Once in a while, we shine the spotlight on one of our many #HugoHeroes to celebrate life! All of us have stories to share—the ups, downs and merry-go-rounds. No person should be isolated, and everyone could use a buddy to experience life with.

We spoke to Lita Syukur, one of our earliest #HugoHeroes, to talk about her story as a mother to a pair of twins, a wife, a caregiver to a son with cerebral palsy, a breast cancer survivor, and how Hugo is making a difference.

About #HugoHero Lita

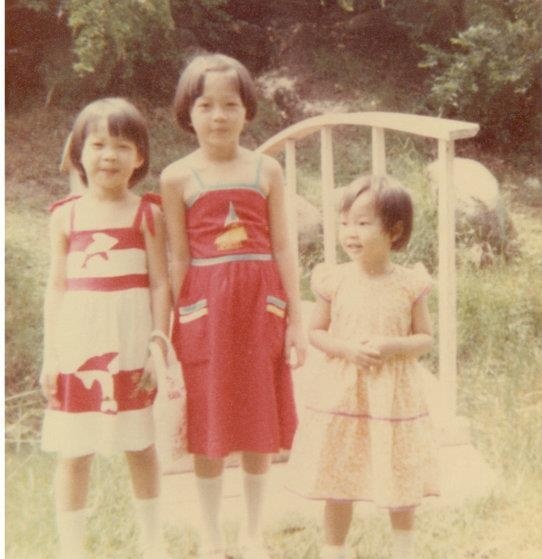

Left to right: Henry, Lita and Edward.

Meet Lita Syukur, an Indonesian-born homemaker who has called Singapore her home for the past 12 years. She is happily married with 2 lovely children, Henry and Edward, and has a majestic golden retriever for a furry companion. Before becoming a full-time homemaker to care for Edward who has cerebral palsy, she was an analyst in the financial sector.

Life goals and ambitions

Lita lives a simple life, and her goals, while certainly requiring some level of finances to afford, are simple nonetheless. All she wanted is to be able to see the world more, with travelling around Europe being a key highlight.

“I haven’t been able to explore the world much actually. I grew up in a middle-income family and my parents were disinclined to travel for various reasons. I worked hard in my early career and hardly gave myself a break. Now that I am a mom and a full-time caregiver, much of my travelling will have to be put off till later,” Lita explained why taking life easy and exploring Europe remain her life goals.

Growing up, Lita learnt that achieving her goals does not necessarily mean that she has to sacrifice all the things she loves and that she has to not just save up, but also grow her money.

She soon decided to take saving for a house, marriage, children, and other long-term plans more seriously by putting away her bonuses and excess funds and going back to her roots.

Lita and Edward in one of their rare trips to Europe.

Learning about the value of money since young

Lita with her mom and her late father.

Lita’s parents came from big families—both her dad and mom have more than 15 siblings between them. Beyond being the sole breadwinner of his nuclear family of 6, Lita’s father also looked after his siblings after his father passed away.

To cope with the overwhelming burden, he took up as many jobs as he could. Eventually, his successful stint in machinery sales gave him a big break and he ventured into other business ventures, turning his finances around. Before he passed away in 2019, his 2 heart attacks and a bad fall burdened his family and businesses greatly. Lita was always aware of how hard her dad worked, as evidenced by him often being out at work till the late evenings.

From being a spendthrift to being thrifty

Rare documented moments of Lita’s (in white cardigan) early career.

“Even though I grew up knowing that money isn’t easy to come by, I still spent carelessly when I first entered the workforce. I started earning money myself and had to contend with this newfound freedom to spend,” Lita admitted about her spending habits when she was in her early 20s. As a new entrant to the workforce, she was more focused on her immediate needs and wants; the future was not a priority then. But it did not take long for her to realise that she needed to think for the future. She soon decided to take saving for a house, marriage, children, and other long-term plans more seriously by putting away her bonuses and excess funds and going back to her roots.

Today, she continues to do likewise. Lita has transferred almost all of her spending onto Hugo, using her Hugo Card for groceries, food and Boost juice (she mumbled that she got to curb her cravings as she showed us her countless Boost juice transactions). Although she has got her own investment portfolio going before she started using Hugo, she nevertheless found that buying physical gold with Roundups was a bonus to her already robust saving discipline.

