The definition of financial freedom is different for everyone. For some, it may be the ability to afford what they want without debt. To others, it may be to save enough to retire comfortably in their 50s. Being financially free seems like a lofty dream; we may not know how to work towards it or how else to attain it more quickly. But regardless, planning our finances well is the first step towards getting there.

Going Digital and Personal

Gone are the days where you had to maintain an extensive Excel sheet to chart all your expenditure, income, FUTURE expenditures and income to plan for your goals, dreams and the days ahead. It’s not easy, and the twists and turns of life make financial planning harder. Whether you are new or seasoned at planning for your finances, using a suitable app can help save you time and effort, and reach your goals.

There are some things to consider when choosing the right finance app:

- What is the app optimised to do? Is it optimised to your financial needs?

- What security features does the app have? This is especially important for apps that have investment functions.

- Is the app easy to learn and use? This can affect how often and how effectively and often you use it.

- Do you have to pay to use the app? If yes, how much? It’s ok to pay, but what do you get out of it?

- What special feature does this app have over others?

In this article, we explore some of the top savings and financial planning apps in Singapore.

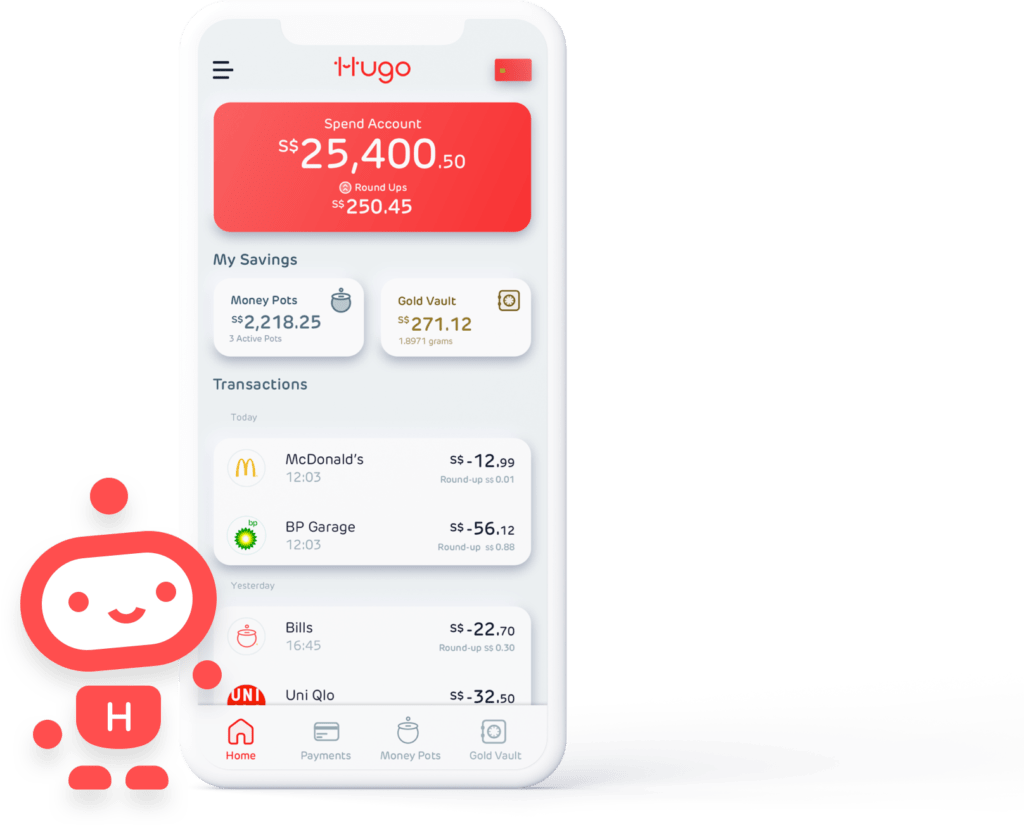

Hugo

Through Hugo, you can keep track of your expenses in real-time while you spend via the “Digital-First” Hugo Platinum Visa Debit Card, create Money Pots to save towards your budgets/financial goals and invest your savings in gold. The app allows users to plan for their finances and make everyday transactions work towards their finances seamlessly: every spend made via the Hugo Card is rounded up to the nearest dollar (Roundups) and the spare change is invested in gold automatically. In addition, all transactions via Hugo are recorded in great detail i.e. merchant credentials, amount, exchange rate (for overseas spending), and personal notes, so you are always on top of your spending.

