About the author: Chiah Tian Ming is a Fraud Analyst at Hugo. He’s quite the life of the party and is usually high even without alcohol. But we’ve learnt to not let that nutty demeanour fool us—his keen eye makes even Sauron blush. And that’s why he excels at spotting minor details like where the savings opportunities are in camp.

Almost every Singaporean male will undergo “training to be soldiers, fight for our land, once in our lives and 2 years of our time”. Every time I watch an Ah Boys to Men movie, I remember a few things from my days of wearing green:

- The day I sold my life a.k.a. my enlistment day

- Getting a new wife a.k.a. my rifle

- Booking in/out + nights out

- Missing my family and friends

- My peanuts NS allowance

Every NSF will know that the NS allowance is just something to get by with, that’s why it’s called an allowance and not a salary. There’s no CPF paid either. With the meagre sum, how can NSFs make it count for the long term?

My NS allowance

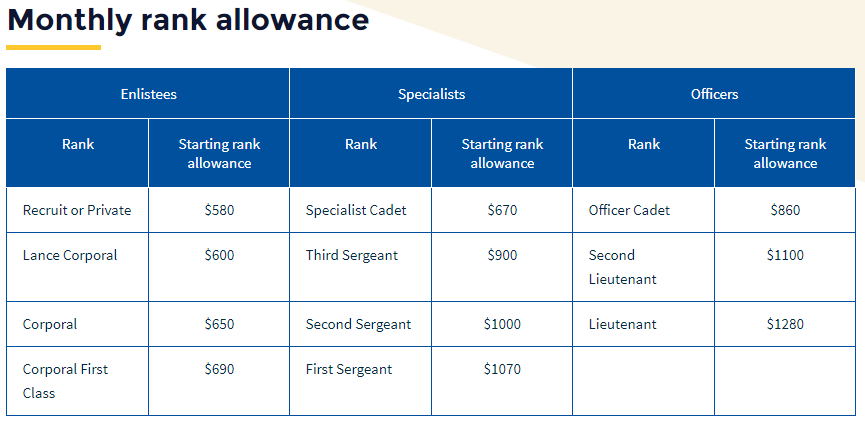

CPF contribution from NS allowance is negligible. NSFs will need to adopt a long-term savings mindset independently | Source: CMPB

I enlisted in 2007 and I ORD-ed in 2009 as a Lieutenant (LTA) in the RSAF. Some people would say I was “lucky” or “privileged” to be an officer. Whether I really was lucky is up for debate, but all will agree that our NSF allowances are peanuts.

My monthly NS allowance was $1040 a month then (today, LTAs get $1,280). Yes, yes, I get that it’s more than some, but look, it’s NEVER going to make me rich. NSFs cannot get a salary outside, cannot run a business, there was no Carousell or FB Marketplace whatsoever back then. We pretty much had no other sources of income available. Since increasing my income was not an option, I focused on reducing my spending. On average, my expenditure during my NS days was about $300/month of which most went to weekend outings and dates. How did I manage to spend only $300/month? Well, read on.

My top financial concern during NS

I came from a middle-income family, and, while the standard of living was comfortable enough, high costs like education still weighed on us. I had aspirations in the banking industry and had hoped to save up enough money to further my education. I was also anticipating financing post-NS commitments too. I figured that I needed to start working on my savings strategies during NS. As we all say during NS, “Where got time?” I am glad that my savings journey started early. I didn’t know much about investing then, so I put a sizable portion of my savings into a savings plan with an insurer. If only I had read up more about gold…

How to maximise your NS allowance

Now that I am an NSman, I believe I’ve earned my rights to share my experiences on making the best out of my NS allowance.

Stay-in to keep finances in shape

I could already hear the groans as I mentioned “stay-in”. But staying in camp meant I could save on transport. Assuming each bus/MRT trip to and fro home and the camp was $2,

$2 x 2 trips to and fro x 5 days= $20/week

$20 x 52 weeks x 2 years = $2080 saved in 2 years

Cookhouse food ftw

Since I stayed in, most of my nutrition between 2007 and 2009 came from the cookhouse. Assuming my meals outside cost on average $5, this was how much I saved eating cookhouse food:

$5 x 3 meals a day x 5 days = $75/week

$75 x 52 weeks x 2 years = $7800 saved in 2 years

e-Mart has free and good stuff

The e-Mart is the ultimate shopping paradise for soldiers. Not only did we get bonus rest time on our e-Mart trips, but we also got stuff for “free”. I saved about $550 over 2 years getting body powder, towel, socks, running shoes and PT kits from e-Mart instead of from the stores.

The camp is a free gym

This needs no explanation. On top of daily fitness training for soldiers, SAF camps have pretty decent gyms, pools, PT instructors, running tracks etc. I got to save about $130/month on gym memberships. That’s $3120 over 2 years. And don’t forget, if we do well at IPPT, more moolah for us.

(FYI, SAFRA’s one-time $270 membership fee for 10 years of pool access is a real steal. Swimming at public pools once a week for 10 years costs more at $780.)

Avoid clubbing or “siam diu”

Many NSFs LOVE going to the club and “siam diu” (Thai disco). Unfortunately, those are crazy expensive places to be. By not going to clubs like Zouk and Phuture (the cover charges and bottle-opening really hurt), I saved more than $3000 over 2 years. During my time, club cover charges cost about $30 per person. Assuming I go clubbing once a week WITHOUT opening bottles:

$30 x 52 weeks x 2 years = $3120

If we really craved alcohol, there was always cheap Tiger beer at the camp’s mess (cannot hang flowers though). But I can fully understand that NSFs love unwinding at night; for that, there are many ways to save too.

It’s about having a Wealthcare® mindset

By employing the tricks above, I avoided spending $16,000 over 2 years AND got to keep a major portion of my total allowance!

It’s about having a Wealthcare® mindset by making smarter spending decisions, having effective saving strategies, investing the savings to grow it, and

- Doing all these things a LITTLE bit at a time

- Practicing it OFTEN, and

- Starting as EARLY as we can.

Since National Service is a phase that lasts only for about 2 years and all NSFs will move on to more long-term things after (e.g. further studies, new job, new businesses) that can add to their expenses, consider saving up the limited allowance using a safe short-term instrument to prepare for what comes after. It could be gold, short-term endowment plans, Singapore Government Treasury Bills/Bonds, and fixed deposits. NSFs should do in-depth research and talk to trustworthy people before making financial decisions.

Hugo works great for NSFs

If you’re an NSF, you may want to consider using the Hugo app and getting the Hugo Platinum Visa Debit Card for your daily spending, saving and investing needs. The Hugo Card is/has

- Available to people 18 and above living in Singapore,

- No minimum annual wage requirement,

- Free to use,

- Has zero fall-under-amount penalties,

- Usable online and worldwide,

- Saves money for you while you spend,

- Equips you with a smart savings tool, and

- Allows you to buy gold from just 1 single cent.

For soldiers who want to make the best out of their allowances and get ready for life after ORD, Hugo is going to give you the boost you need.

ORD loh!