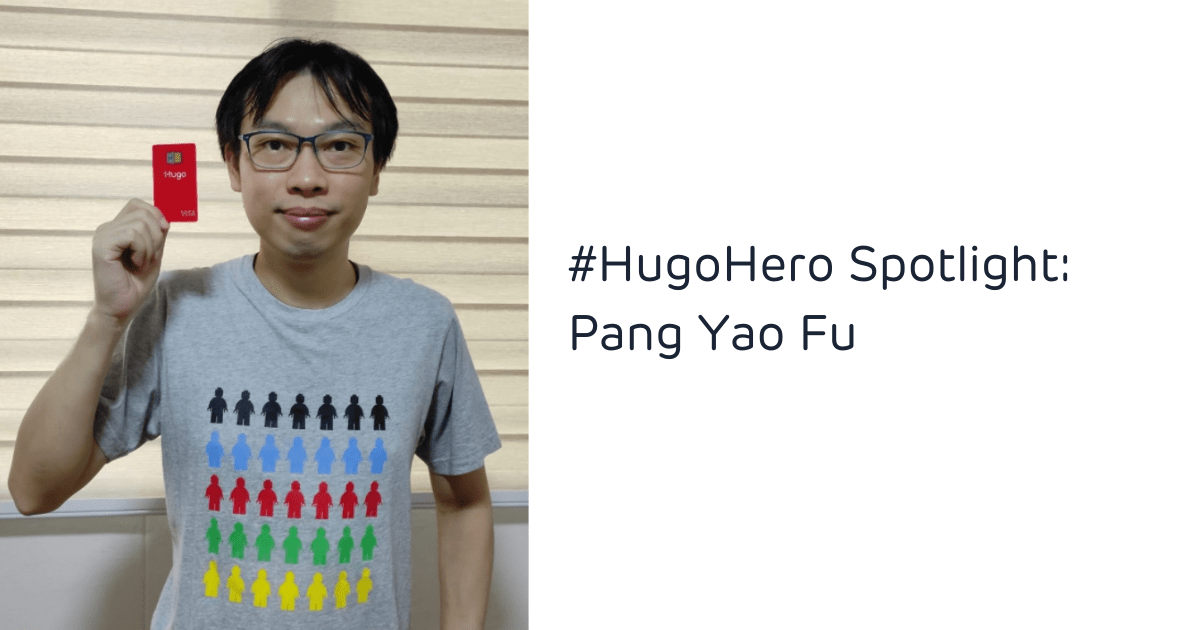

In this #HugoHero Spotlight, I speak to Pang Yao Fu, one of our earliest #HugoHeroes!

- Name: Pang Yao Fu

- Age group: 40s

- Marital status: Married with a child

- Country of residence/birth: Singapore

- Occupation: Software Engineer

Yao Fu grew up in a Singaporean conservative family. “Be obedient and disciplined”, “Do not take unnecessary risks”, “Do not ask too many questions” were common themes. Having grown up in a strict environment with high hopes from his parents, Yao Fu today continues to maintain a performance-driven state of mind in his career and finance, and has embraced the responsibility of contributing to the wellbeing of others.

Read on to hear from Yao Fu about his upbringing, his challenges and opportunities, and why he takes his Wealthcare® seriously while still enjoying life.

Tell us about your upbringing

I came from the typical traditional middle-income Chinese family with a conservative mindset. Money wasn’t an issue and our standard of living was pretty comfortable. My parents worked as goldsmiths (how apt given now I trade gold via Hugo). Although my parents were usually busy with work, they would make space to monitor my brother’s and my academic results to make sure we progressed and performed well enough to not lose face.

What were your savings habit and strategy like?

Teenage confidence, ambition and determination in one picture.

In my childhood

My mother taught me to save and I am really grateful to her. I had a transparent piggy bank in which I would deposit spare allowance and angbao money. I really enjoyed seeing my savings accumulate that I actually skipped meals to save more. It wasn’t sustainable; I ended up spending more on food and toys because I felt so miserable! I also tracked my daily expenses to see how I could minimise expenses, quite similar to how I use Hugo to track my transactions.

Early adulthood

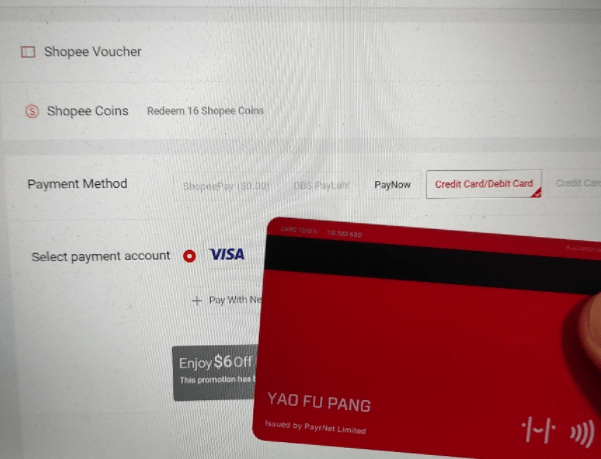

Always on the alert for ways to stretch the dollar. Yao Fu uses his Hugo Card to save while he spends, and earn Shopee coins as he shops!

Expense tracking became too time-consuming. Setting aside a fixed amount from my income for expenses and leaving the rest for savings seemed to be an easier and more efficient method. I decided to put my money in different “buckets” (similar to Hugo’s Money Pots) i.e. individual bank accounts with different purposes in different banks. This segregation made it easier to save and harder to withdraw money unnecessarily.