Pros: The app has multiple layers of security to keep your money safe with features such as card-locking, biometric verification, cloud storage of your account details. Loading money is very easy with FAST transfers from your bank account. The app’s features facilitate all areas of money management, from spending to saving to investing.

Cons: Transactions made outside of the Hugo Card are not recorded. The app is currently not compatible with GPay/Apple Pay.

Suitable for users who want to:

- Track their expenses in real-time

- Have a regular savings habit

- Automate their savings goals

- Invest in physical gold

Monny

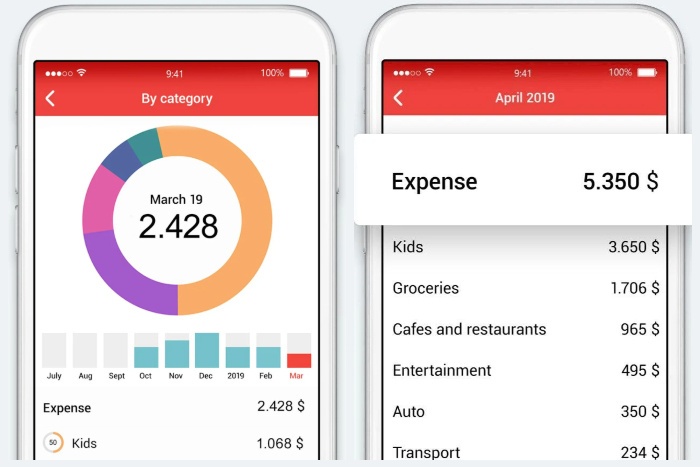

Source: Greamer.com

Monny allows you to keep track of your expenses and set budgets in a fun manner. It has an adorable user interface, and gamified money challenges to earn in-app incentives and unlock in-app achievements.

Pros: The app’s gamified challenges can help you develop a habit of recording your expenses daily. You can customise expense categories, monthly budgets and account books for different saving goals. You can also access simple reports of your expenses and income.

Cons: The app’s account books are not synchronised; if you want to transfer a particular amount from your main account to a separate account book, the deduction will not be recorded automatically. In-app purchase is required to unlock infographic reports and passcode protection.

Suitable for users who want to:

- Track their expenses

- Budget by the month

Spendio

Source: 99images.com

Like Monny, Spendio allows you to keep track of your expenses and set budgets. It’s simple and clean-cut interface is easy to navigate.

Pros: You can secure the app with a passcode lock and access monthly infographic reports of your expenses and income. Your saving goals are synchronised to your wallets (i.e., in-app accounts); whenever you top-up a particular saving goal, the amount will automatically be deducted from your selected wallet.

Cons: In-app purchase is required to unlock premium features, such as customised expense categories and unlimited wallets.

Suitable for users who want to:

- Track their expenses

- Budget by item

Zenmoney

Source: The Singapore Women’s Weekly

Zenmoney allows you to track expenses, savings, and debt through personal and shared accounts. You have the option to sync your bank account(s) from some Singapore-based banks or enter transactions manually. The app can also detect bank transactions through text messages.

Pros: You can secure the app with a passcode lock. By syncing your bank account(s), your transactions will automatically be logged and categorised (e.g. eating out, groceries, transport, etc.).

Cons: Transactions may not be categorised accurately. You have to upgrade to its premium version (Complete Zen) to access detailed monthly reports, customise expense categories, and track your monthly income according to the 50/30/20 budgeting rule (i.e., 50% for needs, 30% for wants, and 20% for savings).

