Over the past years, among the many things technology has transformed and continues to do, it is revolutionising the way we bank and access banking services. As the internet opened access to a tremendous amount of information, financial technology is also making banking more accessible, more responsive, and more secure. As a millennial bracing for risky ambitions, higher costs of living, heavier financial commitments, and delayed retirement, could fintech be the money messiah I have been looking for?

It’s expensive being a millennial in Singapore

We face burgeoning costs of living for essential goods, but also desire creature comforts at the same time. Many of my friends have Dyson vacuum cleaners that cost almost $1K. Some of us don’t boil our water anymore because we now have water dispensers that somehow has WIFI capabilities. Maybe it’s a case of my own subjective perspectives, but regardless, it’s true that there are very real challenges (and often expensive) people like me have to overcome.

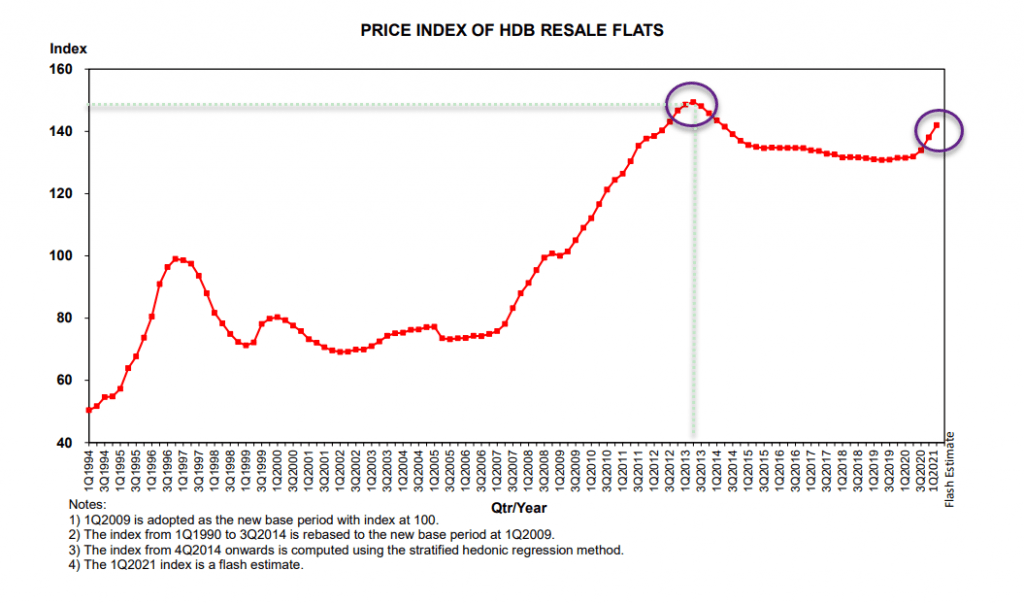

Trying to stay cool-headed over hot property prices

I’ve always dreamed of living atop a hill, just not a price hill. | Source: Property Investor Insights

Public housing is in such high demand that every couple needs to plan years ahead waiting for their flat that costs half a million to be ready. If they cannot wait, or if the combined income exceeds the income ceiling, they face record-high prices in the resale flats market and potentially not qualify for some housing grants. Some will not be thrilled either that the other option is to buy ECs that often cost >$1 million.

