So, 2021 is ending and 2022 is fast approaching. It’s time to look back on our finances to see how we’ve done the past year and what we need to do in the next. The idea of assessing our income and budget is about making sure we have enough or more for the future and ascertaining the maximum level of comfort we can enjoy without compromising that.

We Singaporeans love the good things in life and are prepared to pay for it. We would queue in long queues for food and wake up super early to snatch up limited edition items, among other things. And we don’t necessarily like the idea of having to give them up in order to be financially sound!

Well, the good news is, you can still actively save for your future without giving up all the fun stuff of today. The key is to be both savvy and disciplined when it comes to budgeting.

This guide will help anyone seeking to build on a budget by first assessing your income. It will also provide budgeters with a plan on how to best go about their finances so that they can reach their savings goals sooner.

Why should you plan your finances?

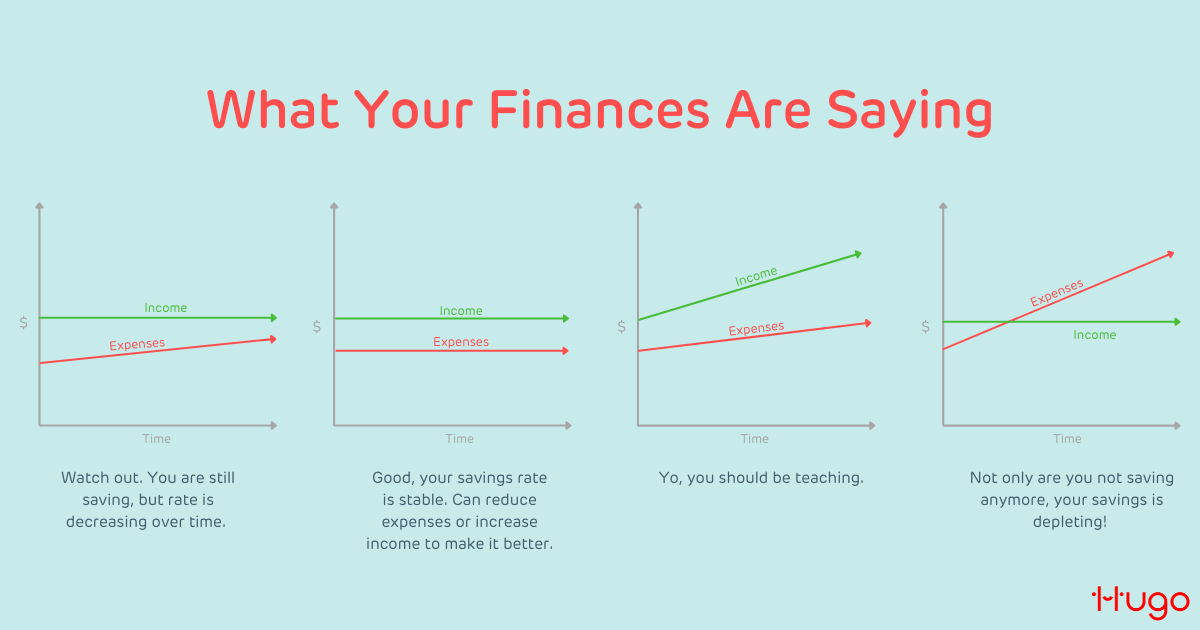

Your finances are always in a state of flux. Depending on your income, your work frequency, and your spending and saving habits, your finances can either make or break you. So the first step to financial planning is to know your current financial position.

If you have a goal of buying a new car or home, or if there have been significant changes to your income, then you need to evaluate your financial position and budget.

Planning your finances this way helps you to determine what adjustments you need to make so you can meet your financial goals while still enjoying a financially stress-free life.

How to evaluate your income and budget

1. Determine your income and net worth

First, you need to know how much bacon you are bringing home. By bacon I mean income. Include all inflows such as your monthly salary, bonuses, rental income (if any), part-time income from side hustles or gigs, and earnings from investments such as dividends etc. Don’t forget your CPF!

Knowing how much income you are earning accurately will help you optimise the way you manage your money; you may realise that perhaps:

- you have more disposable income to invest more,

- you have additional budget to pay down more debt, or

- you need to reorganise your spending priorities.

