We at Hugosave are all about applying tried-and-tested money wisdom to new technologies that power the world today, helping you achieve financial wellbeing. We call that Wealthcare®. It is about spending smart, saving diligently, and making those savings grow. In addition, it’s also about having sound financial habits and protecting your money.

Over the next 3 blog articles, we will explain different aspects of the Hugosave Platinum Visa Debit Card and how going “Digital First” is going to impact your Hugosave experience. In this one, we give you a brief introduction of what it means for the Hugosave Platinum Visa Debit Card, or Hugosave Card for short, to go “Digital First”.

What is a “Digital First” Hugosave Card?

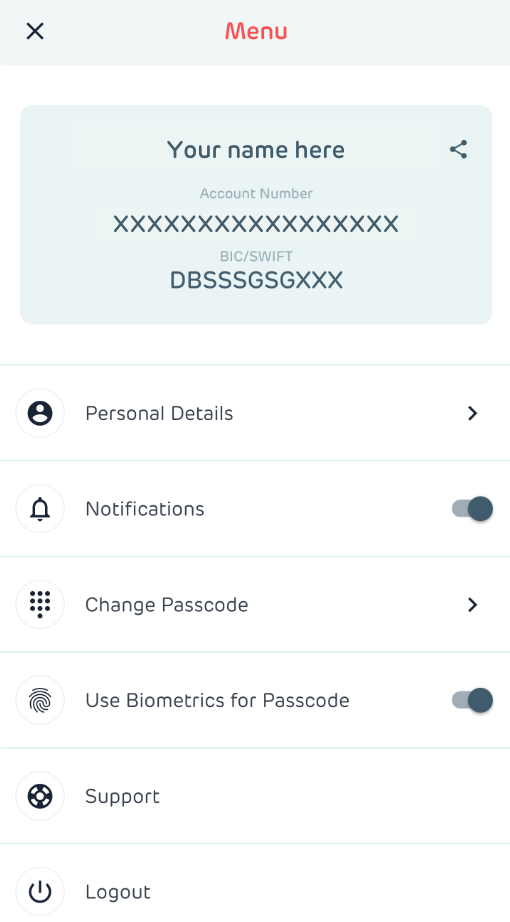

The “Digital First” Hugosave Card is a numberless debit card that works as part of your Hugosave Account, enhancing your payment experience, card management, and security digitally. As a numberless card, all card details are accessible in the app on-demand, along with security and support functions. #HugoHeroes will enjoy digital experiences with real-world impact. The Hugosave Card comes in both digital and physical forms for in-store or online payments.

The Hugosave Card’s design, on top of our iconic red, creatively features a vault motif around the shiny gold-coloured chip as a nod to the role our Gold Vault will play in your Wealthcare® journey.

What does a “numberless” Hugosave Card mean?

Being a numberless card, there are no card details printed on the physical Hugosave Card except for your name. Your card’s details, i.e. card number, expiration date, CVV, are accessible only through the Hugosave app, which is PIN-protected with the option of biometrics protection available. This way, you can enjoy reduced fraud and digital theft risks!

When and where can I use my Hugosave Card?

You can use your Hugosave Card like any modern-day Visa card in Singapore and beyond, wherever Visa is accepted! The Hugosave Card facilitates all payment modes, online (e.g. Taobao, Shopee, Grab delivery) and in-store (i.e. chip and contactless). You can even use your Hugosave Card like an EZ-Link card to pay bus and MRT fares! Read more here about using your card to pay for your purchases.

Being able to use the Hugosave Card anywhere also means that you should be able to keep it safe anywhere in case you misplace it. You can temporarily lock your card via the Hugosave app at any time. Once you have found it, simply go back into the app to enable it again.

Do I need to pay for the Hugosave Card?

The answer is no. Zilch. You don’t have to pay a single cent when you order your own Hugosave Card. Neither are there any fees associated with owning/using a Hugosave Card. When you use your card overseas, the foreign exchange rates are based on Visa’s FX rates and we do not add any additional fees. Find out more here.

Download Hugosave and order the card

Getting your Hugosave Card is super easy, just follow these quick steps.

- Download the Hugosave app and set up your account.

- Tap on the card icon at the top right corner of the home screen to order your Hugosave Card

- Activate your card when it arrives in your mail. (Due to the Covid-19 situation, deliveries may be delayed)

The Hugosave Card is specially designed to enhance your financial wellbeing, making every spend another step towards Wealthcare®. Download the Hugosave app and get your card now!

- Download from App Store for iOS here.

- Download from Play Store for Android here.

For more information about Hugosave and the Hugosave Card, please go to our Help Centre.