What are the main learning points in your financial journey?

From left: Yao Fu, his beloved wife, Mom and Yao Tian (also a fellow #HugoHero)

In my financial journey so far, I’ve learnt that personal finance is not something I will know after reading. At most, it gives me an idea and the logic of what I can try doing. Eventually, I’ll need to act on it, explore and figure out how to make it work for me. It is always a trial-and-error process before finally crafting something suitable for my situation and my goals. It is a continual learning experience and will always be as the world changes. We have to keep up or risk being left behind.

What financial goals do you hope to achieve?

My father mismanaged his finances and caused domestic conflicts that once left my mother, brother and me homeless. Determined not to follow in his footsteps, I am committed to building a sound financial foundation and know-how so that history will not repeat with me. It does not matter if one started off with a lot of money, without sound planning and financial knowledge put to use, one could end up with nothing. Hence, it is important to work towards financial independence/freedom to allow more room to manoeuvre in unexpected circumstances and not cause additional stress.

Being financially independent will allow me to spend more time with my family. I won’t have to worry about not being able to upkeep basic lifestyles without working. I can confidently switch from a full-time job to a freelance/part-time one to focus on other areas of my life. They include spending more time with family, pursuing my interests, working on hobbies and projects that bring me joy, and serving the less fortunate.

What’s your investing experience like?

I started off with fixed deposits based on my mother’s recommendation. Over time, I gained more experience and realised that more can be done to grow my money. Nothing wrong with FDs, they are a decent way to save, but I wanted to do more.

So in my late 20s, I opened up my first trading account without knowing anything about stocks trading. After doing some “extensive” reading, I decided to buy some dividend stocks and naively thought that they would grow after leaving them there. Prices plummeted since and I’m still making a paper loss now. This made me go back to the safety of FDs and Singapore Government Securities (SGS) bonds. Recently, I set up a regular savings plan on STI ETF with robo advisors and I’m quite happy with the returns.

I got a bit more adventurous and put a bit of money in cryptocurrency and signed up for an online brokerage account to invest in China stocks. I guess you know what happened. LOL!

How does Hugo fit into your saving/investing strategies?

Brought up by goldsmith parents, Yao Fu knows full well the value of gold.

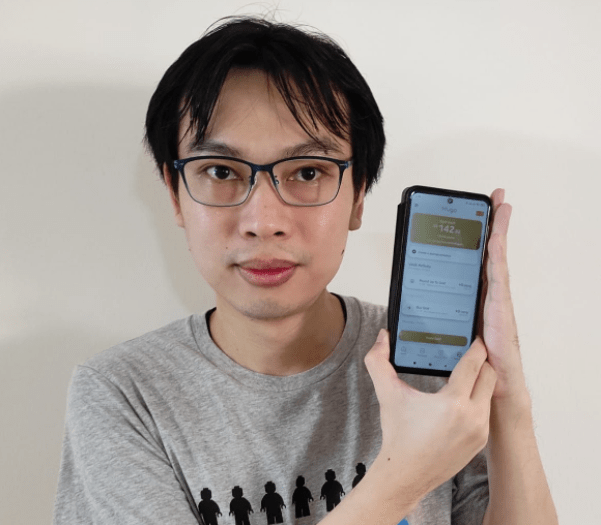

Hugo fits in the missing gap for gold investment. I find that most robo advisors or financial services deal mostly with stocks, bonds and funds but are not so much focused on gold. I see gold as a way to further diversify my portfolio, and as a more stable investment alternative. With Hugo, the low startup criteria and ability to dollar-cost average are attractive. Since my Hugo Account is safeguarded within DBS Bank and my gold holdings insured and securely stored in LBMA-accredited vaults, I think Hugo gives me a great sense of reliability and trust.

The ability to invest in gold at my own pace, the Roundups feature (which is both novel and helpful, in my opinion), being app-based and easy to use are great plus points. I also like how it differentiates from other financial products. Hugo starts from the basics, cultivating the habit of savings and knowing where your money goes in your expenses. I think even people who are just starting out will find it easy and inviting to use. Finally, having gold as an investment option is interesting and, I would say, is a good match; it is more relatable to most people as compared to stocks and cryptocurrency.

What’s your first impression of Hugo?

Hugo is friendly, clear and easy to use. The bright, happy, red colour and simple design of the Hugo Card makes it attractive and unique. The cute and friendly little Hugo robot has been very helpful! My favourite function is Roundups. It is something that I can set up and just “forget” about it, and it will do the constant saving and investing for me automatically. In the event that I forgot to or not be able to invest in gold at a certain point in time, this feature will still continue to work in the background. Having some money invested is better than none!

I’d love to have the option to measure/track growth in gold invested. Probably some indicator for advanced users on whether your gold investment had appreciated. It might be unsettling for novice users but at some point in time, they have to realise that even the most stable investment will not appreciate in value all the time. We have to also look at gold investment over the long term.

Any financial opinions you think more people should know about?

Mom has been a source of wisdom and a pillar of support at every turn in his life.

Don’t be too fixated on the end goal and miss out on more important things in life. Take it as a journey of self-discovery and enjoy the experience. Achieving your financial goals is important but always remember money can be earned; time/experience with people once lost cannot be recovered.

Yao Fu had earlier in the year written a blog piece independently about his first impression of Hugo. Read it here.