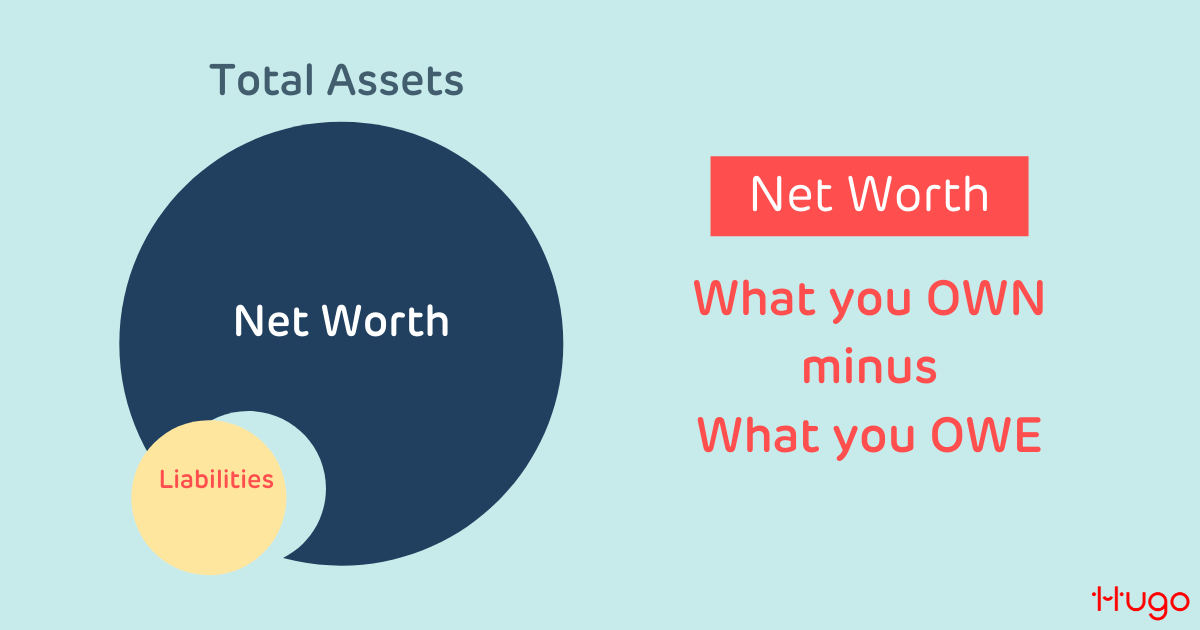

Your income is part of your total net worth, which is all that you own minus all that you owe. A negative net worth—i.e. having more debt than assets—may not necessarily be a bad thing, but it will inform you if you need to make adjustments to your income-to-spending ratio and/or refinance your loans.

2. Calculate your expenses

Once you’ve figured out your income, you want to know how much is leaving your wallet. The best way to track your monthly expenses is to look at your bank statement or use one of the tracking tools most banking apps have featured. (Every spend you make with your Hugo Card is recorded in real-time with handy information that’ll help you analyse your spending patterns.)