Saving money as a mom and a homemaker

In contrast to her ever-hustling dad, Lita’s mom is a thoughtful and prudent woman. “She barters at the wet market, dresses simply, and sewed clothes for the family,” recounts Lita. Most of the clothes she wore when she was a kid were sewn by her mom. Lita’s spending patterns reflect that of her mom’s, scouting for discounts and deals, finding cheaper alternatives and never splurging on the frivolous.

Lita (centre) and her siblings proudly showing off their mom’s fashion design

Got thrown off of all their financial plans

When Lita and her husband were newlyweds, they planned extensively for the life ahead—buying a house, saving for retirement, rearing children, affording children’s education and more.

Just as Lita’s parents made her save her day’s spare change, she encouraged her sons to do the same.

Although both are well-versed in financial planning, they were nevertheless thrown off their plans when the two sons arrived as prematurely-born twins, and Edward being diagnosed with cerebral palsy a year later. From having a plan to gradually expand their new family, they found themselves having 2 new mouths to feed immediately and expensive ICU bills to shoulder.

Fast forward to 2019, Lita was diagnosed with breast cancer, of which she is a survivor.

Two hungry mouths to feed: both sons stay active in their own ways.

Saving money also creates opportunities

“I appreciate my parents a lot. I would think back at how my parents did everything they could to be financially stable and independent so that they would not pass on any intergenerational financial burdens to my siblings and me,” recounts Lita. She knows that such burdens can reduce her ability to afford opportunities for her children, especially for Edward who needs more care. She and her husband are now focused on preparing for when Henry and Edward have to be independent so that Henry will have a much easier time caring for Edward in the future.

Twin brothers Henry and Edward share more than just the same birthdate.

Creating opportunities for Henry to spend money wiser

Lita makes it a point to teach that same financial awareness she was taught to have to her 2 sons. Just as Lita’s parents made her save her day’s spare change, she encouraged her sons to do the same.

To help Henry save up for his dream football shoes, Lita has a Money Pot for that; Henry would hand cash to Lita, and she would then deposit it into the Money Pot on his behalf.

Henry’s and Edward’s piggy banks sit right at the main door.

Although Lita can afford to give her sons allowance more than what she was getting as a kid, she still teaches her children how to stretch the dollar and get more with less. “Back then, Henry would use up his weekly allowance before the week was up, having spent on things like a Starbucks Frappuccino which costs about $8. He had to miss out on things his friends were doing because he didn’t have enough money by then. Over time, he learnt to strategise and spend on more affordable alternatives so he would have enough for activities with his friends,” Lita shared, with Henry sitting beside her with a guilty smirk.

Since Henry has “a penchant for losing things”, Lita insists that he will have to bear his own financial responsibility and replace them using his own savings. Realising that that has been eating into his own goal for a pair of football shoes, he has since sworn off slippers and wears shoes almost all of the time. To help Henry save up for his dream football shoes, Lita has a Money Pot for that; Henry would hand cash to Lita, and she would then deposit it into the Money Pot on his behalf. He’s 3/4 of the way now!

Becoming a #HugoHero

Many things have made Lita a bonafide hero—supporting her mom after her dad’s death, being a mom and a caregiver to Edward, and surviving breast cancer. Becoming a #HugoHero is another addition to her medals. Beyond using Roundups to save as she spends for the family, and Money Pots for her Europe trip and Henry’s shoes, Lita has been investing in gold via Gold Vault for the family’s future needs and wants.

“Roundups is my favourite. I love that I don’t feel like I have to forgo my love for Boost juice to save more. I guess what made me love it even more is that the app helps me save my Roundups consistently in gold. Sometimes I get so busy that putting money aside slips my mind, but I can rely on Hugo to keep it going,” Lita said.

she nevertheless found that buying physical gold with Roundups was a bonus to her already robust saving discipline.

Asked on one thing she would say to anyone, without hesitation she replied, “Ask for help when you’re stuck, and look after yourself.”

Hopes for Hugo

Lita hoped that a Hugo product for kids is on the horizon, believing that it will be a great tool for parents. Recounting stories where children overspent on their parents’ credit cards, by accident or by willful neglect, a Hugo Junior Account can allow parents to give pocket money easily, monitor expenses, and inculcate good financial habits.

Are you a parent like Lita?

Connect with other #HugoHero parents on our community forum to inspire one another on how we can teach good money values to our children!