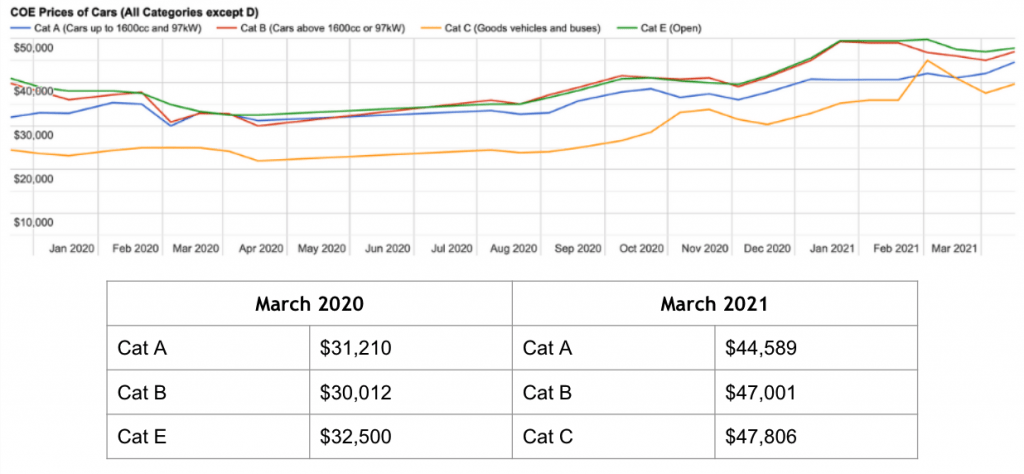

Rising car costs

The cost of owning a car is being…driven up. Haha. | Source: Carro

I’d be surprised if a young adult’s financial planning doesn’t factor in possibly owning one. To buy one of Singapore’s most common cars, the Honda Civic, you have to fork out about $127k the moment you drive it out of the showroom. And don’t forget that COE prices are still rising, as well as fuel costs.

Technology can be costly too

As our lifestyles become more and more digitalised, our thirst for data and connection speeds means we are paying more to work, communicate and be entertained. Choosing not to keep our tech gadgets up to the times is no longer an option; we are sometimes forced to spend on new tech.

We can benefit greatly from better banking

Of course, this is not to say we should start a family under a bridge, ride bicycles everywhere and buy homing pigeons to send text messages. The expenditures stated above are to most of us living essentials. Earning more money is only ⅓ of the equation; the ⅔ includes keeping more of our earnings and generating more with it.

Having a banking service that we can rely on to seamlessly facilitate our spending WHILE covering our future backsides, i.e. saving on our behalf and growing our wealth without us having to micromanage it, is so coveted. In my opinion, the banks do offer a suite of tools to do that, but it’s still quite a tedious and complicated process that could do with greater transparency.

My cost of banking is reduced

As a customer of one of the major banks here, I must maintain a minimum balance of $500 in my account (which is virtually loaning the bank at interest rates way lower than that of inflation) and pay $2/month as a service charge. My credit card comes with a $200 annual fee and God forbid I forget to pay my bills lest I get slapped with a 27% finance charge.

Me whenever it’s credit card bill payment time.

Nowadays, fintech firms like Hugo issue their own cards that are way more flexible, user-friendly and convenient. Some ways I saved on banking costs:

- I haven’t paid any fees for maintaining my Hugo Account because there isn’t any,

- I didn’t have to maintain any minimum balance nor pay fall-below fees,

- My Hugo Card charges zero admin fees, and

- I can use all of Hugo’s features regardless of my annual income or employment status.

Now, my bank account is mostly for salary crediting and for official matters. I have moved almost all my spending to Hugo and virtually removed the risk of incurring fees on late card bill payments. My next step is to disable some of my bank cards and save >$200/year.

Investment apps helped me lower the costs of trading

With way lower overheads than banks do, fintech platforms can offer pretty competitive rates. Let’s take gold investment for example. Investing in gold via a bank can be rather costly. Banks in Singapore typically charge

- Annual holding fees (about 0.25% p.a.) that recurrently eat into your holdings,

- A one-time admin fee at a few dollars per trade, thus increasing your cost of trading.

It’s really not worth it if I am planning to buy only a small amount, and these fees can rack up as my gold holdings increase. Banks require us to buy a minimum amount of gold each time too.

Hugo’s Gold Vault allows me to

- Buy gold at ANY amount.