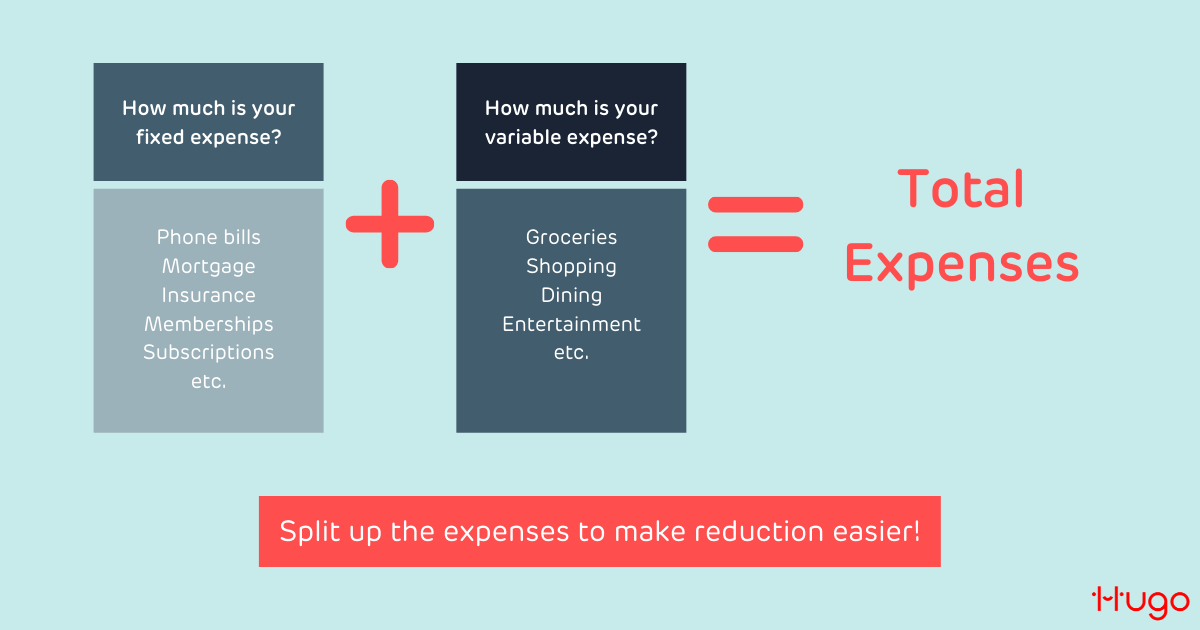

When calculating your expenses, you can start with the fixed debits or payments that remain the same each month. For example, your phone bills, mortgage repayments, insurance, gym memberships and so on. Then, calculate your variable expenses (such as groceries, shopping and dining out) and optional expenses (such as entertainment).

3. What’s the difference?

Once you’ve totalled up your income and expenses, it’s time to bust out the calculator and subtract your expense total from your income total. This will give you your percentage difference which will then help you to take stock of your spending and saving habits.

After calculating your expenses, if you find that your expenses are greater than your savings then there are only a couple of options:

- Spend less

- Earn more

- Or both (this is the best, of course)

Another way to take control of your finances is to go over your budget and find out either what can be reduced or what can be substituted. You can drink less Starbucks coffee or switch it out with local kopi, get your workout gear from Decathlon instead of Adidas or be a Netflix friend to someone with HBO Go. The key here is to not feel restricted with your budget, rather adapt it to suit both your lifestyle and saving goals.

Using Hugo for your expenses is a great way to save while you spend with our Roundups feature, and the app records your transactions so you can review your spending behaviour at any time.

4. Have a savings goal

Now that you have some savings, it’s time to establish a goal. Whether it’s paying off debt or saving for a HDB deposit, your savings goal will help you to stay motivated and keep you on track.

A good savings goal is to build a 3-month emergency fund (some may prefer 6 months). You can start off with the goal of saving $1,000 by the end of the month or decide to put away 10% of your monthly income. Regardless, your goal should be realistic and achievable. If your expense calculation finds you’re spending more than you earn, then create a financial goal to create more income (whether by taking on another job or investing) or determine which expenses you can eliminate.

Because investing can go both ways, you may want to invest in a vehicle that appreciates and is stable over the long term. Instead of the volatile Bitcoin, or the sky-high property prices, consider the good old gold! Hugo’s Gold Vault allows you to start investing in the precious metal from $0.01 or whatever amount that suits you.

5. Track, track, track

Creating a budget is the easy part – the real challenge is sticking to it!

To ensure you’re sticking to your budget, keep track of it from month to month and adjust it when necessary. You can set a reminder on your phone or planner to review your budget every couple of weeks. That way, you’re forming the habit of budgeting so that eventually it’ll become second nature and therefore easier and easier to do!

To help you start tracking a budget while you build up that habit, you can consider using apps that help you to track your and perhaps even save into it on our behalf. Hugo’s Money Pots feature not only lets you set budgets for different wants and needs, but it also allows you to set a savings schedule so you’ll always meet them on time.

Hugo is here to help you save!

See how Hugo Money Pots make saving towards your goals so easy!

Like a superhero swooping in to save the day, Hugo will help you to keep track of your budget and start saving for the things you want while growing your savings in gold so you can enjoy life without worries! Whatever your saving goals, Hugo’s Money Pots is an amazing tool to plan your savings strategy and budget more effectively! Think of it as a super smart piggy bank that compartmentalises your savings goals and allows you to easily check in on the progress of each. From saving for a wedding a year from now to more urgent goals such as a new car or even a new bike! With Money Pots you can tell Hugo what you want and Hugo will help you to get there.