Every #HugoHero has different views on money, personal finance, savings and investing practices. In this Spotlight, we showcase #HugoHero Jeriel Tan, a hopeful Millennial, an aspiring entrepreneur with big dreams for his community, and how Hugo is helping him in the process.

About #HugoHero Jeriel Tan

- Graduate with Bachelor of Arts in Communication and Spanish

- Entrepreneur, owner of a communications agency

- 30+, Millennial in Singapore

- Life goal: To provide job upskilling opportunities for the young and the underprivileged.

- POV on Wealthcare®: “It’s about taking care of personal wealth. It’s about knowing your goals clearly and the way(s) of getting there.

Lifelong goal to build and lift up communities

Jeriel was exposed to diverse cultures during his university days.

Jeriel had a dream to be a journalist to report on social matters he felt the masses should be aware of. With a Bachelor of the Arts in Communications and the Spanish language, Jeriel is hoping that his trilingualism (English, Mandarin and Spanish) will enable him to reach 90% of the world’s population. In 2014, he pursued further studies and work opportunities in Argentina where he could put his Spanish to the test and open doorways within populous South America.

It was yet another reminder to him that changing one’s financial circumstances requires commitment, taking small and gradual steps towards a big goal and easy access to opportunities.

From journalism-hopeful to businessman

Jeriel on an Alibaba Campus Tour in Hangzhou, China

After Argentina, he went on to live and work in China for 3 years where his goal evolved to become one that would be more responsive and have a direct impact – by creating enterprises that would give good, intelligent and able people honest livelihoods that will uplift communities. He now runs a digital communications agency that provides jobs and upskilling opportunities for the uninitiated.

Learning about the value of money as a Millennial

Jeriel grew up in an upper-middle-income family with 2 other siblings. While the standard of living was relatively comfortable, it was not one of excesses. With his parents being financial consultants, the idea of financial and wealth management, i.e. saving effectively, spending wisely and growing money, was taught to the 3 Tan siblings from a young age.

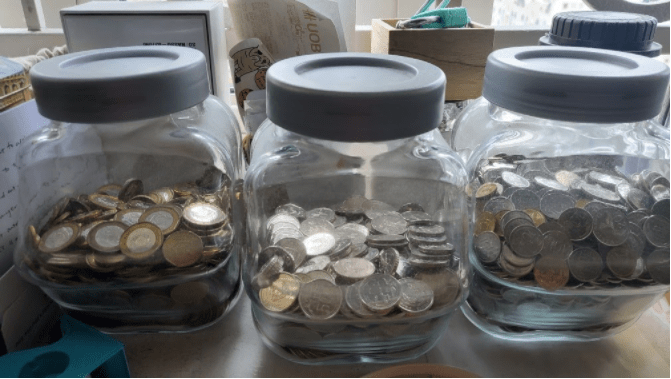

Unlike with his coin jar, he can automate his savings with Money Pots and make sure he achieves his savings goals on time.

Bringing order to…order. Jeriel has different coin jars for different denominations.

Jeriel’s family practises the same idea of saving away Roundups, just like Lita’s children! Since his childhood, Jeriel and his siblings would squirrel away coins into coin jars. Every month’s end, they would unload the coins and either deposit them into a joint bank account or spend it on the next big purchase.

“We would look forward to counting the coins at the end of every month. For us as kids, it felt satisfying and rewarding. There was a sense of accomplishment when we found out how much we’ve saved,” Jeriel recounted. Asked about what he thinks of Hugo’s Money Pots, now that he’s a #HugoHero, he drew some comparisons and similarities:

- Like his coin jars, Money Pots is a fun and fulfilling way to save up for a goal.

- Money Pots is a great way to develop disciplined savings habits himself and with others.

- He can view his progress with Money Pots anytime, unlike his coin jar.

- Both Money Pots and the coin jar allow him to compartmentalise his savings, but Money Pots is way more convenient and easy to manage.

- Unlike with his coin jar, he can automate his savings with Money Pots and make sure he achieves his savings goals on time.

Profits = extra chicken wings for recess

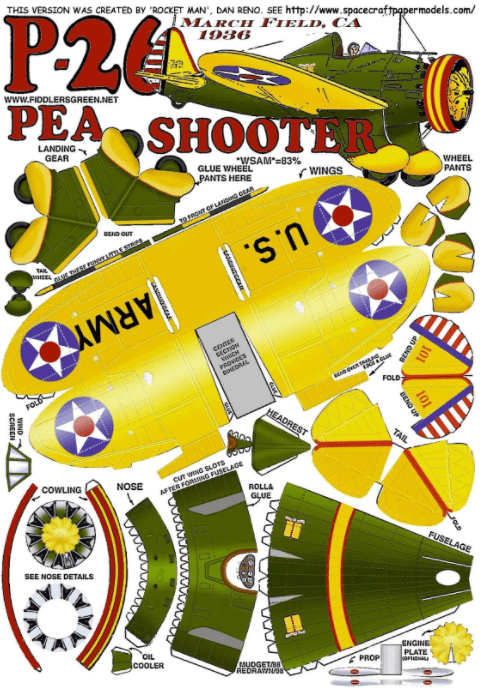

Jeriel’s friends loved the toys, but not the process of building them.

Jeriel’s entrepreneurial spirit began when he was 9, and paper pop-up planes were popular toys among primary schoolers then.

He explained, “I would buy the planes from the school bookshop, assemble them, then sell the completed work to my friends at a profit and buy myself chicken wings with it!”. However, when Jeriel’s mom found out about his “business venture”, she “disapproved of it and told me that we should earn money in ways that consider and protect the interests of others.” Turns out, as his friends bought the toys from him, they had less pocket money for their recess. He realised that it was better for everyone if he stopped selling the toys.