Suitable for users who want to:

- Track their expenses

- Share expenses and savings logs with other people

Planner Bee

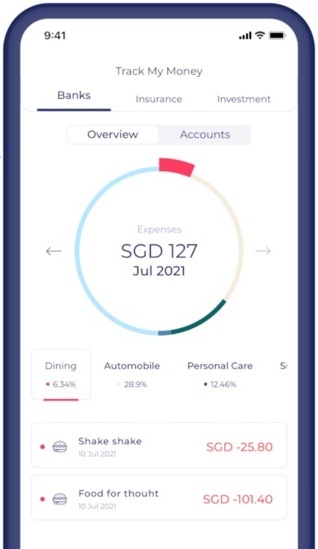

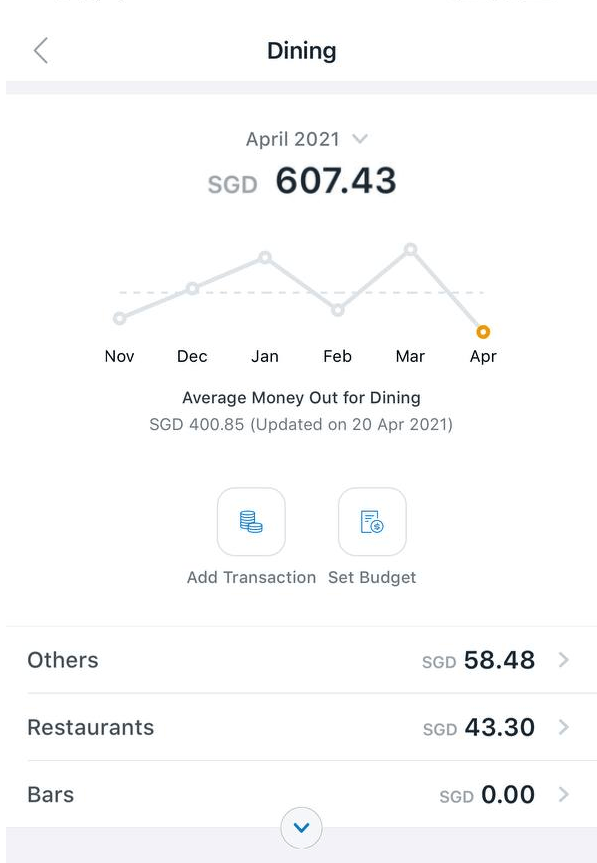

Source: AppAdvice

Planner Bee allows you to keep track of your expenses, savings, insurance, and investments in a single app. You can sync bank account(s) from most Singapore-based banks and some insurance and investment providers.

Pros: You can secure the app with a passcode lock. Your transactions can be logged and categorised automatically by syncing your bank account(s), insurance, and investment providers.

Cons: Transactions may not be categorised accurately. There is a lag time for records to be updated on the app even if they reflect on your banking app(s). The current list of investment providers is limited, so you may have to input related information manually.

Suitable for users who want to:

- Track their expenses

- Track finances across multiple channels (i.e., banks, insurance, investments, etc.)

- Learn about other financial products

DBS NAV Planner

Source: TheSmartLocal

DBS NAV Planner allows you to keep track of your expenses, savings, insurance and investments consolidated by SGFinDex. Besides providing reports on your monthly cash flow (i.e., income and expenses), its analytics can assess your emergency savings, insurance coverage and risk profile.

Pros: DBS customers can easily access NAV Planner on their Digibank app. The app introduces you to various insurance policies (e.g., Health, Life, Personal Accident, etc.) and investment types (e.g., Unit Trusts, Equities, Bonds, etc.).

Cons: You are required to create a DBS account if you are not an existing customer. The app may not categorise your expenses accurately, and you can’t add transactions manually. Product recommendations made are limited to insurance and investment providers under DBS’s portfolio.

