Saving and budgeting may seem like a simple task – just put some money aside to keep, and decide what you want to spend on with the rest, right?

In reality, it can also be complex as there are just so many distractions and temptations around! Whether it’s that nifty little gadget that appeared as an ad on your newsfeed, or a fancy dessert that caught your eye on the way home, it might sometimes seem that saving isn’t as easy as you thought it would be. Fret not, we’ve got some suggestions on how to save that are so fun that they might just motivate you to stay true to your money-savings goal!

The 100-Envelope Challenge

This challenge will help you save for at least 100 days in a fun and engaging way while you develop a savings discipline. You’ll need 100 envelopes (can reuse your angbaos!), willpower, and INTEGRITY.

Label the envelopes 1 through 100 and store them in a container in a random order. For 100 days, you randomly select an envelope out of the box and put in the amount of cash equal to the number written on the outside of it. E.g. if you draw envelope number 20, you’ll have put $20 in it. If you manage to complete this challenge, you’ll have $5,050 saved up at the end of the 100 days! Amazing, right?!

But ok, if you find saving $5,000 in less than half a year a tall order, you can start more modestly by having fewer envelopes (maybe 50?). Another option is to space out your contributions if you can’t put aside money every day; you can pull an envelope every alternate day and save the same amount within a longer period. This is a great way to save towards a short- or medium-term goal e.g. vacation, while keeping the journey fun and disciplined.

Using Money Pots to do envelope saving

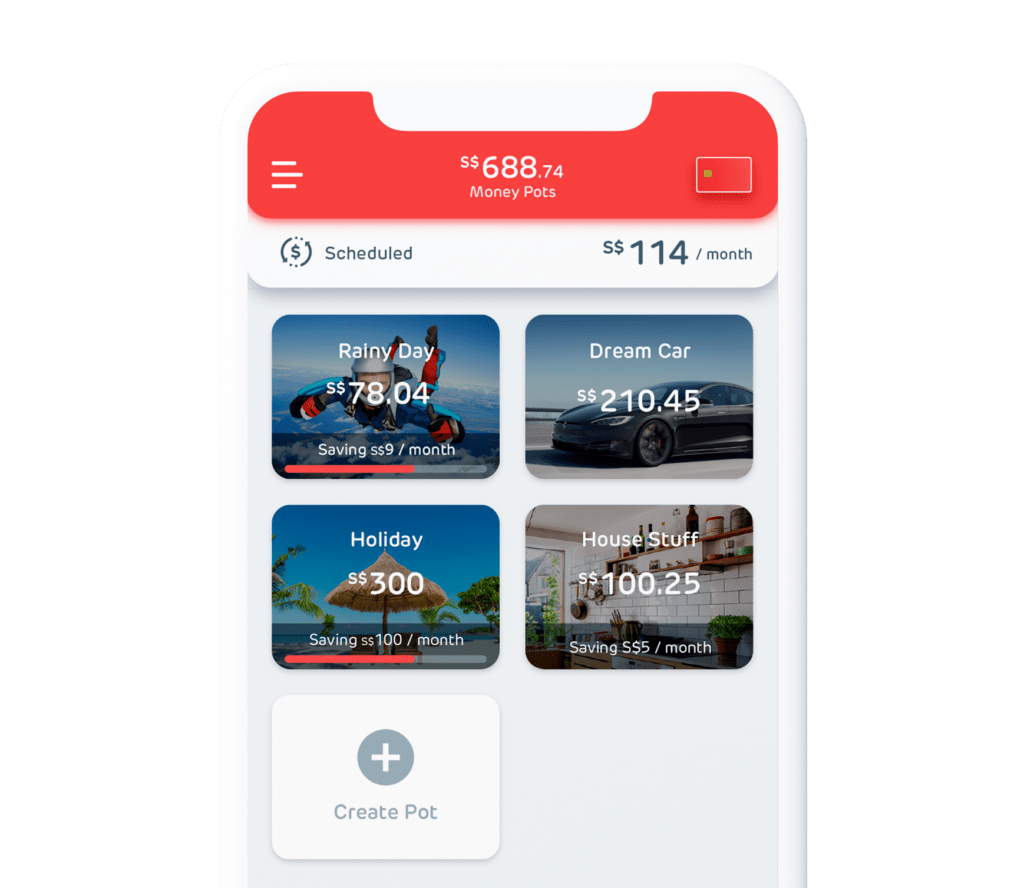

Hugo’s Money Pots is amazing for making sure you keep to your savings goals. With it, you can set as many goals as you want and make regular deposits for each goal. You can track your progress and make adjustments to get there comfortably and surely. The most amazing thing is that you can set a monthly savings schedule and let Hugo do the deposits for you automatically! Fuss-free saving!

