We all know saving money is essential for building wealth. However, when it comes down to it, saving is easy to understand but that much more challenging to put into action. Yet an effective saving habit doesn’t have to take monumental effort or discipline. Making micro-changes in different aspects of your everyday life can see you achieving your savings goals, given enough time.

In this first of a 4-part article series, we list 12 (out of 48) super practical, flexible, and adaptable money-saving tips you can apply to increase your Wealthcare® – which is all about financial wellbeing for you, your loved ones, and your hopes for the future.

1. Create a budget or spending plan

STICKING to a budget, geddit?

Set up a budget and track everything you’re spending on. This way, you will know what you can cut back on. Try not to go on a shoestring budget at the get-go; not meeting some unrealistic goal can have a negative psychological effect on you. Instead, aim for modest progress at first (e.g. 10% spending reduction), understanding your needs and wants along the way, and readjust your budget accordingly.

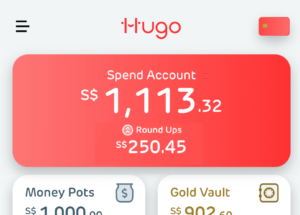

2. Using a round-up savings app

These “silent savings” apps round up your purchases to the nearest dollar. They make your savings automatic and just about painless. With Hugo’s Roundups, saving will become second nature. What’s more, your balance is automatically invested into your Gold Vault to maximise growth potential. Never underestimate the significance of small but frequent savings!

3. Have no-spend periods

Set no-spending periods, whether for yourself or for the whole household. During these days, weeks, or certain months of the year, you can become aware of how easy it is to abstain from buying things. This doesn’t mean you should go on a shopping spree prior, though!

4. Set savings targets

Stay motivated by setting savings targets, such as for a holiday or car, and use Hugo’s Money Pots to make achieving your personal and shared savings goals easier. A target is way easier to hit when you can track your progress in real-time. With Money Pots, you can see your progress and make necessary adjustments.

5. Pack your own lunch

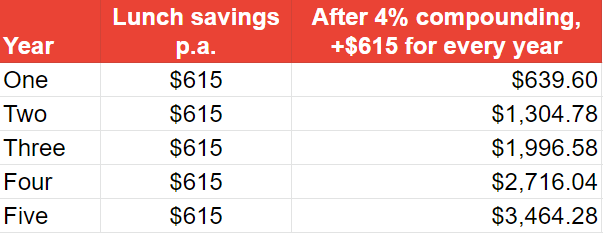

This is one of the easiest ways to save a lot of money and be in control of your nutrition. If you pack your own lunch (assuming it costs $2.50), you can save $615 in a year (with 246 workdays and assuming your bought lunch costs an average of $5). $615 a year may seem small at first, but it’s more significant than we’d think. Let’s say, you invest your lunch savings in gold for 5 years, with an average growth rate of 4% YOY, by the power of compounding it will grow to become $3464.28 from a principal sum of $3075—a 12.66% difference.

6. Compare unit prices

Xiao Ming buys 100 1-kilogram watermelons at $5 each. Gopal buys 80 1.5-kilogram watermelons at $6 each. Solve for who got more watermelon per dollar. (6 marks)

When you’re shopping for groceries, get a more accurate comparison by comparing the unit price (such as per kilo or per 100 ml) rather than item price. We didn’t do those math problem sums in school for nothing! When you’ve developed the habit of calculating unit prices, you’ll be a much savvier shopper.

7. Make your own cleaning products

Mix your own natural detergents, disinfectants, and stain removers from basic ingredients like salt, lemon juice, vinegar, and baking soda. Check online for recipes. If you have a good sales flair, you can even make some money out of it on Carousell, FB Marketplace and even at the weekend flea markets!

8. Eat out less frequently

Eating out can become a major drain on your budget if you’re not careful. Get busy prepping your own meals so you can avoid the temptation of ordering takeaway or delivery, or going out to eat. This is not to say you should completely swear off dining out; enjoying a meal with loved ones is good for the mind and the soul. Check out some tips and tricks you can use to save on your night out!

9. Set spending limits on gifts

Christmas and New Year are coming, and it’s time to think about gifts to buy! Ask everyone in the family (and friends too) to adhere to an agreed spending limit on gifts and/or pool money together for gifts so each person gets one gift from everyone for birthdays, special occasions and seasons.

10. Keep your tyres inflated

This is one for the drivers. Inflated tyres enhance fuel economy and save you on petrol, and they’re also likely to last longer.

11. Invest in gold

![]()

Gold is an excellent investment, holding its value over the longer term. If you’ve ever wanted to invest in gold but have thought it too complicated an investment to start with, there’s now an easy way to dip your toe in the market! The new Hugo Gold Vault is a safe and secure way to grow your savings faster, utilising gold investment opportunities.

12. Pay down debt

One of the Wealthcare® power moves you can make this year is to pay down your debt a.k.a. pay off your loans earlier. Pay down any high-interest debt as a matter of priority, as otherwise, you could be paying a lot in interest on your credit cards and personal loans.

Growing our finances does not always need to be difficult or involve complicated strategies. By using Hugo and making simple lifestyle adjustments, everyone can make a positive difference to their financial wellbeing. Hugo’s user interface and experience are designed to be simple and enjoyable to use. This is the first article of a 4-part series. Stay tuned for more easy things you can do to grow your finances!