- Charges only a ONE-TIME 0.5% admin fee per trade and nothing else beyond that. This makes the cost structure very flexible and fair for me instead of a flat fee.

- I don’t have to incur time and opportunity costs by having to go to a bank to do my trade. I can set a gold-buy schedule in the app anywhere and at any time.

I set up a monthly $100 gold-buy schedule so I can build up my gold holdings over time steadily. I’ve been paying no fees during the free trading period that ends on 27 November 2021.

Since using Hugo, I have accumulated nearly 10g of gold (worth about $750) at the time of writing and I only paid about $3.75 in fees so far, which is WAY LESSER than what I would have paid if I had gone the bank route. It easily becomes a non-issue when my gold holdings appreciate in value; I can recover those fees in no time. Hugo is working on including more investment products in the near future, offering the same affordability and convenience.

Greater convenience with finance apps at lower cost

While banks offer a comprehensive set of tools we can use to save, the onus is still almost all on us to make them work for our savings. Personally, I don’t have the time and energy to study and strategise like Sun Tzu would. What I need is a platform that will do it with me intuitively. Some fintech players recognise that our financial wellness isn’t a solo effort and are offering to shoulder a part of the burden of helping one save.

Hugo’s Roundups and its link to the Gold Vault is one way I have been growing my savings easily. Since using Hugo, I realised my savings strategy has been supercharged.

On top of paying myself first, where I set aside a sum of my paycheck into savings, Hugo has been silently stashing away my spare change and investing them in gold. I have bought about $40 worth of gold since May using Roundups ALONE (on top of my scheduled trades). Is $40 a huge deal? Maybe not for some, but keep in mind that this is $40 worth of gold I accumulated without putting in any effort. It’s been really helpful for me at developing a healthy savings habit, something that I haven’t experienced with other financial institutions, to be honest.

I receive faster and more transparent transaction details

Finally, one thing that we want is control. We love having dashboards, the idea of multitasking, working with multiple monitors etc. It’s the same for banking. A quintessential millennial like me typically has a few recurring spending on top of the essentials:

- Netflix subscription at $13/month,

- Premium Spotify account at about $10/month

- Data subscriptions at $140/month (mobile+home broadband, cable TV)

- Gym membership at $80/month

- Grab rides at around $200/month (yikes!)

- Coffee joint patronage at about $80/month

- Total: $523/month

Based on this article, the average income of Singaporean millennials is about $5154. That makes my recurring expenses a whopping 10% of my pay. By the time my credit card bill arrives, my sins have already been committed. I’d pay it off and forget it till the 30th of next month. Sure, most banking apps show us our spending analytics, but how many of us really would sit down to analyse it like an accountant?

In comparison, Hugo keeps a readily accessible record of all my transactions on the home screen. I can see how much I spent, on what and how often. I set for myself a recurring reminder to follow up on my spending and make adjustments as soon as I can. It works wonders at reducing recurring money leakages. In fact, I’ve managed to trim off about 15% of my daily spending by keeping myself aware of my purchases history with Hugo. Soon, Hugo will be able to provide analytics of my spending AND help me come up with strategies to spend more wisely. I’m looking forward to that.

Fintech apps are great supplements to millennials’ personal finance

All in all, the innovations and the incentives for smaller-outfit fintech companies to focus on a particular area of finance generally bear very well for users like us who want to take greater steps towards better financial wellbeing. We are pretty financially literate, are more frequent spenders and have looming heavy financial commitments. Having much more responsive, accessible and tailored finance apps at lower costs are always welcome. While fintech firms are not likely to replace the essential role major banks play anytime soon, they can be very helpful supplements to how we spend, save and invest our money. Share with me in the comments how fintech platforms are making your personal finance a much better experience!

About the author: Raymond Lo is the Content Marketing Manager at Hugo. He is very proud of his practice of visiting a shop at least 3 separate times to look at something he’s interested in before buying it. Buyer’s remorse has nothing on him, he declared.