The Little Vices Challenge

Be warned, this will take more time and effort, and you’ll have to resist temptations! Carefully consider all your purchases and decide if it’s an impulse buy. Impulse or vice purchases are purchases you did not plan to make, e.g. grabbing extra bars of chocolate at the cash register or upsizing your meal just for the extra fries. Each time you give in to an impulse buy, you deposit the same amount of money into a Money Pot or buy gold via Gold Vault. We’re not saying you cannot enjoy life, but why not include a beneficial element to your impulses? Accumulate your savings and stretch every dollar, even while spending.

To make this challenge easier to adopt, set certain rules or exceptions so that you can gradually make it fit into your habits. You can try cutting out all vice for a set period or apply this challenge to online shopping only. Try out different methods and find one that works best for you!

Squirrel away your spare change

For those looking to save at a very comfortable intensity, this one’s for you. Whenever you buy something with cash and receive coins as change, put those coins away in a piggy bank! It may not sound like much but change accumulated over time will still turn into a decent sum of money, given how many purchases we need to make daily.

But, you might be thinking, “Eh hello, it’s the digital payments age. What coins?!”

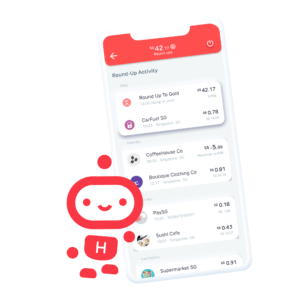

Well, use Hugo’s Roundups to automatically save your digital spare change every time you make purchases with your Hugo Card. Your Roundups are then invested in physical gold for you for growth. This is going to give your brains an additional shot of dopamine each time you spend, knowing it’s also a step towards Wealthcare®.

The rainy day fund

Hear me out, this is saving up for your emergency fund with a twist! There are many who don’t have enough set aside for unforeseen circumstances like retrenchment, sickness, sudden expenses etc. Well, since it’s either rain or shine in Singapore, why not use the weather to remind and help you build up your rainy fund? Every time it rains, deposit a fixed amount of money into your Money Pot or savings account. Try it for a year and you might find how much cash you can accumulate.

Play the A-Saving Race

The saying goes, “If you want to go fast, go alone. If you want to go far, go with someone.” Rope in your friends and family and make it a game! Set a collective goal, split it between the participants and race to see who reaches the individual savings goal the fastest. It could be for a shared vacation, a birthday meal, or simply a personal goal.

If you’re unsure where to start or what’s a good goal to work towards, Hugo’s Money Pots is a great platform to tap on. It makes managing such goals and saving for them really convenient. Hugo’s Money Pots allows you to create financial goals and actively save for future spends you plan to make! Read more about Money Pots here.

With so many methods to make your saving journey smoother and more productive, you just have to commit to completing a challenge and watch your money grow. For those looking for that extra motivation or guidance in saving, Hugo can help you to spend, save and invest effectively. Get on board today!

Set goals and track your progress

Millennials are now at the prime of their lives. Career is progressing, life’s fulfillments (home, family, children) are at the cusps, income is on the rise. If you have good financial planning, you will know how to maximise what you have now, reap huge rewards in the future while avoiding preventable financial disasters. The process of setting financial goals now helps you assess where you are at now, determine your end goal, and strategise how to get there. You will become clear about what you have now and what else you need—a new role in a rising sector, a higher pay, a different skill etc.

Hugo’s Money Pots makes managing such goals and saving for them a breeze. It allows you to create financial goals and actively save for future spends you plan to make; it could be a post-COVID-19 vacation, a lavish Valentine’s Day meal, cash to learn a new skill, a new degree/course, or even expenses in 2022. Read more about Money Pots here.

Tracking progress is key

Having clear goals is good, but tracking makes it great. Constantly check in on your progress to ensure that you are on track to achieving your goal. Some #HugoHeroes break up their grand dream and set a Money Pot for each smaller milestones for better management.

Saving has never been easier

There are no more excuses for not being able to save. Unlike older generations that had to rely on manual ways of saving, we now have smart platforms that we can use to automate saving and investing to make financial management consistent and transparent! Hugo helps you to spend, save and invest effectively. Get on board today!