Suitable for want to:

- Budget by item

- Track their finances across multiple channels

- Learn about other financial products

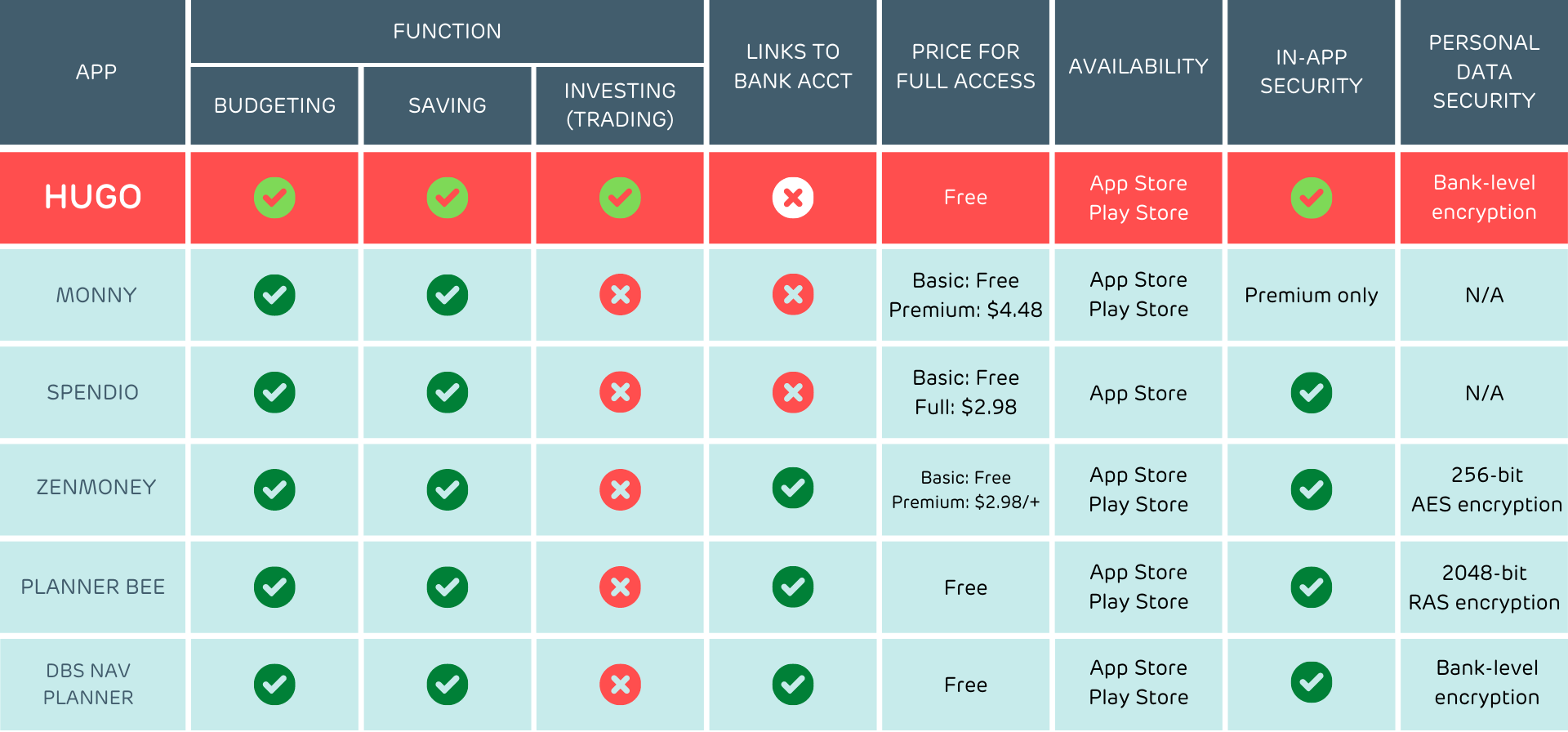

A simple table comparing functions, price and security.

Why Hugo?

Savings and financial planning apps can help us track our expenses and improve our financial wellbeing. But because maintaining good financial health is a holistic process that involves controlling spending, consistently saving, and making money grow through sound investments, having multiple apps to manage each of these functions can be very tedious. If you want an app that addresses all areas in one place, look no further! Hugo gives you a clear view of your spending habits, saves on your behalf intuitively and investment features starting with gold.

Just as some of us might have a separate account for spending, your Hugo Account can work similarly. As you spend with your Hugo Card, you are also investing in gold and growing your savings at the same time—allowing you to maintain your financial wellbeing more conveniently.