I liked that Hugo sincerely helps me to save for the long-term. For me, it’s about being financially secure and free.

Personal financial goals and challenges today

Jeriel pitching his business idea at iFLYTEK Competition

Jeriel’s financial goal today is no longer having extra chicken wings for recess, but “to be financially free and live minimally”. He added, “I want to work towards my goal to build up communities and not get drawn into a mindless rat race to the top of some corporate ladder.”

Saving without sacrifice means enjoying life, but wisely

Pointing to his unbranded T-shirt and shorts, “I am always trying to live with less without sacrificing my quality of life, and it’s not always easy, especially now that I have my own business to run.”

He now experiences a greater need to manage his finances responsibly, choosing to eat out or travel less, and when he does, to do so less lavishly. “There are a lot of things I would like to do, such as skiing in Japan or doing a road trip to Central Asia, but all these will have to be put on hold for now,” Jeriel said.

However, this does not mean Jeriel is disavowing all the pleasures of life, but that to him, part of Wealthcare is about knowing how best to enjoy luxuries when you can. “I still want to enjoy good food, comfy clothes and go on adventures. I just need to spend on those in smarter ways and prioritise them wisely in view of my other responsibilities.”

If I abandon every big goal that I cannot reach in one fell swoop, I will achieve nothing. So I’m inclined to take small steps to get there by hook or by crook. To me, that’s what Gold Vault is like.

Jeriel and the Millennials’ rat race

Jeriel believes that a lot of Millennials like him are trying to find out what this rat race is, what they are in this rat race for, and how they can win the race. 3 of the proverbial Singaporeans’ 5Cs—cash, car, condominium—have not changed, while the remaining 2 could arguably be credentials and convenience.

“We will always be caught in the race because new nice things will always pop up. We will keep shifting our goals,” he lamented.

However, he explained that he is trying to exit the race and focus on the longer-term priorities, and him using Hugo is evidence of that, “I liked that Hugo sincerely helps me to save for the long-term. For me, it’s about being financially secure and free. I can embark on different projects and interests without worrying about not having enough.”

His views on money as an entrepreneur

When he first struck out on his own, he saw in a new aspect how precious every dollar can be and how important it is to make every investment produce value. Funding a startup with no revenue at the start taught him to use as little as possible to achieve as much as possible.

“Even the Kacang Putih man knows to mix up different kinds of nuts to increase the value and demand for his snacks, all to earn and provide more for his family, ” he quipped.

When he became a business owner, he learnt 3 things that applies to his personal finance:

- Excess money sitting in the bank account is money that is not generating more value.

- But that does not mean he should spend at any opportunity.

- He needs a safe way to make the money grow

He began to take an interest in gold investment as a way to store the value of his money and growing it over time while staying accessible anytime he needs cash.

Hugo’s Gold Vault: the power of taking small financial steps

Although his business is vastly different from selling packs of mixed nuts, the discipline of investing in or creating something that will generate more value over time still applies, “As a small business with few resources, every little bit of value I create is extremely vital. They generate greater value as they compound, and suddenly, the small steps I took become huge strides!”

As a #HugoHero, he found the way Hugo Gold Vault is designed to encourage people to invest their money in gold in any amount an appealing concept.

“It resonates with me as an entrepreneur. If I abandon every big goal that I cannot reach in one fell swoop, I will achieve nothing. So I’m inclined to take small steps to get there by hook or by crook. To me, that’s what Gold Vault is like.”

Jeriel has made gold a part of his investment portfolio with Hugo and has been making multiple small purchases via Roundups to get it going.

His thoughts on the Hugo app

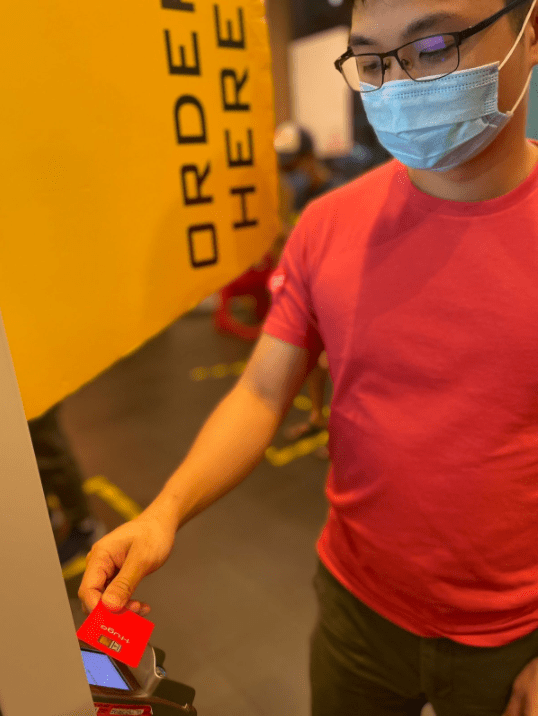

Using his Hugo Card creates extra value on his Extra Value Meal.

Jeriel liked that he can review and track his spending via Hugo, “I am always on the move for work and it’s easy to lose track of what I spend on, especially when they are small transactions like food, drinks and transport.”

For him, being able to review his spending easily in one place, have Hugo Roundups save for him while he spends and save the sum in gold, he could better manage his finances on the go.

“I use Hugo Card to spend on groceries and dining because those spendings are more regular and I get to generate more Roundups!”, Jeriel explained as he scrolled through his transactions.

“I cannot really decide which feature is my favourite though, but I know my favourite Hugo moment is when my Roundups are automatically used to buy gold.”