to an earlier retirement.

8. Round it up!

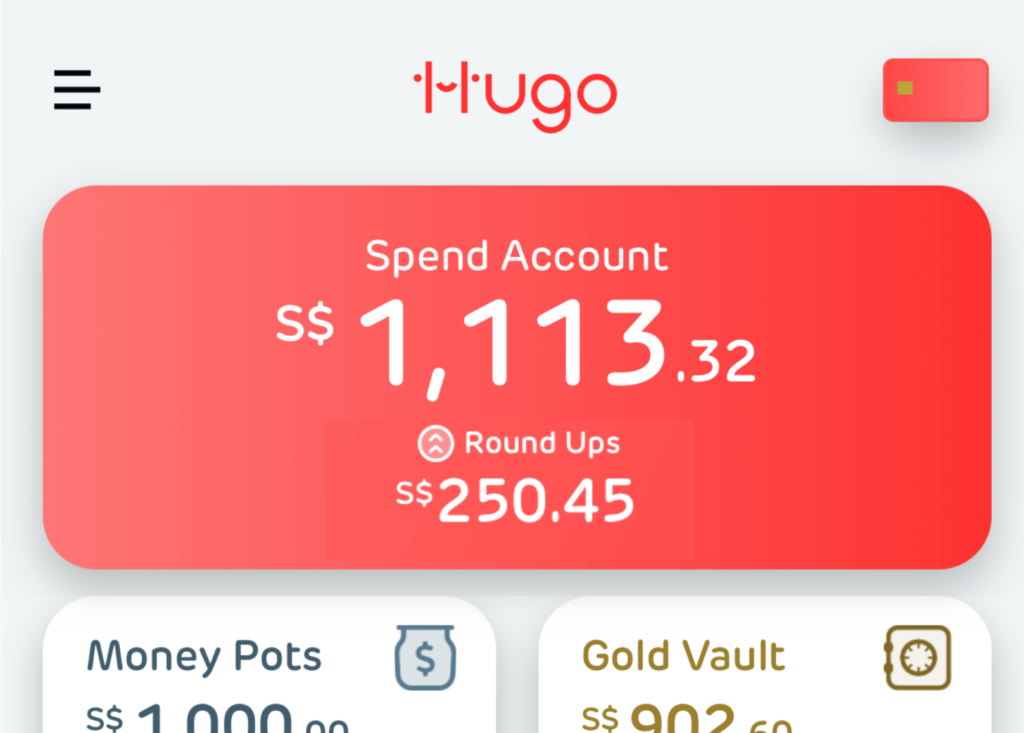

Save up with Roundups!

Even while you’re having fun, it’s important to save where you can and build wealth for your short-term and longer-term goals. So why not save every time you spend during your night out? Sounds impossible? Actually, with Hugo Save’s Roundups, it’s very easy. You can save automatically every time you pay with your debit card. Hugo then rounds up your purchase to the nearest dollar and puts the extra amount into your savings. This is then invested in your Gold Vault, helping you turn your savings into wealth. More savings means more Wealthcare®. These “silent savings” won’t interrupt your fun when you’re out and over time, the small amounts could add up to big savings and growth. You could buy a house sooner or take that overseas holiday you’ve been planning for.

At Hugo, our digital account is designed to help you build healthy 💸 and saving habits. Hugo, your Wealthcare® Buddy, takes care of your financial wellbeing. Learn more about how Hugo can help you develop healthy 💲 habits where you spend smarter, save for goals sooner, and grow your 💰 faster!